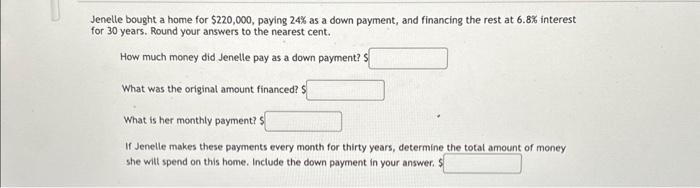

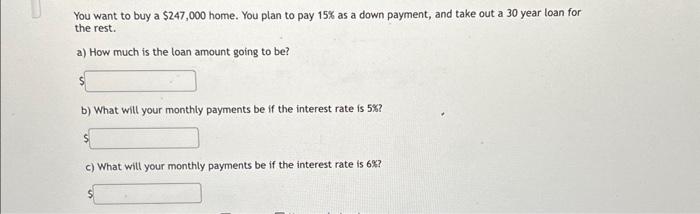

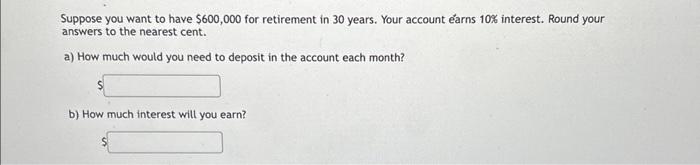

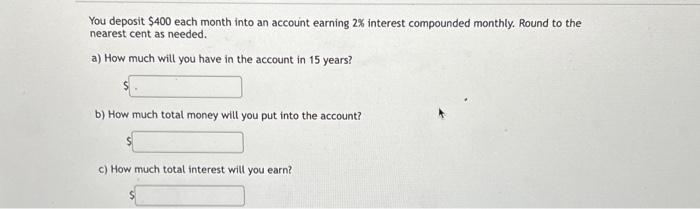

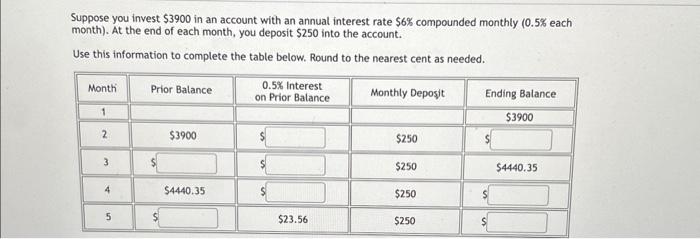

Suppose you want to have $600,000 for retirement in 30 years. Your account arns 10% interest. Round your answers to the nearest cent. a) How much would you need to deposit in the account each month? b) How much interest will you earn? Jenelle bought a home for $220,000, paying 24% as a down payment, and financing the rest at 6.8% interest for 30 years. Round your answers to the nearest cent. How much money did Jenelle pay as a down payment? What was the original amount financed? What is her monthly payment? If Jenelle makes these payments every month for thirty years, determine the totat amount of money she will spend on this home. Include the down payment in your answer. $ You want to buy a $247,000 home. You plan to pay 15% as a down payment, and take out a 30 year loan for the rest. a) How much is the loan amount going to be? b) What will your monthly payments be if the interest rate is 5%? c) What will your monthly payments be if the interest rate is 6% ? Suppose you invest $3900 in an account with an annual interest rate $6% compounded monthly (0.5% each month). At the end of each month, you deposit \$250 into the account. Use this information to complete the table below. Round to the nearest cent as needed. You deposit $400 each month into an account earning 2% interest compounded monthly. Round to the nearest cent as needed. a) How much will you have in the account in 15 years? b) How much total money will you put into the account? c) How much total interest will you earn? Suppose you want to have $600,000 for retirement in 30 years. Your account arns 10% interest. Round your answers to the nearest cent. a) How much would you need to deposit in the account each month? b) How much interest will you earn? Jenelle bought a home for $220,000, paying 24% as a down payment, and financing the rest at 6.8% interest for 30 years. Round your answers to the nearest cent. How much money did Jenelle pay as a down payment? What was the original amount financed? What is her monthly payment? If Jenelle makes these payments every month for thirty years, determine the totat amount of money she will spend on this home. Include the down payment in your answer. $ You want to buy a $247,000 home. You plan to pay 15% as a down payment, and take out a 30 year loan for the rest. a) How much is the loan amount going to be? b) What will your monthly payments be if the interest rate is 5%? c) What will your monthly payments be if the interest rate is 6% ? Suppose you invest $3900 in an account with an annual interest rate $6% compounded monthly (0.5% each month). At the end of each month, you deposit \$250 into the account. Use this information to complete the table below. Round to the nearest cent as needed. You deposit $400 each month into an account earning 2% interest compounded monthly. Round to the nearest cent as needed. a) How much will you have in the account in 15 years? b) How much total money will you put into the account? c) How much total interest will you earn