Answered step by step

Verified Expert Solution

Question

1 Approved Answer

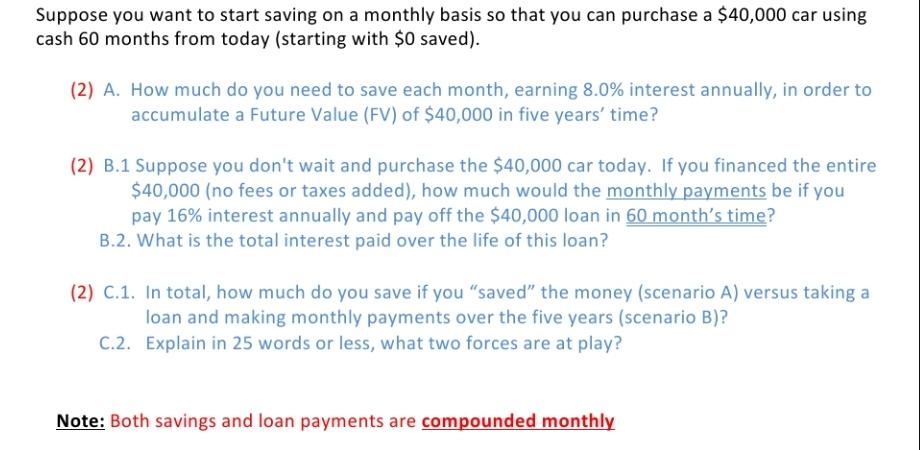

Suppose you want to start saving on a monthly basis so that you can purchase a $40,000 car using cash 60 months from today

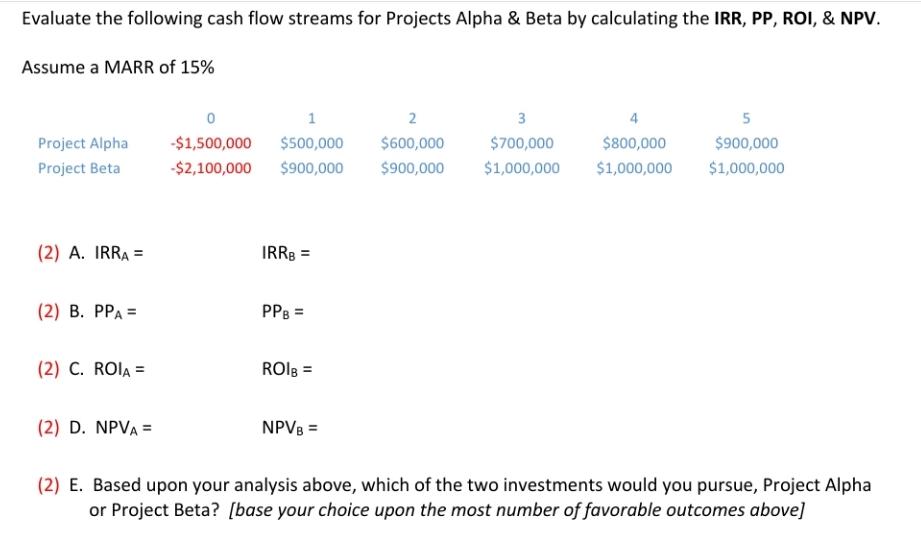

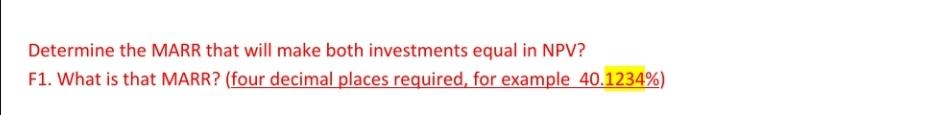

Suppose you want to start saving on a monthly basis so that you can purchase a $40,000 car using cash 60 months from today (starting with $0 saved). (2) A. How much do you need to save each month, earning 8.0% interest annually, in order to accumulate a Future Value (FV) of $40,000 in five years' time? (2) B.1 Suppose you don't wait and purchase the $40,000 car today. If you financed the entire $40,000 (no fees or taxes added), how much would the monthly payments be if you pay 16% interest annually and pay off the $40,000 loan in 60 month's time? B.2. What is the total interest paid over the life of this loan? (2) C.1. In total, how much do you save if you "saved" the money (scenario A) versus taking a loan and making monthly payments over the five years (scenario B)? C.2. Explain in 25 words or less, what two forces are at play? Note: Both savings and loan payments are compounded monthly Evaluate the following cash flow streams for Projects Alpha & Beta by calculating the IRR, PP, ROI, & NPV. Assume a MARR of 15% Project Alpha Project Beta (2) A. IRRA = (2) B. PPA = (2) C. ROIA = (2) D. NPVA = 0 1 -$1,500,000 $500,000 -$2,100,000 $900,000 IRRB = PPB = ROIB = NPVB = 2 3 4 $600,000 $700,000 $800,000 $900,000 $1,000,000 $1,000,000 5 $900,000 $1,000,000 (2) E. Based upon your analysis above, which of the two investments would you pursue, Project Alpha or Project Beta? [base your choice upon the most number of favorable outcomes above] Determine the MARR that will make both investments equal in NPV? F1. What is that MARR? (four decimal places required, for example 40.1234%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

2 A How much do you need to save each month earning 80 interest annually in order to accumulate a Future Value FV of 40000 in five years time Use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started