Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you were a financial analyst trying to compare the performance of two companies. Company A uses the double-declining- balance depreciation method. Company B

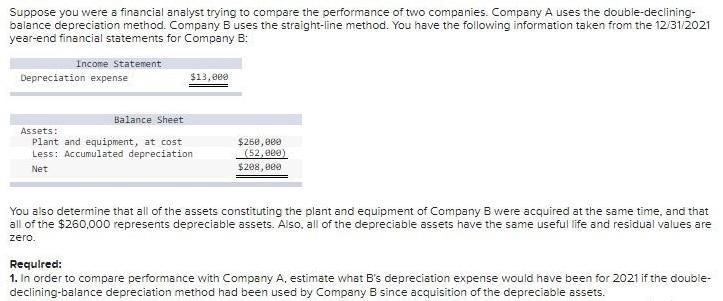

Suppose you were a financial analyst trying to compare the performance of two companies. Company A uses the double-declining- balance depreciation method. Company B uses the straight-line method. You have the following information taken from the 12/31/2021 year-end financial statements for Company B: Income Statement Depreciation expense $13,000 Balance Sheet Assets: Plant and equipment, at cost $260,000 Less: Accumulated depreciation Net (52,000) $208,000 You also determine that all of the assets constituting the plant and equipment of Company B were acquired at the same time, and that all of the $260,000 represents depreciable assets. Also, all of the depreciable assets have the same useful life and residual values are zero. Required: 1. In order to compare performance with Company A, estimate what B's depreciation expense would have been for 2021 if the double- declining-balance depreciation method had been used by Company B since acquisition of the depreciable assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Estimating Company Bs Depreciation Expense under DoubleDeclining Balance DDB Heres how to estimate Company Bs depreciation expense for 2021 if they ha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started