Answered step by step

Verified Expert Solution

Question

1 Approved Answer

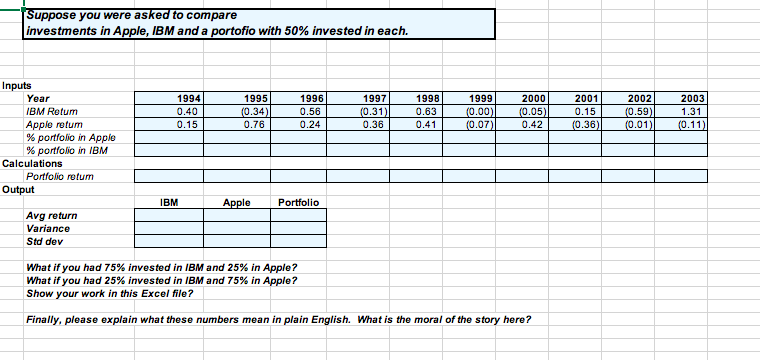

Suppose you were asked to compare investments in Apple, IBM and a portfolio with 50% in each IBM return Apple return % portfolio in apple

Suppose you were asked to compare investments in Apple, IBM and a portfolio with 50% in each

Suppose you were asked to compare investments in Apple, IBM and a portfolio with 50% in each

IBM return

Apple return

% portfolio in apple

% of portfolio in IBM

Calculations

Portfolio return

Output

Avg return

Variance

Std Dev

What if you had 75% invested in IBM and 25% in Apple

What if you had 25% invested in IBM and 75% in Apple

Finally please explain what these numbers mean in plain English. What is the moral of the story.

Suppose you were asked to compare investments in Apple, IBM and a portofio with 50% invested in each. 1994) 0.40 0.15 199519961 (0.34)| 0.56 0.76 0.24 1997 (0.31)| 0.36 1998 0.63 0.41 1999 (0.00)| (0.07)| 2000 (0.05) 0.42 2001 0.15 (0.36)| 2002 (0.59) (0.01) 2003 1.31 (0.11) Inputs Year IBM Retum Apple retum % portfolio in Apple % portfolio in IBM Calculations Portfolio rotum Output IBM Apple Portfolio Avg return Variance Std dev What if you had 75% invested in IBM and 25% in Apple? What if you had 25% invested in IBM and 75% in Apple? Show your work in this Excel file? Finally, please explain what these numbers mean in plain English. What is the moral of the story here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started