Suppose you were hired as a consultant for a company that wants to penetrate the Comp-XM market. This company wants to pursue a niche differentiation strategy. From last years reports, which company would be the strongest competitor?

Select: 1

Andrews

Chester

Digby

Baldwin

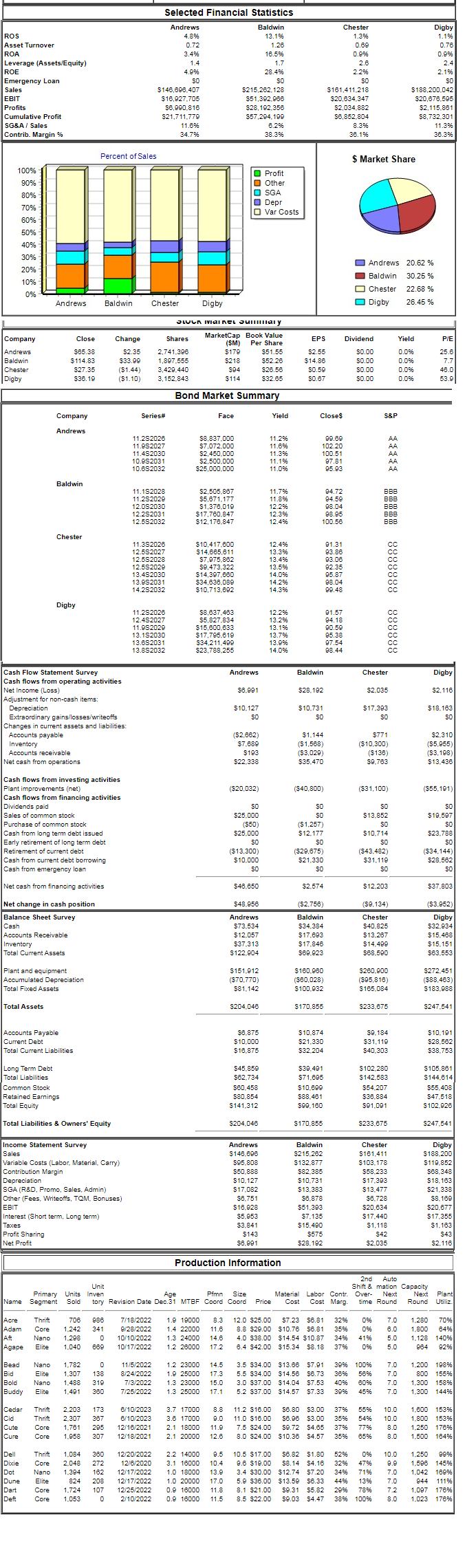

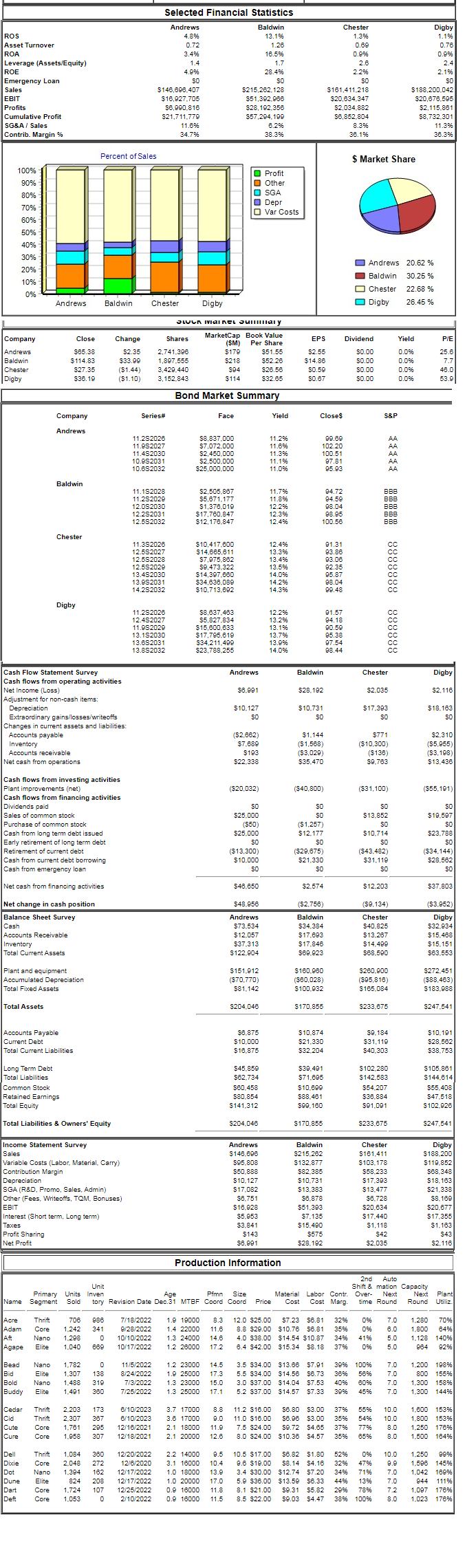

Selected Financial Statistics Andrews 4.8% 0.72 3.4% Baldwin 13.1% 1.26 18.5% Digby 1.1% 0.76 0.9% 2.4 2.1% 1.4 4.9% ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG&A / Sales Contrib. Margin % Chester 1.396 0.69 0.9% 2.6 2.2% SO $161.411.218 $20,634.347 $2,034.882 56,852,804 8.396 30.1% 28.4% SO $215,262.128 $51,392.968 $28,192.356 $57,294,199 6.2% 38.3% $146,698,407 $16.927.705 $6.990.816 $21,711.779 11.6% 34.7% $188,200.042 $20,676.595 $2.115.861 $8,732.301 11.396 38.3% Percent of Sales $ Market Share 100% 1 90% 80% Profit Other O SGA Depr O Var Costs 70% 60% 50% Andrews 20.62 % Baldwin 30.25% Chester 22.68 % Digby 26.45% Andrews Baldwin Chester Digby LUUN VAI NEL JUIllary Change Shares PIE 25.6 Company Andrews Baldwin Chester Digby Close $65.38 $114.83 $27.35 $36.19 $2.35 $33.99 ($1.44) ($1.10) 2,741.396 1,897.555 3,429,440 3,152.843 MarketCap Book Value ($M) Per Share $179 $51.55 $218 $52.26 S94 $26.58 $114 $32.65 EPS $2.55 $14.86 $0.59 $0.67 Dividend $0.00 $0.00 $0.00 $0.00 Yield 0.0% 0.0% 0.0% 0.0% 48.0 Bond Market Summary Company Series# Face Yield Close$ Andrews 11.252026 11.9S2027 11.452030 10.982031 10.6S2032 $8,837.000 $7,072.000 $2,450.000 $2.500.000 $25.000.000 11.2% 11.6% 11.396 11.196 11.0% 99.69 102.20 100.51 97.81 95.93 Baldwin 11.1S2028 11.252029 12.0S2030 12.252031 12.592032 $2,505.867 $5,671,177 $1,376.019 $17,760.847 $12, 178.847 11.79% 11.896 12.2% 12.396 12.496 94.72 94.59 98.04 98.95 100.58 mm D Chester 91.31 93.88 93.06 11.3S2026 12.5S2027 12.5S2028 12.58 2029 13.482030 13.982031 14.252032 $10,417.600 $14.685.611 $7,975.862 $9,473.322 $14,397.680 $34,638,089 $10,713.892 12.496 13.396 12.4% 13.5% 14.0% 14.2% 14.396 92.36 98.04 99.48 Digby 11.252026 12.492027 11.9S2029 13.1S2030 13.682031 13.8S2032 $8,637.463 $5,827.834 $15,600.633 $17,795.619 $34,211.499 $23,788,255 12 296 13.2% 13.1% 12 796 13.9% 14.096 91.57 94.18 90.59 95.38 97.54 98.44 Andrews Baldwin Chester Digby $8.991 $28.192 $2.035 $2,116 $10,127 $17,393 Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Accounts payable Inventory Accounts receivable Net cash from operations $10.731 SO $18.163 50 50 (52,662) $7.689 $193 $22.338 $1.144 ($1,568) ($3,029) $35.470 $771 ($10.300) ($138) $9.763 $2.310 ($5,955) ($3,198) $13.438 ($20.032) ($40,800) (531,100) (555.191) $19.697 Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan ($1,257) $12.177 50 $25.000 (550) $25.000 SO ($13,300) $10,000 SO SO SO $13.852 SO $10.714 SO (543,482) $31,119 SO $23.788 So (534,144) $28,562 (529,675) $21.330 SO Net cash from financing activities $46.650 $2.574 $12.203 $37.803 $48.956 ($2,756) ($9,134) Net change in cash position Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Andrews $73.534 $12.057 $37.313 $122.904 Baldwin $34.384 $17.693 $17.846 $69.923 Chester $40.825 $13.267 $14.499 $68.590 (53,952) Digby $32.934 $15.468 $15.151 $63.553 Plant and equipment Accumulated Depreciation Total Fixed Assets S151.912 ($70,770) $81.142 $160.960 ($80,028) $100.932 $260.900 ($95.816) $165.084 $272.451 (588.463) $183.988 Total Assets S204046 $170,855 S233.875 $247.541 Accounts Payable Current Debt Total Current Liabilities $8.875 $10.000 $16.875 $10.874 $21.330 $32.204 $9.184 $31,119 $40,303 $10.191 $28.562 $38.753 Long Term Debt Total Liabilities Common Stock Retained Earnings Total Equity $45.859 $62.734 $60.458 $80.854 $141.312 $39.491 $71,895 $10.699 $88,481 $99.180 $102.280 $142.583 $54.207 $38.884 $91,091 $105.861 $144.614 $55,408 $47.518 $102.926 Total Liabilities & Owners' Equity S204,046 $170.855 S233.875 $247.541 Income Statement Survey Sales Variable Costs (Labor. Material. Carry) Contribution Margin Depreciation SGA (R&D. Promo, Sales, Admin) Other (Fees, Writeoffs, TQM. Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit Andrews $146.696 $95.808 $50,888 $10.127 $17,082 $8.751 $16.928 $5.953 $3.841 $143 $8.991 Baldwin $215.262 $132.877 $82.385 $10.731 $13.383 $8.878 $51,393 $7.135 $15.490 $575 $28.192 Chester S161,411 $103.178 $58,233 $17.393 $13.477 $8.728 $20.834 $17.440 $1,118 $42 $2.035 Digby S188.200 $119.852 $88.348 $18.163 $21,338 $8.169 $20.677 $17.355 $1,163 $43 $2,116 Production Information Primary Units Name Segment Sold Unit Inven Age Pfmn Size tory Revision Date Dec.31 MTBF Coord Coord 2nd Auto Shift & mation Capacity Material Labor Contr. Over- Next Next Plant Price Cost Cost Margtime Round Round Utiliz. 8 JAcre Adam 8 Thrift Core Nano Elite 708 1.242 1.298 1.040 986 341 0 889 7/18/2022 9/28/2022 10/10/2022 10/17/2022 1.9 19000 1.4 22000 1.3 24000 1.2 26000 .3 11. 6 14.8 17.2 12.0 $25.00 .8 $29.00 4.0 $38.00 6.4 $42.00 $7.23 $8.81 $10.76 $6.81 $14.54 $10.87 $15.34 $8.18 32% 35% 34% 37% 0% 0% 41% 0% 7.0 6. 0 5.0 5.0 1.280 1.800 1.128 964 70% 64% 140% 92% Agape Bead Bid Bold Buddy Nano Elite Nano Elite 1.782 1.307 1.488 1.491 138 319 360 11/5/2022 8/24/2022 7/3/2022 7/25/2022 1.2 23000 1.9 25000 1.3 23000 1.3 25000 14.5 17.3 15.0 17.1 3.5 $34.00 5.5 $34.00 3.0 $37.00 5.2 $37.00 $13.68 $14.56 $14.04 $14.57 $7.91 $6.73 $7.53 $7.33 39% 36% 40% 39% 100% 56% 60% 45% 7. 0 7.0 7.0 7.0 1.200 800 1.300 1.300 198% 15596 158% 144% Cedar Cid Cute Thrift Thrift Core 2.203 2.307 1.761 1.958 173 367 295 307 8/10/2023 6/10/2023 12/16/2021 12/18/2021 3.7 17000 3.6 17000 2.1 18000 2.1 20000 8.8 9.0 11. 9 12.6 11.2 $16.00 11.0 $16.00 7 .5 $24.00 8.0 $24.00 $6.80 $6.96 $9.72 $10.36 $3.00 $3.00 $4.65 $4.57 37% 35% 37% 35% 56% 54% 77% 65% 10.0 10.0 8. 0 8.0 1.600 1.800 1.250 1.500 153% 15396 176% 164% Dell Dixie Thrift Core Nano Elite Core Core Dune Dart Deft 1.084 2.048 1.394 824 1.724 1,053 360 272 162 208 107 0 12/20/2022 12/8/2020 12/17/2022 12/17/2022 12/25/2022 2 /10/2022 1 2.2 14000 3.1 16000 1.0 18000 .0 20000 0.9 16000 0.9 16000 9.5 10.4 13.9 17.0 11.8 11.5 10.5 $17.00 9.6 $19.00 3.4 $30.00 5.9 $36.00 8.1 $21.00 8.5 $22.00 56.82 58.14 $12.74 $13.59 $9.31 $9.03 $1.80 $4.16 $7.20 $8.33 $5.82 $4.47 52% 32% 34% 44% 29% 38% 0% 47% 71% 13% 78% 100% 10.0 9.9 7.0 7.0 7.2 8.0 1.250 99% 1.598 145% 1.042 169% 944 111% 1.097 1789 1.023 176% Selected Financial Statistics Andrews 4.8% 0.72 3.4% Baldwin 13.1% 1.26 18.5% Digby 1.1% 0.76 0.9% 2.4 2.1% 1.4 4.9% ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG&A / Sales Contrib. Margin % Chester 1.396 0.69 0.9% 2.6 2.2% SO $161.411.218 $20,634.347 $2,034.882 56,852,804 8.396 30.1% 28.4% SO $215,262.128 $51,392.968 $28,192.356 $57,294,199 6.2% 38.3% $146,698,407 $16.927.705 $6.990.816 $21,711.779 11.6% 34.7% $188,200.042 $20,676.595 $2.115.861 $8,732.301 11.396 38.3% Percent of Sales $ Market Share 100% 1 90% 80% Profit Other O SGA Depr O Var Costs 70% 60% 50% Andrews 20.62 % Baldwin 30.25% Chester 22.68 % Digby 26.45% Andrews Baldwin Chester Digby LUUN VAI NEL JUIllary Change Shares PIE 25.6 Company Andrews Baldwin Chester Digby Close $65.38 $114.83 $27.35 $36.19 $2.35 $33.99 ($1.44) ($1.10) 2,741.396 1,897.555 3,429,440 3,152.843 MarketCap Book Value ($M) Per Share $179 $51.55 $218 $52.26 S94 $26.58 $114 $32.65 EPS $2.55 $14.86 $0.59 $0.67 Dividend $0.00 $0.00 $0.00 $0.00 Yield 0.0% 0.0% 0.0% 0.0% 48.0 Bond Market Summary Company Series# Face Yield Close$ Andrews 11.252026 11.9S2027 11.452030 10.982031 10.6S2032 $8,837.000 $7,072.000 $2,450.000 $2.500.000 $25.000.000 11.2% 11.6% 11.396 11.196 11.0% 99.69 102.20 100.51 97.81 95.93 Baldwin 11.1S2028 11.252029 12.0S2030 12.252031 12.592032 $2,505.867 $5,671,177 $1,376.019 $17,760.847 $12, 178.847 11.79% 11.896 12.2% 12.396 12.496 94.72 94.59 98.04 98.95 100.58 mm D Chester 91.31 93.88 93.06 11.3S2026 12.5S2027 12.5S2028 12.58 2029 13.482030 13.982031 14.252032 $10,417.600 $14.685.611 $7,975.862 $9,473.322 $14,397.680 $34,638,089 $10,713.892 12.496 13.396 12.4% 13.5% 14.0% 14.2% 14.396 92.36 98.04 99.48 Digby 11.252026 12.492027 11.9S2029 13.1S2030 13.682031 13.8S2032 $8,637.463 $5,827.834 $15,600.633 $17,795.619 $34,211.499 $23,788,255 12 296 13.2% 13.1% 12 796 13.9% 14.096 91.57 94.18 90.59 95.38 97.54 98.44 Andrews Baldwin Chester Digby $8.991 $28.192 $2.035 $2,116 $10,127 $17,393 Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Accounts payable Inventory Accounts receivable Net cash from operations $10.731 SO $18.163 50 50 (52,662) $7.689 $193 $22.338 $1.144 ($1,568) ($3,029) $35.470 $771 ($10.300) ($138) $9.763 $2.310 ($5,955) ($3,198) $13.438 ($20.032) ($40,800) (531,100) (555.191) $19.697 Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan ($1,257) $12.177 50 $25.000 (550) $25.000 SO ($13,300) $10,000 SO SO SO $13.852 SO $10.714 SO (543,482) $31,119 SO $23.788 So (534,144) $28,562 (529,675) $21.330 SO Net cash from financing activities $46.650 $2.574 $12.203 $37.803 $48.956 ($2,756) ($9,134) Net change in cash position Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Andrews $73.534 $12.057 $37.313 $122.904 Baldwin $34.384 $17.693 $17.846 $69.923 Chester $40.825 $13.267 $14.499 $68.590 (53,952) Digby $32.934 $15.468 $15.151 $63.553 Plant and equipment Accumulated Depreciation Total Fixed Assets S151.912 ($70,770) $81.142 $160.960 ($80,028) $100.932 $260.900 ($95.816) $165.084 $272.451 (588.463) $183.988 Total Assets S204046 $170,855 S233.875 $247.541 Accounts Payable Current Debt Total Current Liabilities $8.875 $10.000 $16.875 $10.874 $21.330 $32.204 $9.184 $31,119 $40,303 $10.191 $28.562 $38.753 Long Term Debt Total Liabilities Common Stock Retained Earnings Total Equity $45.859 $62.734 $60.458 $80.854 $141.312 $39.491 $71,895 $10.699 $88,481 $99.180 $102.280 $142.583 $54.207 $38.884 $91,091 $105.861 $144.614 $55,408 $47.518 $102.926 Total Liabilities & Owners' Equity S204,046 $170.855 S233.875 $247.541 Income Statement Survey Sales Variable Costs (Labor. Material. Carry) Contribution Margin Depreciation SGA (R&D. Promo, Sales, Admin) Other (Fees, Writeoffs, TQM. Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit Andrews $146.696 $95.808 $50,888 $10.127 $17,082 $8.751 $16.928 $5.953 $3.841 $143 $8.991 Baldwin $215.262 $132.877 $82.385 $10.731 $13.383 $8.878 $51,393 $7.135 $15.490 $575 $28.192 Chester S161,411 $103.178 $58,233 $17.393 $13.477 $8.728 $20.834 $17.440 $1,118 $42 $2.035 Digby S188.200 $119.852 $88.348 $18.163 $21,338 $8.169 $20.677 $17.355 $1,163 $43 $2,116 Production Information Primary Units Name Segment Sold Unit Inven Age Pfmn Size tory Revision Date Dec.31 MTBF Coord Coord 2nd Auto Shift & mation Capacity Material Labor Contr. Over- Next Next Plant Price Cost Cost Margtime Round Round Utiliz. 8 JAcre Adam 8 Thrift Core Nano Elite 708 1.242 1.298 1.040 986 341 0 889 7/18/2022 9/28/2022 10/10/2022 10/17/2022 1.9 19000 1.4 22000 1.3 24000 1.2 26000 .3 11. 6 14.8 17.2 12.0 $25.00 .8 $29.00 4.0 $38.00 6.4 $42.00 $7.23 $8.81 $10.76 $6.81 $14.54 $10.87 $15.34 $8.18 32% 35% 34% 37% 0% 0% 41% 0% 7.0 6. 0 5.0 5.0 1.280 1.800 1.128 964 70% 64% 140% 92% Agape Bead Bid Bold Buddy Nano Elite Nano Elite 1.782 1.307 1.488 1.491 138 319 360 11/5/2022 8/24/2022 7/3/2022 7/25/2022 1.2 23000 1.9 25000 1.3 23000 1.3 25000 14.5 17.3 15.0 17.1 3.5 $34.00 5.5 $34.00 3.0 $37.00 5.2 $37.00 $13.68 $14.56 $14.04 $14.57 $7.91 $6.73 $7.53 $7.33 39% 36% 40% 39% 100% 56% 60% 45% 7. 0 7.0 7.0 7.0 1.200 800 1.300 1.300 198% 15596 158% 144% Cedar Cid Cute Thrift Thrift Core 2.203 2.307 1.761 1.958 173 367 295 307 8/10/2023 6/10/2023 12/16/2021 12/18/2021 3.7 17000 3.6 17000 2.1 18000 2.1 20000 8.8 9.0 11. 9 12.6 11.2 $16.00 11.0 $16.00 7 .5 $24.00 8.0 $24.00 $6.80 $6.96 $9.72 $10.36 $3.00 $3.00 $4.65 $4.57 37% 35% 37% 35% 56% 54% 77% 65% 10.0 10.0 8. 0 8.0 1.600 1.800 1.250 1.500 153% 15396 176% 164% Dell Dixie Thrift Core Nano Elite Core Core Dune Dart Deft 1.084 2.048 1.394 824 1.724 1,053 360 272 162 208 107 0 12/20/2022 12/8/2020 12/17/2022 12/17/2022 12/25/2022 2 /10/2022 1 2.2 14000 3.1 16000 1.0 18000 .0 20000 0.9 16000 0.9 16000 9.5 10.4 13.9 17.0 11.8 11.5 10.5 $17.00 9.6 $19.00 3.4 $30.00 5.9 $36.00 8.1 $21.00 8.5 $22.00 56.82 58.14 $12.74 $13.59 $9.31 $9.03 $1.80 $4.16 $7.20 $8.33 $5.82 $4.47 52% 32% 34% 44% 29% 38% 0% 47% 71% 13% 78% 100% 10.0 9.9 7.0 7.0 7.2 8.0 1.250 99% 1.598 145% 1.042 169% 944 111% 1.097 1789 1.023 176%