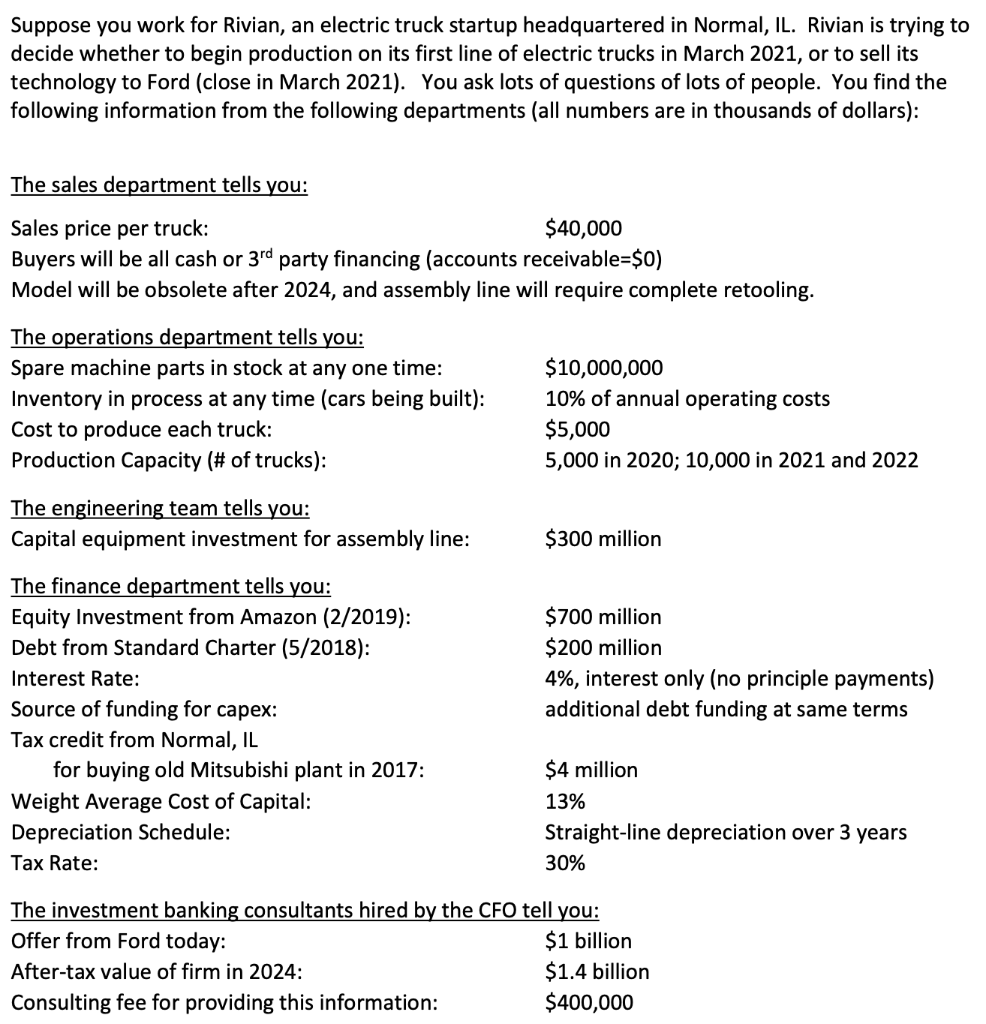

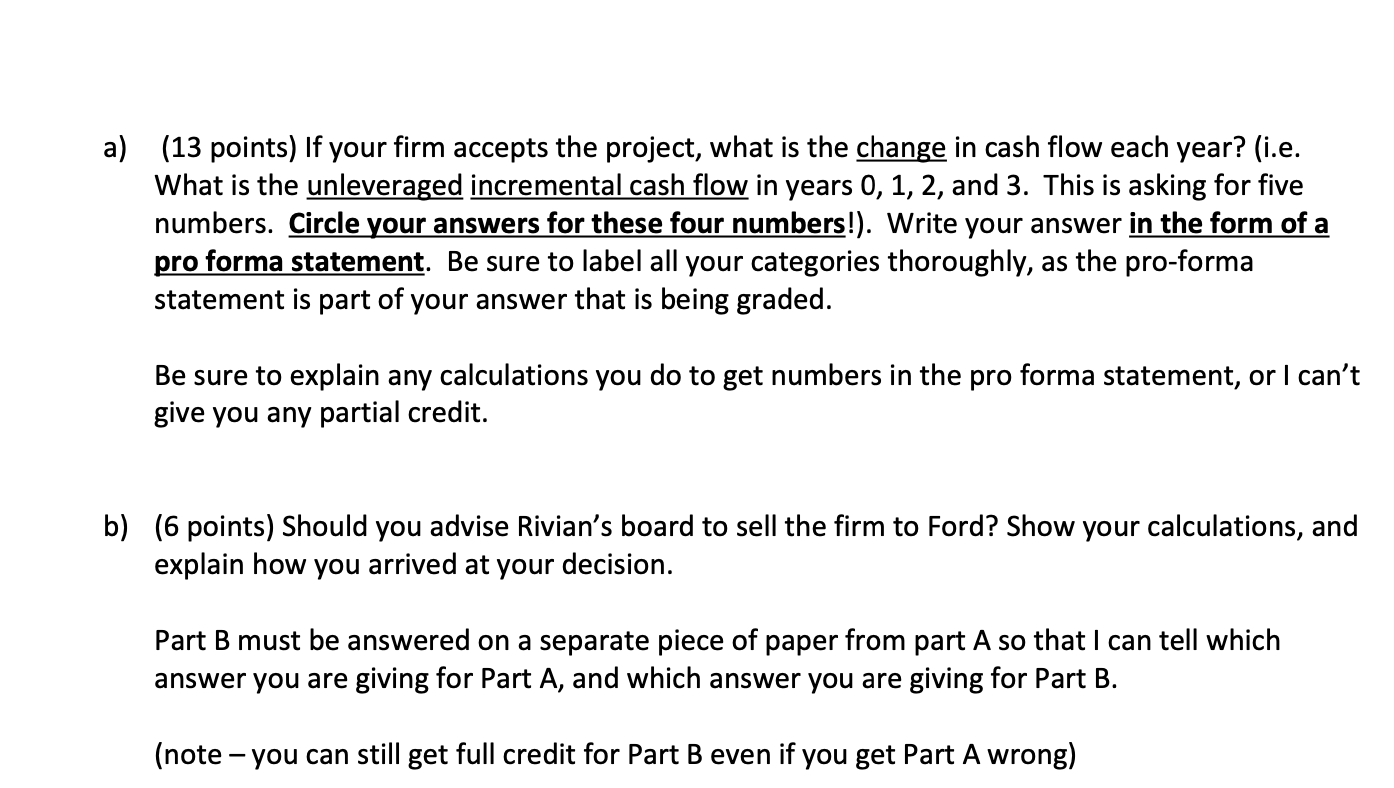

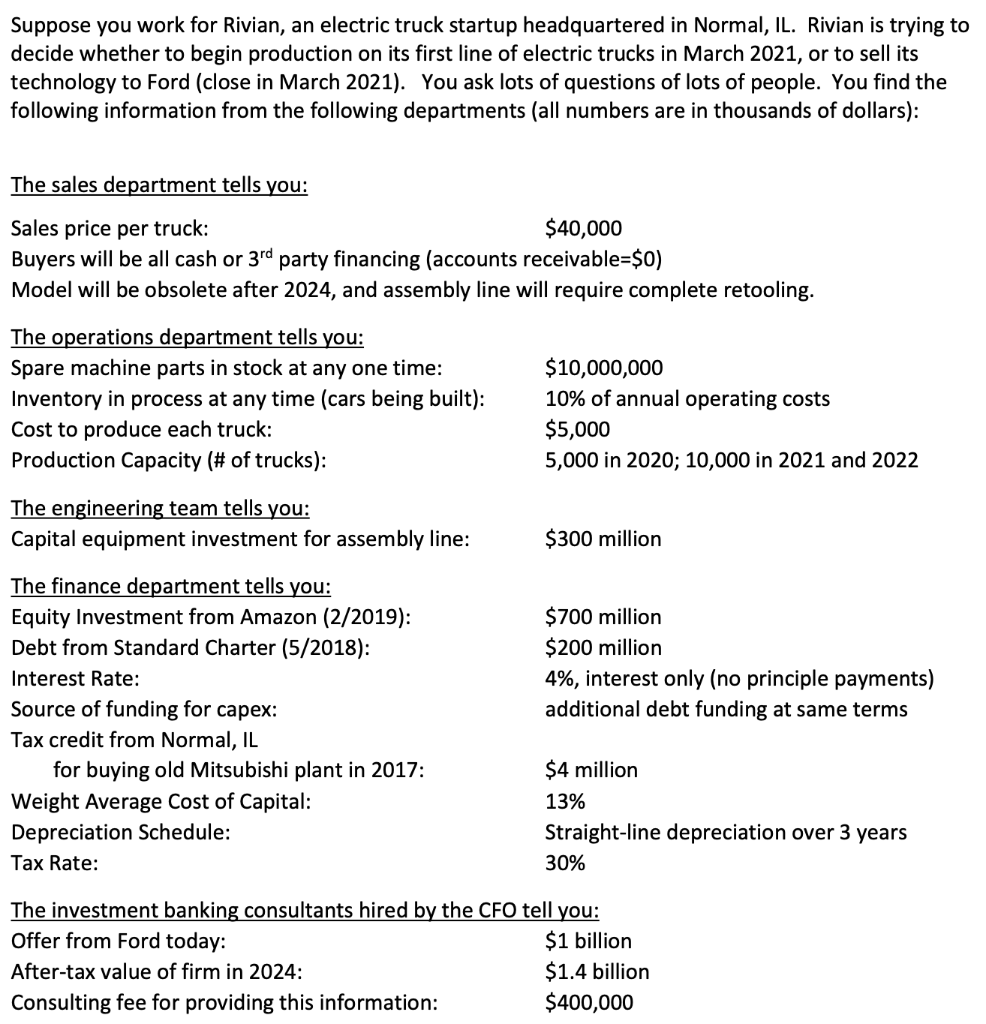

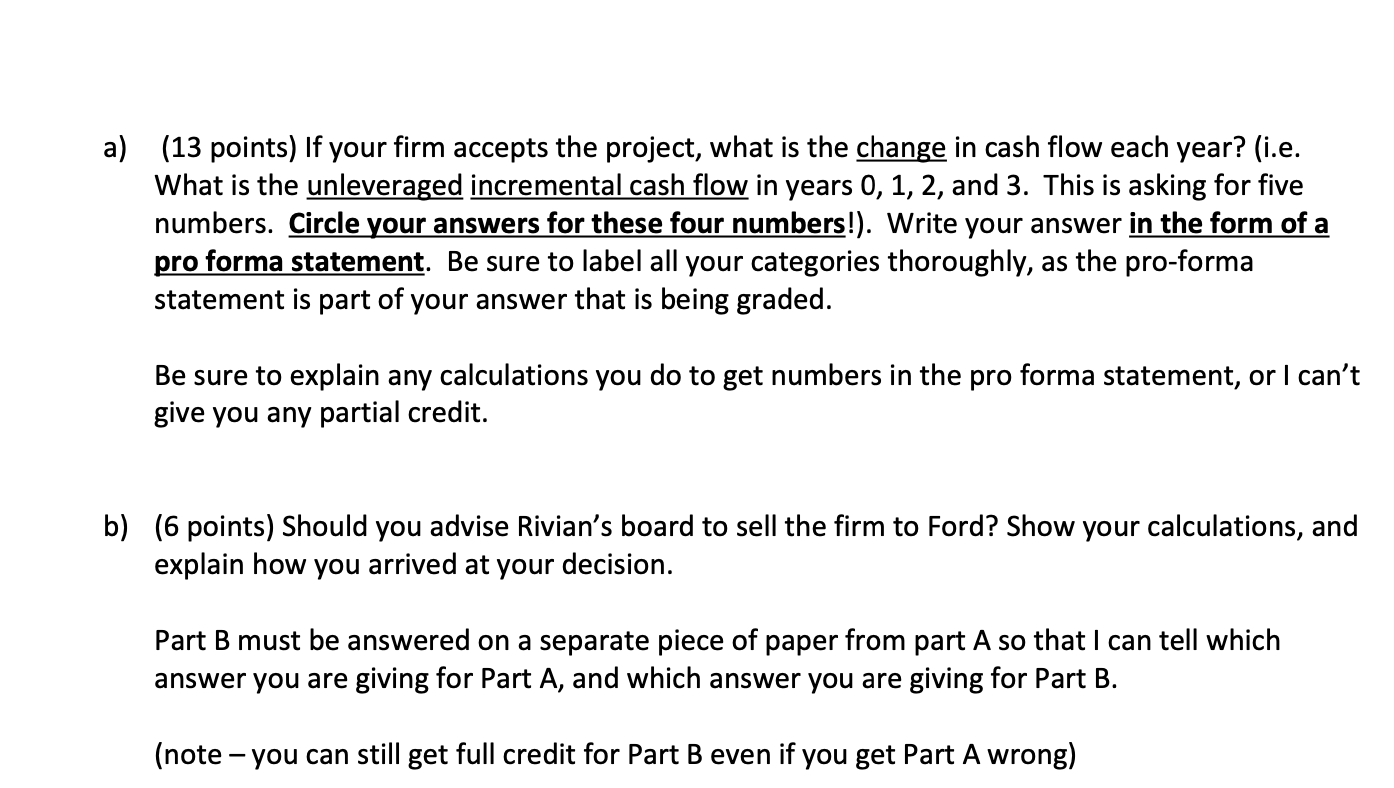

Suppose you work for Rivian, an electric truck startup headquartered in Normal, IL. Rivian is trying to decide whether to begin production on its first line of electric trucks in March 2021, or to sell its technology to Ford (close in March 2021). You ask lots of questions of lots of people. You find the following information from the following departments (all numbers are in thousands of dollars): The sales department tells you: Sales price per truck: $40,000 Buyers will be all cash or 3rd party financing (accounts receivable=$0) Model will be obsolete after 2024, and assembly line will require complete retooling. The operations department tells you: Spare machine parts in stock at any one time: Inventory in process at any time (cars being built): Cost to produce each truck: Production Capacity (# of trucks): $10,000,000 10% of annual operating costs $5,000 5,000 in 2020; 10,000 in 2021 and 2022 The engineering team tells you: Capital equipment investment for assembly line: $300 million The finance department tells you: Equity Investment from Amazon (2/2019): Debt from Standard Charter (5/2018): Interest Rate: Source of funding for capex: Tax credit from Normal, IL for buying old Mitsubishi plant in 2017: Weight Average Cost of Capital: Depreciation Schedule: Tax Rate: $700 million $200 million 4%, interest only (no principle payments) additional debt funding at same terms $4 million 13% Straight-line depreciation over 3 years 30% The investment banking consultants hired by the CFO tell you: Offer from Ford today: $1 billion After-tax value of firm in 2024: $1.4 billion Consulting fee for providing this information: $400,000 a) (13 points) If your firm accepts the project, what is the change in cash flow each year? (i.e. What is the unleveraged incremental cash flow in years 0, 1, 2, and 3. This is asking for five numbers. Circle your answers for these four numbers!). Write your answer in the form of a pro forma statement. Be sure to label all your categories thoroughly, as the pro-forma statement is part of your answer that is being graded. Be sure to explain any calculations you do to get numbers in the pro forma statement, or I can't give you any partial credit. b) (6 points) Should you advise Rivian's board to sell the firm to Ford? Show your calculations, and explain how you arrived at your decision. Part B must be answered on a separate piece of paper from part A so that I can tell which answer you are giving for Part A, and which answer you are giving for Part B. (note - you can still get full credit for Part B even if you get Part A wrong) Suppose you work for Rivian, an electric truck startup headquartered in Normal, IL. Rivian is trying to decide whether to begin production on its first line of electric trucks in March 2021, or to sell its technology to Ford (close in March 2021). You ask lots of questions of lots of people. You find the following information from the following departments (all numbers are in thousands of dollars): The sales department tells you: Sales price per truck: $40,000 Buyers will be all cash or 3rd party financing (accounts receivable=$0) Model will be obsolete after 2024, and assembly line will require complete retooling. The operations department tells you: Spare machine parts in stock at any one time: Inventory in process at any time (cars being built): Cost to produce each truck: Production Capacity (# of trucks): $10,000,000 10% of annual operating costs $5,000 5,000 in 2020; 10,000 in 2021 and 2022 The engineering team tells you: Capital equipment investment for assembly line: $300 million The finance department tells you: Equity Investment from Amazon (2/2019): Debt from Standard Charter (5/2018): Interest Rate: Source of funding for capex: Tax credit from Normal, IL for buying old Mitsubishi plant in 2017: Weight Average Cost of Capital: Depreciation Schedule: Tax Rate: $700 million $200 million 4%, interest only (no principle payments) additional debt funding at same terms $4 million 13% Straight-line depreciation over 3 years 30% The investment banking consultants hired by the CFO tell you: Offer from Ford today: $1 billion After-tax value of firm in 2024: $1.4 billion Consulting fee for providing this information: $400,000 a) (13 points) If your firm accepts the project, what is the change in cash flow each year? (i.e. What is the unleveraged incremental cash flow in years 0, 1, 2, and 3. This is asking for five numbers. Circle your answers for these four numbers!). Write your answer in the form of a pro forma statement. Be sure to label all your categories thoroughly, as the pro-forma statement is part of your answer that is being graded. Be sure to explain any calculations you do to get numbers in the pro forma statement, or I can't give you any partial credit. b) (6 points) Should you advise Rivian's board to sell the firm to Ford? Show your calculations, and explain how you arrived at your decision. Part B must be answered on a separate piece of paper from part A so that I can tell which answer you are giving for Part A, and which answer you are giving for Part B. (note - you can still get full credit for Part B even if you get Part A wrong)