Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose your company will be receiving 6 0 million euros six months from now and the euro is currently selling for 1 euro per dollar.

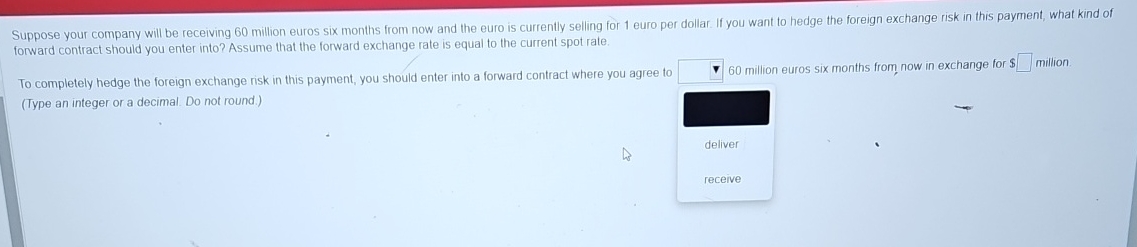

Suppose your company will be receiving million euros six months from now and the euro is currently selling for euro per dollar. If you want to hedge the foreign exchange risk in this payment, what kind of forward contract should you enter into? Assume that the forward exchange rate is equal to the current spot rate.

To completely hedge the foreign exchange risk in this payment, you should enter into a forward contract where you agree to million euros six months from, now in exchange for $ million

Type an integer or a decimal. Do not round.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started