Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose your firm earns $2 million in taxable income. What is the firm's tax liability? What is the average tax rate? What is the

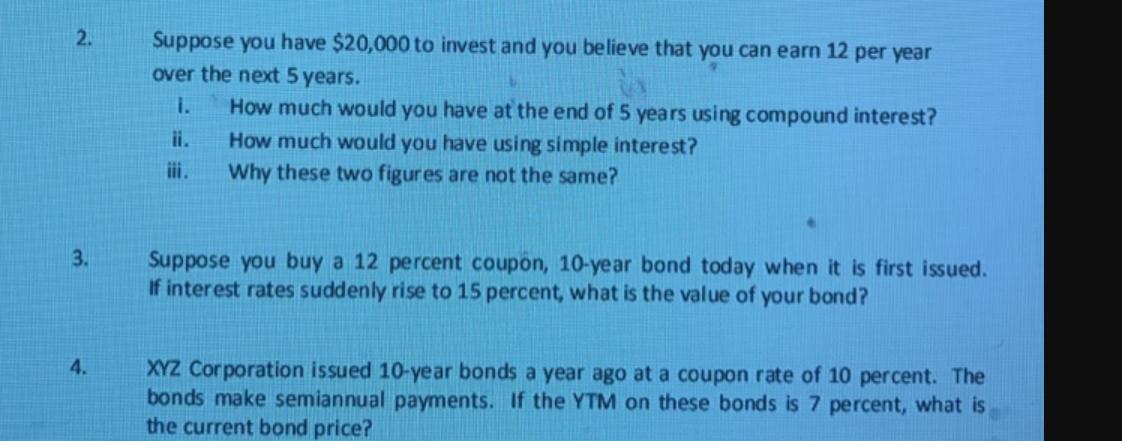

Suppose your firm earns $2 million in taxable income. What is the firm's tax liability? What is the average tax rate? What is the marginal tax rate? 1. ii. Taxable Income 0 and under 50,000 50,000 and under 75,000 75,000 and under 100,000 100,000 and under 335,000 335,000 and under 4,000,000 Tax Rate 10% 20% 30% 40% 50% 2. 3. 4. Suppose you have $20,000 to invest and you believe that you can earn 12 per year over the next 5 years. i. How much would you have at the end of 5 years using compound interest? How much would you have using simple interest? Why these two figures are not the same? ii. iii. Suppose you buy a 12 percent coupon, 10-year bond today when it is first issued. If interest rates suddenly rise to 15 percent, what is the value of your bond? XYZ Corporation issued 10-year bonds a year ago at a coupon rate of 10 percent. The bonds make semiannual payments. If the YTM on these bonds is 7 percent, what is the current bond price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the firms tax liability we need to determine the tax rate applicable to the taxable income of 2 million Based on the provided tax rates and income brackets the tax liability can be calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started