Answered step by step

Verified Expert Solution

Question

1 Approved Answer

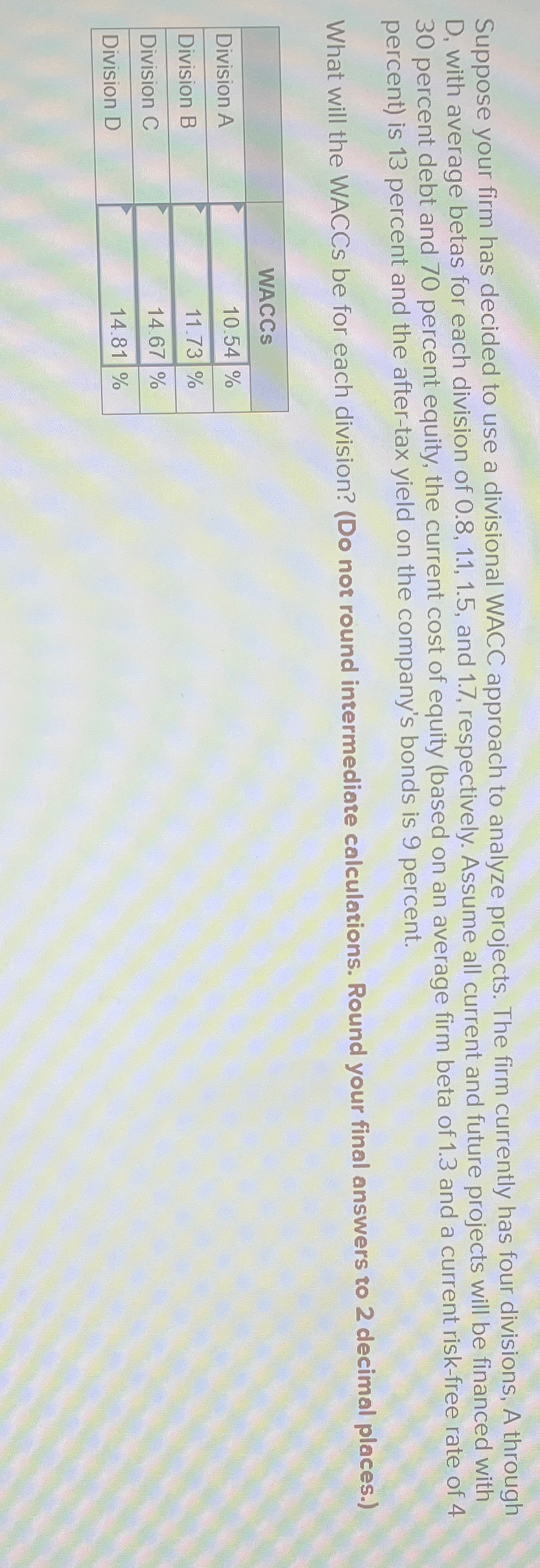

Suppose your firm has decided to use a divisional WACC approach to analyze projects. The firm currently has four divisions, A through D , with

Suppose your firm has decided to use a divisional WACC approach to analyze projects. The firm currently has four divisions, A through with average betas for each division of and respectively. Assume all current and future projects will be financed with percent debt and percent equity, the current cost of equity based on an average firm beta of and a current riskfree rate of percent is percent and the aftertax yield on the company's bonds is percent.

What will the WACCs be for each division? Do not round intermediate calculations. Round your final answers to decimal places.

tableWACCsDivision ADivision BDivision CDivision D

the answers i put where from a post i made about this same question originally and these where the wrong answers they gave me

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started