Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose your firm invests $ 1 0 0 , 0 0 0 in a project in Italy. At the time the exchange rate is .

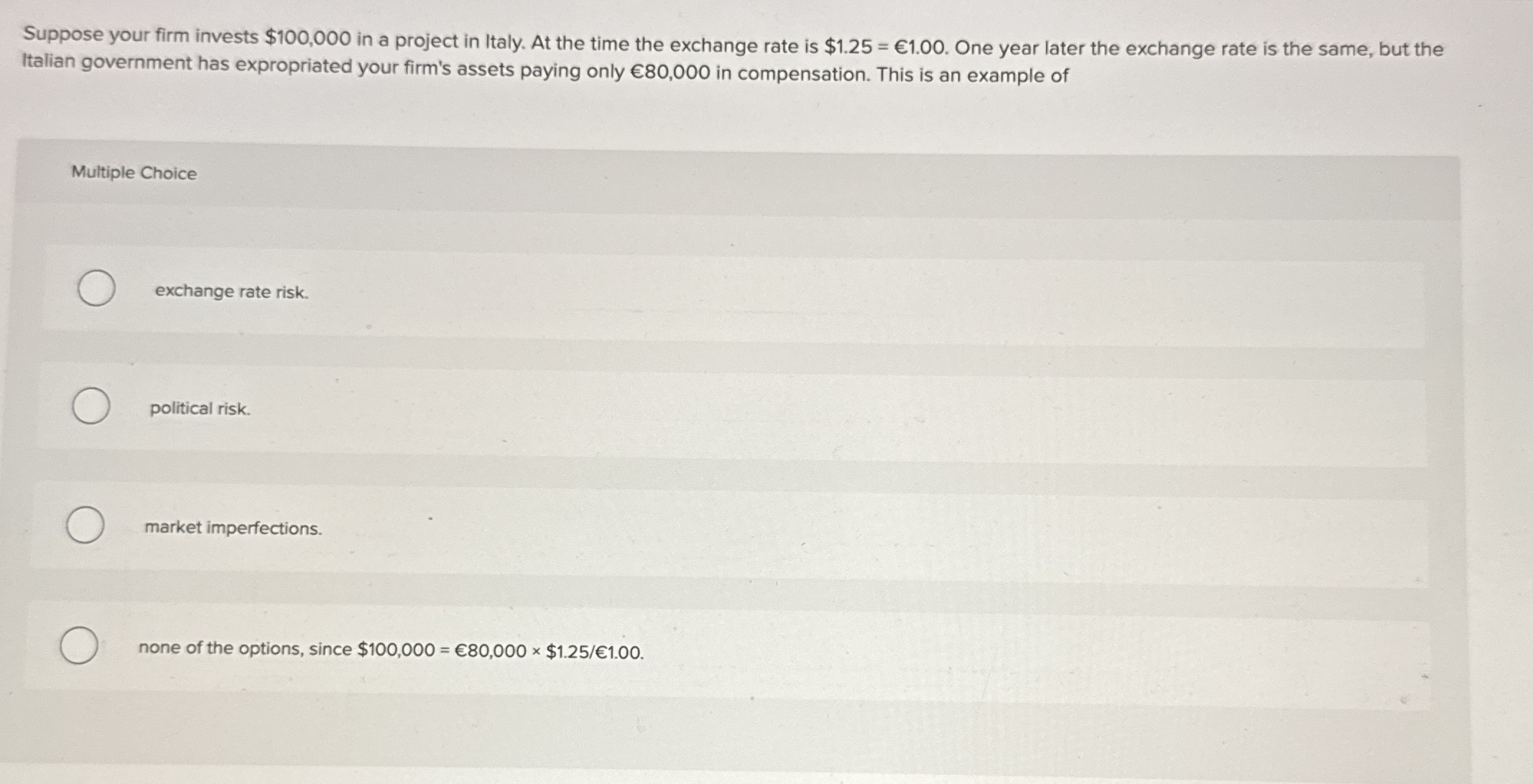

Suppose your firm invests $ in a project in Italy. At the time the exchange rate is One year later the exchange rate is the same, but the

Italian government has expropriated your firm's assets paying only in compensation. This is an example of

Multiple Choice

exchange rate risk.

political risk.

market imperfections.

none of the options, since

Suppose your firm invests $ in a project in Italy. At the time the exchange rate is One year later the exchange rate is the same, but the

Italian government has expropriated your firm's assets paying only in compensation. This is an example of

Multiple Choice

exchange rate risk.

political risk.

market imperfections.

none of the options, since

Suppose your firm invests $ in a project in Italy. At the time the exchange rate is One year later the exchange rate is the same, but the

Italian government has expropriated your firm's assets paying only in compensation. This is an example of

Multiple Choice

exchange rate risk.

political risk.

market imperfections.

none of the options, since

Suppose your firm invests $ in a project in Italy. At the time the exchange rate is One year later the exchange rate is the same, but the

Italian government has expropriated your firm's assets paying only in compensation. This is an example of

Multiple Choice

exchange rate risk.

political risk.

market imperfections.

none of the options, since

Suppose your firm invests $ in a project in Italy. At the time the exchange rate is One year later the exchange rate is the same, but the

Italian government has expropriated your firm's assets paying only in compensation. This is an example of

Multiple Choice

exchange rate risk.

political risk.

market imperfections.

none of the options, since

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started