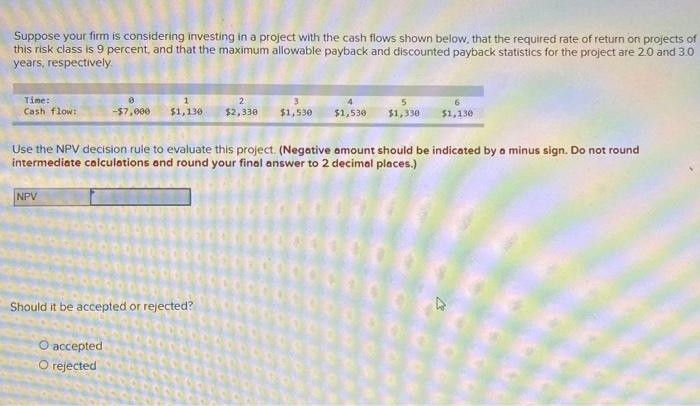

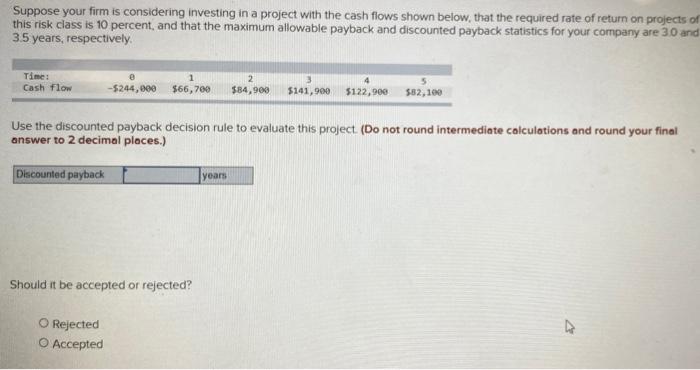

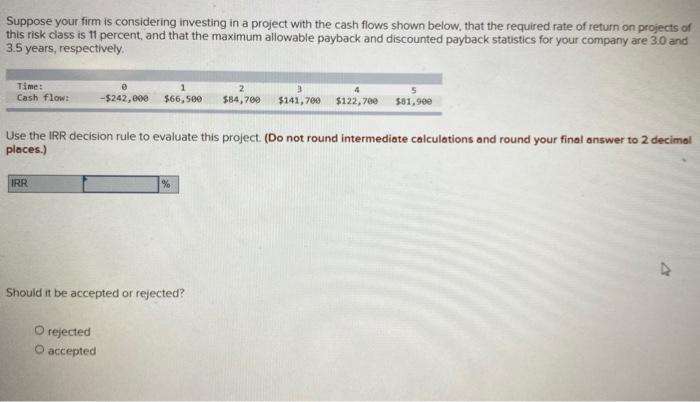

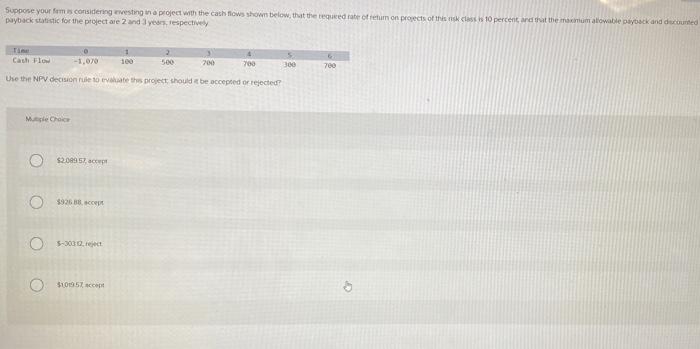

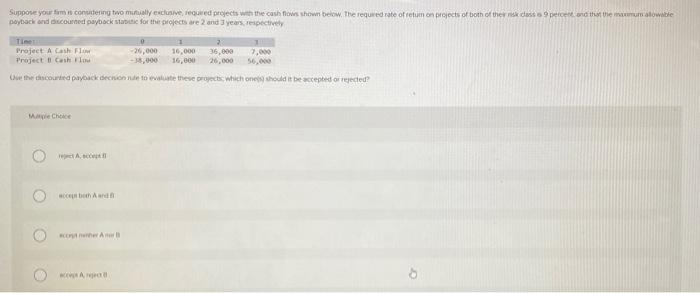

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively Time: Cash flow: -$7,000 1 $1,130 2 $2,330 $1,530 $1,530 5 $1,330 6 $1,130 Use the NPV decision rule to evaluate this project. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) NPV Should it be accepted or rejected? . O accepted O rejected Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for your company are 30 and 3.5 years, respectively 1 Time: Cash flow -5244,000 $66,700 2 $84,900 3 5141,900 $122,900 $82,100 Use the discounted payback decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Discounted payback years Should it be accepted or rejected? O Rejected O Accepted Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3.0 and 3.5 years, respectively Time: Cash flow -$242,000 $66,500 2 $84,700 $141,700 $122,700 $81,900 Use the IRR decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) IRR % Should it be accepted or rejected? O rejected O accepted Suppose your firms considering resting a project with the cash flows shown below, that the required rate of return on projects of this class 10 percent and that the manum allowable back and discounted payback statistic for the project are 2 and 3 years, respective + Cash Flow -1,070 100 500 200 700 300 Use the NPV decision rule ove this project should be accepted or rejected 700 Me Choc $2.048 57 cp $926 5-3000rect $100cc Suppose your fum contering two millende regowed projects with the cash flows shown below. The required rate of return on projects of both of the speed and that the mowite Dayback and courted payback for the projects are 2 and 3 years respectively Time Project A Cash Flow -20,000 10,000 36,000 Project Cash Flow 16,000 26,000 the hecouried you decide to use these project which one should it be accepted or reeded ie chece hard