Answered step by step

Verified Expert Solution

Question

1 Approved Answer

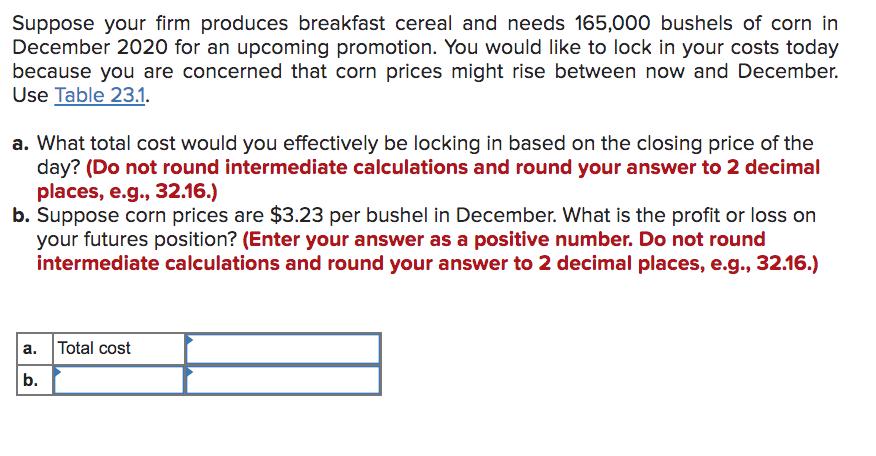

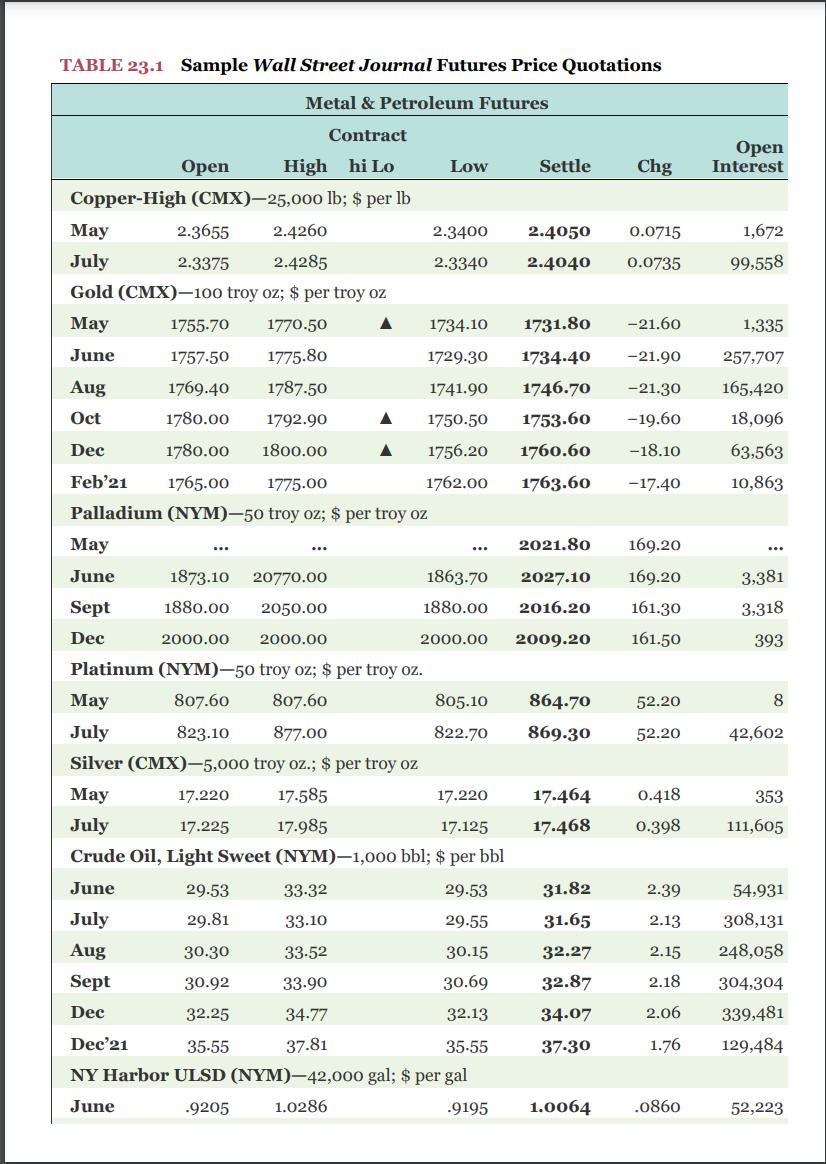

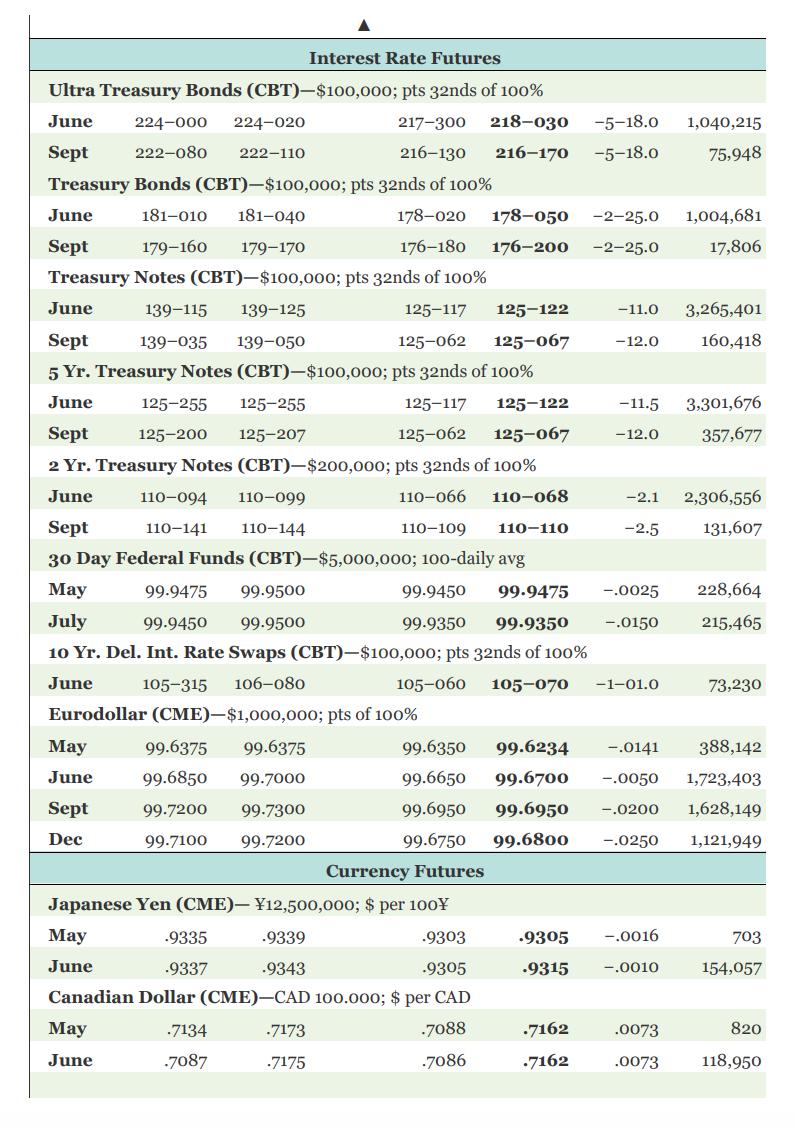

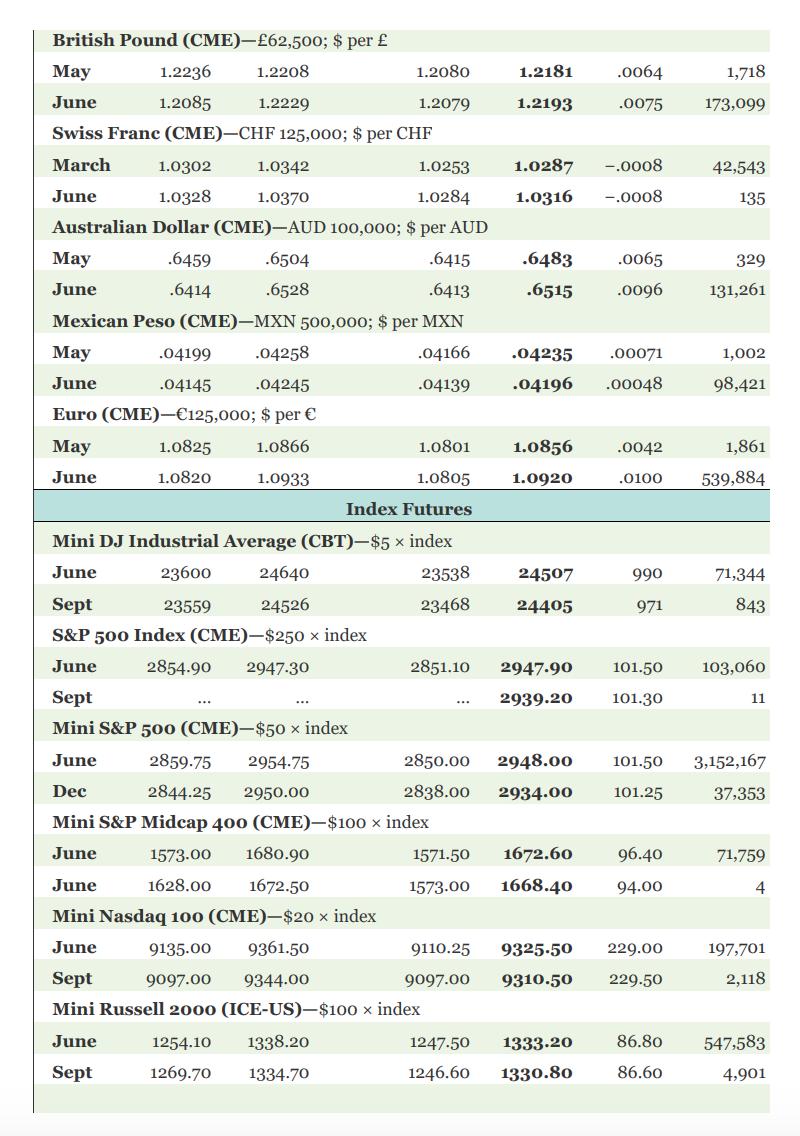

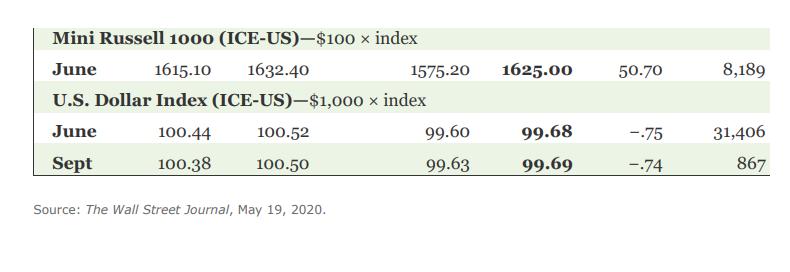

Suppose your firm produces breakfast cereal and needs 165,000 bushels of corn in December 2020 for an upcoming promotion. You would like to lock

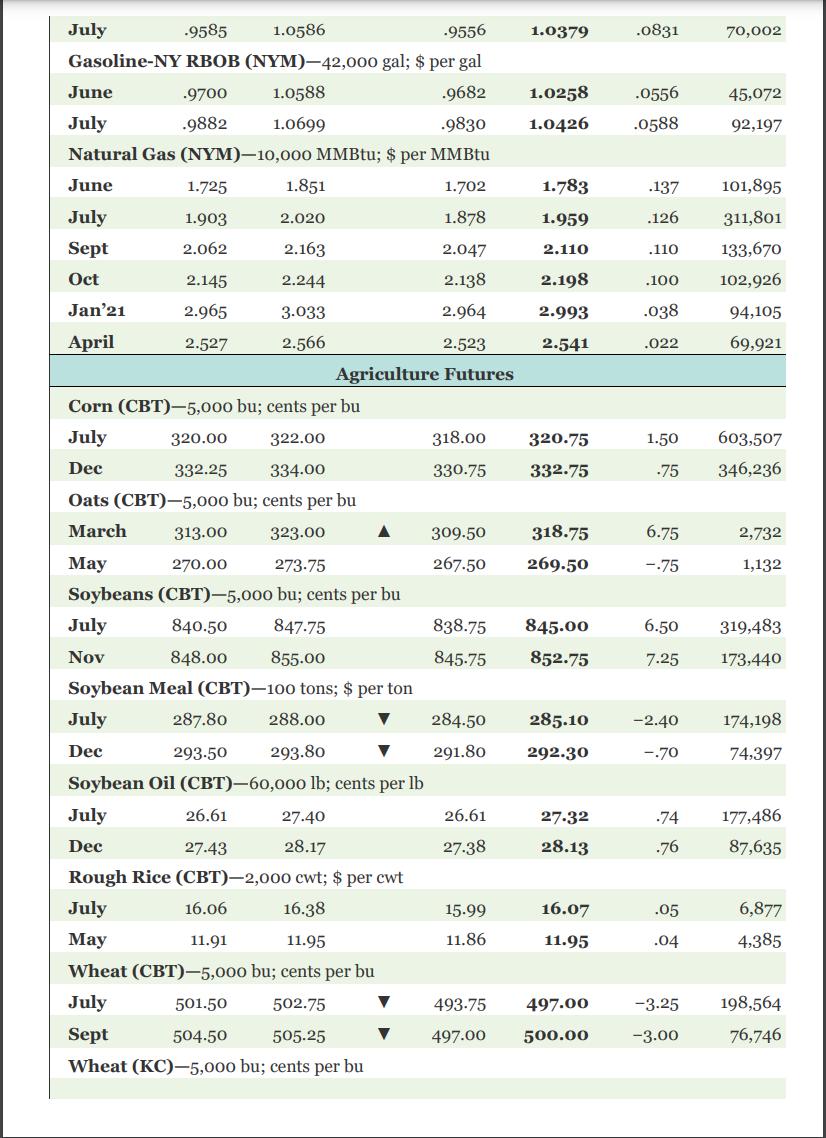

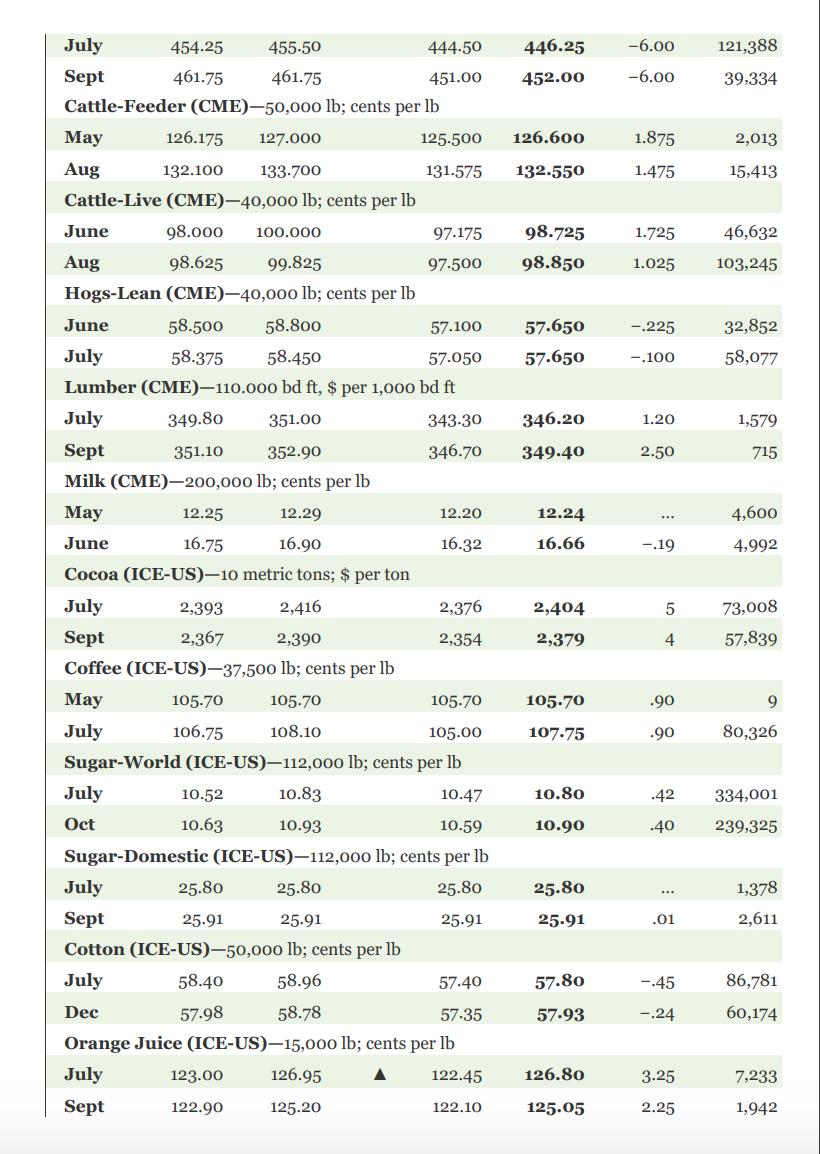

Suppose your firm produces breakfast cereal and needs 165,000 bushels of corn in December 2020 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might rise between now and December. Use Table 23.1. a. What total cost would you effectively be locking in based on the closing price of the day? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Suppose corn prices are $3.23 per bushel in December. What is the profit or loss on your futures position? (Enter your answer as a positive number. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Total cost b. TABLE 23.1 Sample Wall Street Journal Futures Price Quotations Metal & Petroleum Futures Contract High hi Lo Copper-High (CMX)-25,000 lb; $ per lb Open May 2.3655 2.4260 July 2.3375 2.4285 Gold (CMX)-100 troy oz; $ per troy oz May 1755.70 1770.50 June 1757.50 1775.80 1769.40 1787.50 1780.00 1792.90 1780.00 1800.00 May June Sept Dec Aug Oct Dec Feb'21 1765.00 1775.00 Palladium (NYM)-50 troy oz; $ per troy oz ... July Aug Sept Dec A Low 2.3400 2.3340 1734.10 1729.30 1741.90 1750.50 1756.20 1762.00 *** 1873.10 20770.00 1880.00 2050.00 2000.00 2000.00 Platinum (NYM)-50 troy oz; $ per troy oz. May 807.60 807.60 July 823.10 877.00 Silver (CMX)-5,000 troy oz.; $ per troy oz May 17.220 17.585 17.220 July 17.225 17.985 17.125 Crude Oil, Light Sweet (NYM)-1,000 bbl; $ per bbl June 29.53 29.55 30.15 30.69 32.13 1863.70 1880.00 2000.00 805.10 822.70 29.53 33.32 29.81 33.10 30.30 33-52 30.92 33.90 32.25 34.77 Dec'21 35-55 37.81 35-55 NY Harbor ULSD (NYM)-42,000 gal; $ per gal June .9205 1.0286 .9195 Settle 2.4050 2.4040 1731.80 -21.60 1734.40 -21.90 1746.70 -21.30 1753.60 -19.60 1760.60 -18.10 1763.60 -17.40 2027.10 2016.20 2009.20 2021.80 169.20 169.20 161.30 161.50 864.70 869.30 Chg 17.464 17.468 0.0715 0.0735 31.82 31.65 32.27 32.87 34.07 37.30 52.20 52.20 0.418 0.398 2.39 2.13 2.15 2.18 2.06 1.76 1.0064 .0860 Open Interest 1,672 99,558 1,335 257,707 165,420 18,096 63,563 10,863 ... 3,381 3,318 393 8 42,602 353 111,605 54,931 308,131 248,058 304,304 339,481 129,484 52,223 -9585 1.0586 -9556 Gasoline-NY RBOB (NYM)-42,000 gal; $ per gal June 1.0588 .9682 July 1.0699 .9830 Natural Gas (NYM)-10,000 MMBtu; $ per MMBtu June 1.702 July 1.878 Sept 2.047 Oct 2.138 Jan'21 2.964 April 2.523 Agriculture Futures July .9700 .9882 1.725 1.903 2.062 2.145 2.965 2.527 July Nov 320.00 332.25 Corn (CBT)-5,000 bu; cents per bu July 322.00 Dec 334.00 840.50 848.00 287.80 293.50 1.851 Oats (CBT)-5,000 bu; cents per bu March 313.00 323.00 May 270.00 273.75 Soybeans (CBT)-5,000 bu; cents per bu 847-75 855.00 Soybean Meal (CBT)-100 tons; $ per ton July Dec 2.020 26.61 27.43 2.163 2.244 16.06 11.91 3.033 2.566 Soybean Oil (CBT)-60,000 lb; cents per lb July 27.40 Dec 28.17 Rough Rice (CBT)-2,000 cwt; $ per cwt July 16.38 May 11.95 Wheat (CBT)-5,000 bu; cents per bu July 501.50 502.75 Sept 504.50 505.25 Wheat (KC)-5,000 bu; cents per bu 288.00 293.80 318.00 330.75 838.75 845-75 284.50 291.80 26.61 27.38 309.50 318.75 267.50 269.50 15.99 11.86 1.0379 493-75 497.00 1.0258 1.0426 1.783 1.959 2.110 2.198 2.993 2.541 320.75 332.75 845.00 852.75 285.10 292.30 27.32 28.13 16.07 11.95 497.00 500.00 .0831 .0556 .0588 .110 .137 101,895 .126 311,801 133,670 102,926 .100 .038 .022 1.50 -75 6.75 -.75 70,002 -2.40 -.70 45,072 92,197 .05 1.04 94,105 69,921 603,507 346,236 6.50 319,483 7.25 173,440 2,732 1,132 174,198 74,397 .74 177,486 .76 87,635 6,877 4,385 -3.25 198,564 -3.00 76,746 July Sept May Aug Cattle-Feeder (CME)-50,000 lb; cents per lb 126.175 127.000 132.100 133.700 Cattle-Live (CME)-40,000 lb; cents per lb June Aug 454.25 461.75 98.000 100.000 98.625 99.825 Hogs-Lean (CME)-40,000 lb; cents per lb June July May July 455-50 461.75 July Oct 58.500 58.800 57.100 58.375 58.450 57.050 Lumber (CME)-110.000 bd ft, $ per 1,000 bd ft July 349.80 351.00 343-30 Sept 351.10 352.90 346.70 Milk (CME)-200,000 lb; cents per lb May 12.29 June 16.90 Cocoa (ICE-US)-10 metric tons; $ per ton July 2,393 2,416 Sept 2,367 2,390 Coffee (ICE-US)-37,500 lb; cents per lb 105.70 105.70 106.75 108.10 12.25 16.75 10.52 10.63 444.50 451.00 July 25.80 Sept 25.91 25.91 Cotton (ICE-US)-50,000 lb; cents per lb July 58.40 58.96 Dec 57.98 58.78 123.00 122.90 125.500 131.575 105.70 105.00 Sugar-World (ICE-US)-112,000 lb; cents per lb 10.83 10.47 10.93 10.59 Sugar-Domestic (ICE-US)-112,000 lb; cents per lb 25.80 25.80 25.91 97.175 97.500 126.95 125.20 12.20 16.32 2,376 2,354 57.40 57-35 Orange Juice (ICE-US)-15,000 lb; cents per lb July 122.45 Sept 122.10 446.25 -6.00 452.00 -6.00 126.600 132.550 98.725 98.850 57.650 57.650 346.20 349.40 12.24 16.66 2,404 2,379 105.70 107.75 10.80 10.90 25.80 25.91 57.80 57.93 126.80 125.05 1.875 1.475 1.725 1.025 -.225 -.100 1.20 2.50 *** -.19 5 4 .90 .90 .42 .40 *** .01 -.45 -.24 3.25 2.25 121,388 39,334 2,013 15,413 46,632 103,245 32,852 58,077 1,579 715 4,600 4,992 73,008 57,839 80,326 334,001 239,325 1,378 2,611 86,781 60,174 7,233 1,942 Interest Rate Futures Ultra Treasury Bonds (CBT)-$100,000; pts 32nds of 100% June 224-000 224-020 217-300 218-030 Sept 222-080 222-110 216-130 216-170 Treasury Bonds (CBT)-$100,000; pts 32nds of 100% June 181-010 181-040 178-020 Sept 179-160 179-170 176-180 Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 139-115 139-125 125-117 Sept 139-035 139-050 125-062 5 Yr. Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 125-117 Sept 125-062 2 Yr. Treasury Notes (CBT)-$200,000; pts 32nds of 100% June 110-066 Sept 110-109 30 Day Federal Funds (CBT)-$5,000,000; 100-daily avg May 99.9475 99.9500 July 99.9450 99.9500 10 Yr. Del. Int. Rate Swaps (CBT)-$100,000; pts June 105-315 106-080 105-060 May June Sept Dec 125-255 125-200 Eurodollar (CME)-$1,000,000; pts of 100% May June May June 125-255 125-207 110-094 110-099 110-141 110-144 99.6375 99.6375 99.6850 99.7000 99.7200 99.7300 99.7100 99.7200 .7134 .7087 -9339 .9343 178-050 176-200 .7173 .7175 125-122 125-067 125-122 125-067 110-068 110-110 -5-18.0 -5-18.0 -2-25.0 1,004,681 -2-25.0 17,806 -11.0 3,265,401 160,418 -12.0 .7162 .7162 -11.5 -12.0 -2.5 99.9450 99.9475 99.9350 99.9350 -.0150 32nds of 100% 99.6350 99.6234 -.0141 388,142 99.6650 99.6700 -.0050 1,723,403 99.6950 99.6950 -.0200 1,628,149 99.6750 99.6800 1,121,949 Currency Futures Japanese Yen (CME)- 12,500,000; $ per 100 .9335 -9303 .9337 .9305 Canadian Dollar (CME)-CAD 100.000; $ per CAD .7088 .7086 -2.1 2,306,556 131,607 105-070 -1-01.0 1,040,215 75,948 -.0025 228,664 215,465 -.0250 .9305 -.0016 .9315 -.0010 3,301,676 357,677 .0073 .0073 73,230 703 154,057 820 118,950 British Pound (CME)-62,500; $ per May June Swiss Franc (CME)-CHF 125,000; $ per CHF March June 1.2236 1.2085 May June 1.0302 1.0342 1.0253 1.0328 1.0370 1.0284 Australian Dollar (CME)-AUD 100,000; $ per AUD .6459 .6414 1.2208 1.2229 .6504 .6528 .6415 .6413 Mexican Peso (CME)-MXN 500,000; $ per MXN .04166 .04139 May .04199 .04258 June .04145 .04245 Euro (CME)-125,000; $ per May 1.0825 1.0866 June 1.0820 1.0933 *** 1.0801 1.0805 Index Futures Mini DJ Industrial Average (CBT)-$5 x index June 23600 23538 23559 23468 1.2080 1.2079 24640 24526 Sept S&P 500 Index (CME)-$250 x index June 2854.90 2947-30 Sept Mini S&P 500 (CME)-$50 x index June 1254.10 1338.20 1269.70 1334.70 2851.10 2859.75 2954.75 Dec 2844.25 2950.00 Mini S&P Midcap 400 (CME)-$100 x index June 1573.00 1680.90 June 1628.00 1672.50 Mini Nasdaq 100 (CME)-$20 x index June 9135.00 9361.50 Sept 9097.00 9344.00 Mini Russell 2000 (ICE-US)-$100 x index June Sept 1571.50 1573.00 9110.25 9097.00 1.2181 1.2193 1247.50 1246.60 1.0287 -.0008 1.0316 -.0008 .6483 .6515 .04235 .04196 2850.00 2948.00 2838.00 2934.00 1.0856 1.0920 24507 24405 2947.90 2939.20 1672.60 1668.40 .0064 .0075 1333.20 1330.80 .0065 .0096 .00071 .00048 990 971 101.50 101.25 .0042 1,861 .0100 539,884 96.40 94.00 9325.50 229.00 9310.50 229.50 1,718 173,099 42,543 135 86.80 86.60 329 131,261 101.50 103,060 101.30 1,002 98,421 71,344 843 11 3,152,167 37,353 71,759 4 197,701 2,118 547,583 4,901 Mini Russell 1000 (ICE-US)$100 x index June 1615.10 1632.40 U.S. Dollar Index (ICE-US)-$1,000 x index June 100.44 100.52 Sept 100.38 100.50 Source: The Wall Street Journal, May 19, 2020. 1575.20 99.60 99.63 1625.00 99.68 99.69 50.70 --75 -.74 8,189 31,406 867

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 QuantityPrice per bushe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started