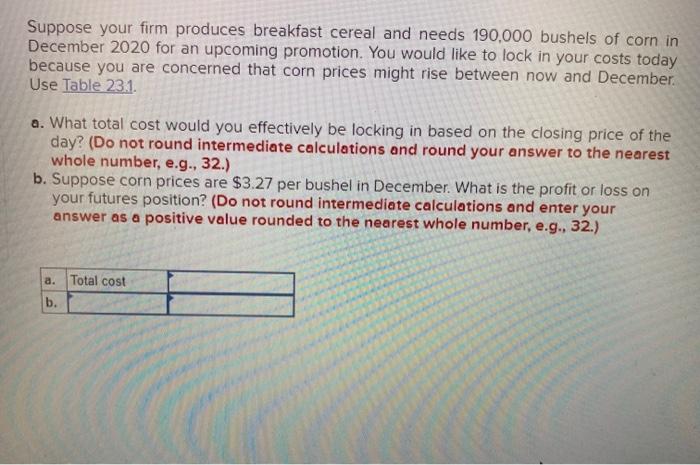

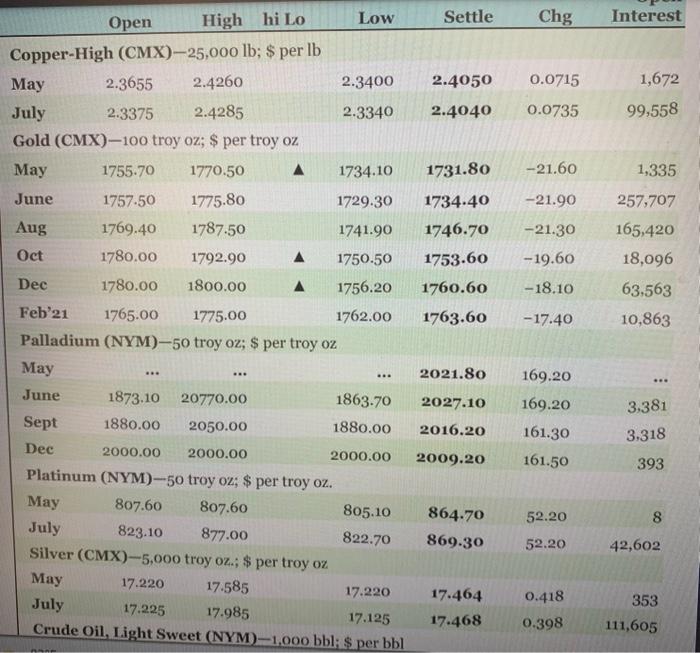

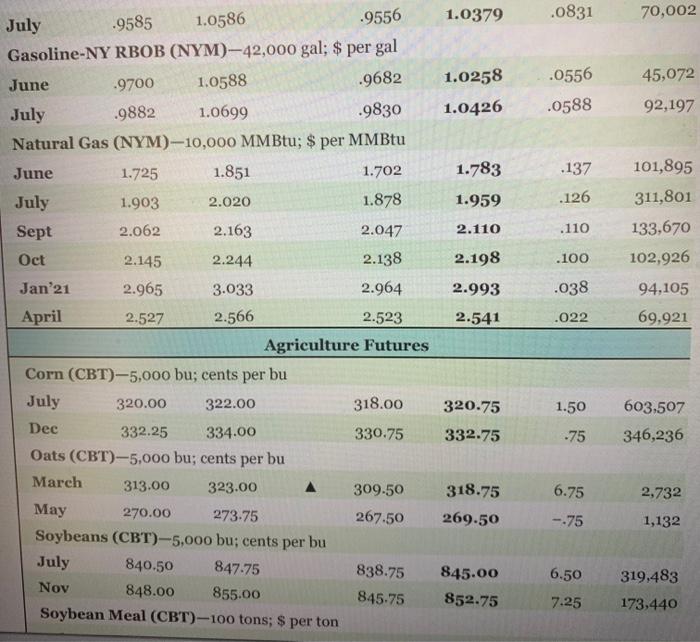

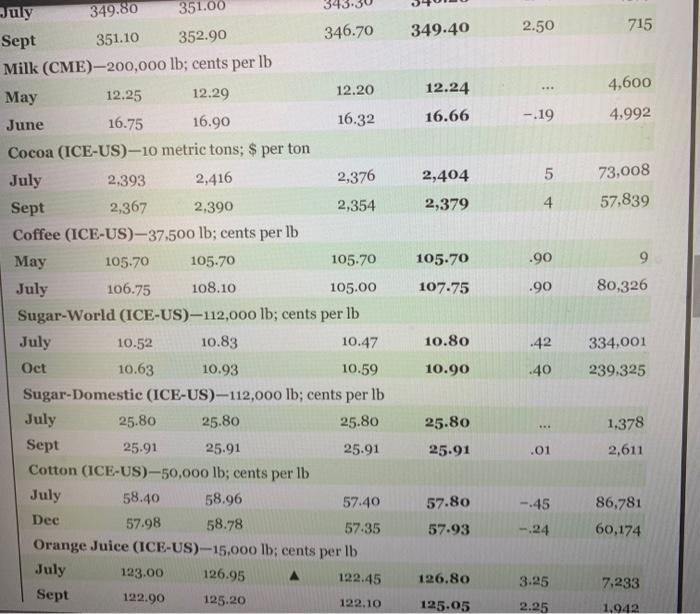

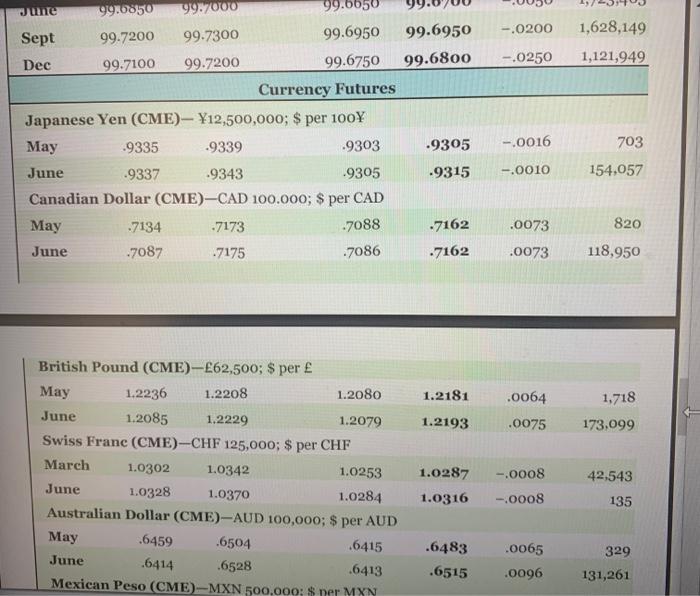

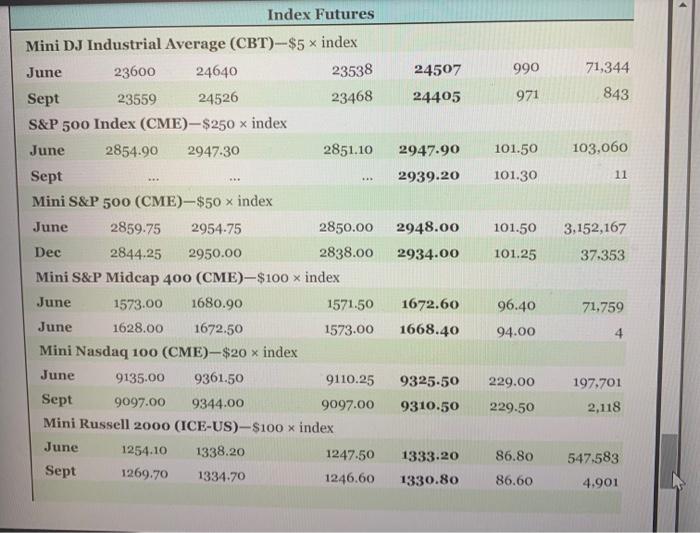

Suppose your firm produces breakfast cereal and needs 190,000 bushels of corn in December 2020 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might rise between now and December. Use Table 231. a. What total cost would you effectively be locking in based on the closing price of the day? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Suppose corn prices are $3.27 per bushel in December. What is the profit or loss on your futures position? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) Palladium (NYM) -50 troy oz; \$ per troy oz \begin{tabular}{|lrrrrr|rr} May & & & & 2021.80 & 169.20 & \\ June & 1873.10 & 20770.00 & 1863.70 & 2027.10 & 169.20 & 3.381 \\ Sept & 1880.00 & 2050.00 & 1880.00 & 2016.20 & 161.30 & 3.318 \\ Dec & 2000.00 & 2000.00 & 2000.00 & 2009.20 & 161.50 & 393 \end{tabular} Platinum (NYM) - 50 troy oz; \$ per troy oz. MayJuly807.60823.10807.60877.00805.10822.70864.70869.3052.2052.20842,602 Silver (CMX) 5,000 troy oz.; $ per troy oz July.95851.0586.95561.0379.083170,002 Gasoline-NY RBOB (NYM) -42,000 gal; \$ per gal JuneJuly.9700.98821.05881.0699.9682.98301.02581.0426.0556.058845,07292,197 Natural Gas (NYM) -10,000 MMBtu; \$ per MMBtu \begin{tabular}{lrrrrrrr} June & 1.725 & 1.851 & 1.702 & 1.78 & .137 & 101,895 \\ July & 1.903 & 2.020 & 1.878 & 1.959 & .126 & 311,801 \\ Sept & 2.062 & 2.163 & 2.047 & 2.110 & .110 & 133,670 \\ Oct & 2.145 & 2.244 & 2.138 & 2.198 & .100 & 102,926 \\ Jan'21 & 2.965 & 3.033 & 2.964 & 2.993 & .038 & 94,105 \\ April & 2.527 & 2.566 & 2.523 & 2.541 & .022 & 69,921 \\ \hline \end{tabular} Agriculture Futures Corn (CBT) 5,000 bu; cents per bu JulyDec320.00332.25322.00334.00318.00330.75320.75332.751.50.75603,507346,236 Oats (CBT) 5,000 bu; cents per bu MarchMay313.00270.00323.00273.754309.50267.50318.75269.506.75.752,7321,132 Soybeans (CBT) 5,000 bu; cents per bu JulyNov840.50848.00847.75855.00838.75845.75845.00852.756.507.25319,483173.440 Soybean Meal (CBT) - 100 tons; \$ per ton Wheat (KC) 5,000 bu; cents per bu Sept351.10352.90346.70349.402.50715 Milk (CME) -200,000 lb; cents per lb MayJune12.2516.7512.2916.9012.2016.3212.2416.66.194,6004,992 Cocoa (ICE-US) -10 metric tons; \$ per ton JulySept2,3932,3672,4162,3902,3762,3542,4042,3795473,00857,839 Coffee (ICE-US) 37,500lb; cents per lb \begin{tabular}{|rrrrrrrr} \hline May & 105.70 & 105.70 & 105.70 & 105.70 & .90 & 9 \\ July & 106.75 & 108.10 & 105.00 & 107.75 & .90 & 80,326 \end{tabular} Sugar-World (ICE-US) - 112,000lb; cents per lb Sugar-Domestic (ICE-US) 112,000lb; cents per lb JulySept25.8025.9125.8025.9125.8025.9125.8025.91.011,3782,611 Cotton (ICE-US) 50,000lb; cents per lb \begin{tabular}{|lllllll} \hline July & 58.40 & 58.96 & 57.40 & 57.80 & -.45 & 86.781 \\ Dee & 57.98 & 58.78 & 57.35 & 57.93 & -.24 & 60,174 \end{tabular} Orange Juice (ICE-US) 15,000lb; cents per lb \begin{tabular}{|lllllllll} July & 123.00 & 126.95 & 4 & 122.45 & 126.80 & 3.25 & 7.233 \\ Sept & 122.90 & 125.20 & & 122.10 & 125.05 & 2.25 & 1.942 \end{tabular} Interest Rate Futures Ultra Treasury Bonds (CBT) - $100,000; pts 32 nds of 100% JuneSept224000222080224020222110217300216130218030216170518.0518.01,040,21575,948 Treasury Bonds (CBT) $100,000;pts32 nds of 100% JuneSept181010179160181040179170178020176180178050176200225.0225.01,004,68117,806 Treasury Notes (CBT) - $100,000; pts 32 nds of 100% JuneSept13911513903513912513905012511712506212512212506711.012.03,265,401160,418 5 Yr. Treasury Notes (CBT) $100,000; pts 32 ds of 100% JuneSept12525512520012525512520712511712506212512212506711.512.03,301,676357,677 2 Yr. Treasury Notes (CBT) $200,000; pts 32 nds of 100% June 1100941100991100661100682.12,306,556 Sept 1101411101441101091101102.5131,607 30 Day Federal Funds (CBT) - $5,000,000;100 daily avg MayJuly99.947599.945099.950099.950099.945099.935099.947599.9350.0025.0150228,664215.465 10Yr. Del. Int. Rate Swaps (CBT) - \$100,000; pts 32 nds of 100% June 105315106080105060105070101.073,230 Eurodollar (CME) $1,000,000; pts of 100% Index Futures Mini DJ Industrial Average (CBT)$5 index JuneSept236002355924640245262353823468245072440599097171,344843 S\&P 500 Index (CME) $250 index June2854.902947.302851.102947.90101.50103,060 Sept2939.20101.3011 Mini S\&P 500 (CME) $50 index June2859.752954.752850.002948.00101.503,152,167 Dec2844.252950.002838.002934.00101.2537.353 Mini S\&P Midcap 400 (CME) $100 index \begin{tabular}{|l|r|rrr|r|r|} \hline June & 1573.00 & 1680.90 & 1571.50 & 1672.60 & 96.40 & 71,759 \\ June & 1628.00 & 1672.50 & 1573.00 & 1668.40 & 94.00 & 4 \end{tabular} Mini Nasdaq 100 (CME) $20 index Mini Russell 2000 (ICE-US) $100 index JuneSept1254.101269.701338.201334.701247.501246.601333.201330.8086.8086.60547.5834.901 \begin{tabular}{l|llllll} Sept 1269.70 & 1334.70 & 1246.60 & 1330.80 & 86.60 & 4.901 \end{tabular}