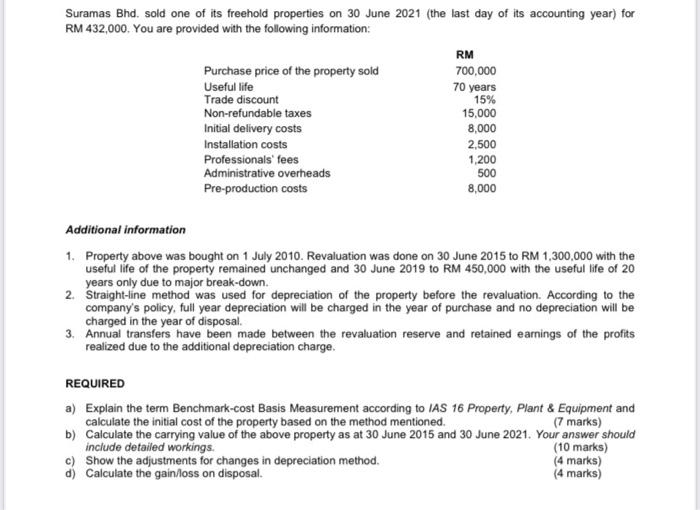

Suramas Bhd. sold one of its freehold properties on 30 June 2021 (the last day of its accounting year) for RM 432,000. You are provided with the following information: RM Purchase price of the property sold 700,000 Useful life 70 years Trade discount 15% Non-refundable taxes 15,000 Initial delivery costs 8,000 Installation costs 2,500 Professionals' fees 1,200 Administrative overheads Pre-production costs 8,000 500 Additional information 1. Property above was bought on 1 July 2010. Revaluation was done on 30 June 2015 to RM 1,300,000 with the useful life of the property remained unchanged and 30 June 2019 to RM 450,000 with the useful life of 20 years only due to major break-down. 2. Straight-line method was used for depreciation of the property before the revaluation. According to the company's policy, full year depreciation will be charged in the year of purchase and no depreciation will be charged in the year of disposal. 3. Annual transfers have been made between the revaluation reserve and retained earnings of the profits realized due to the additional depreciation charge REQUIRED a) Explain the term Benchmark-cost Basis Measurement according to IAS 16 Property, Plant & Equipment and calculate the initial cost of the property based on the method mentioned (7 marks) b) Calculate the carrying value of the above property as at 30 June 2015 and 30 June 2021. Your answer should include detailed workings. (10 marks) c) Show the adjustments for changes in depreciation method. (4 marks) d) Calculate the gain/loss on disposal. (4 marks) Suramas Bhd. sold one of its freehold properties on 30 June 2021 (the last day of its accounting year) for RM 432,000. You are provided with the following information: RM Purchase price of the property sold 700,000 Useful life 70 years Trade discount 15% Non-refundable taxes 15,000 Initial delivery costs 8,000 Installation costs 2,500 Professionals' fees 1,200 Administrative overheads Pre-production costs 8,000 500 Additional information 1. Property above was bought on 1 July 2010. Revaluation was done on 30 June 2015 to RM 1,300,000 with the useful life of the property remained unchanged and 30 June 2019 to RM 450,000 with the useful life of 20 years only due to major break-down. 2. Straight-line method was used for depreciation of the property before the revaluation. According to the company's policy, full year depreciation will be charged in the year of purchase and no depreciation will be charged in the year of disposal. 3. Annual transfers have been made between the revaluation reserve and retained earnings of the profits realized due to the additional depreciation charge REQUIRED a) Explain the term Benchmark-cost Basis Measurement according to IAS 16 Property, Plant & Equipment and calculate the initial cost of the property based on the method mentioned (7 marks) b) Calculate the carrying value of the above property as at 30 June 2015 and 30 June 2021. Your answer should include detailed workings. (10 marks) c) Show the adjustments for changes in depreciation method. (4 marks) d) Calculate the gain/loss on disposal. (4 marks)