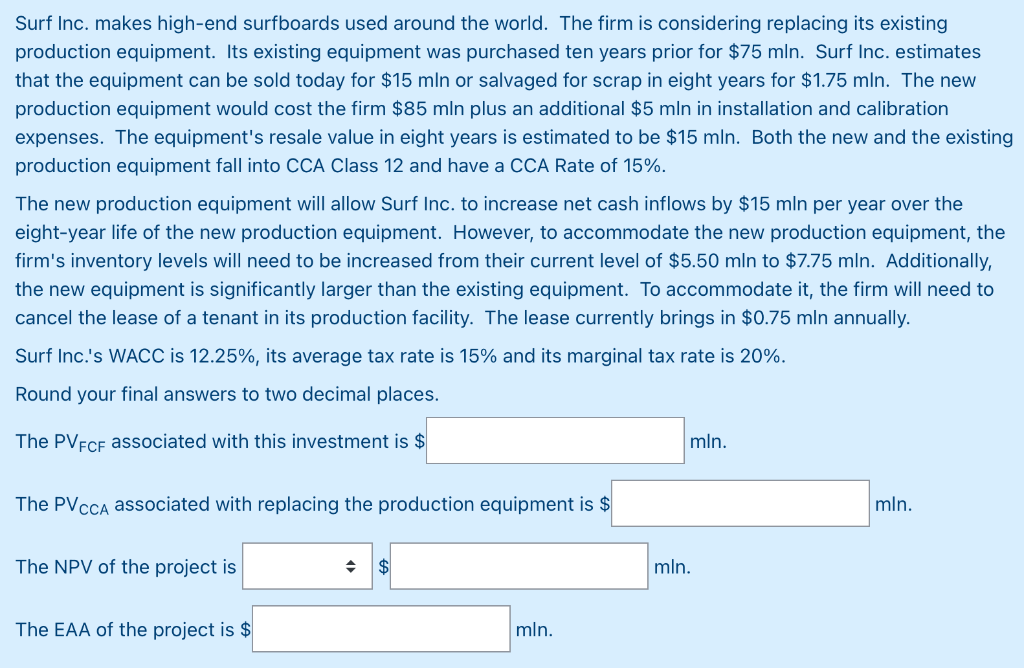

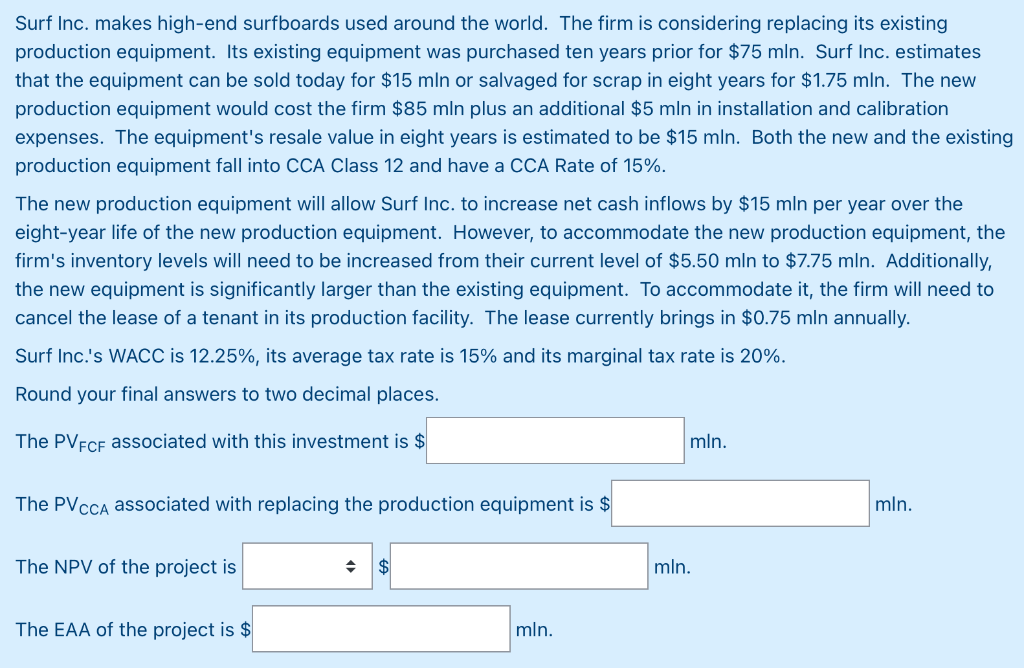

Surf Inc. makes high-end surfboards used around the world. The firm is considering replacing its existing production equipment. Its existing equipment was purchased ten years prior for $75 mln. Surf Inc. estimates that the equipment can be sold today for $15 mln or salvaged for scrap in eight years for $1.75 mln. The new production equipment would cost the firm $85 mln plus an additional $5 mln in installation and calibration expenses. The equipment's resale value in eight years is estimated to be $15 mln. Both the new and the existing production equipment fall into CCA Class 12 and have a CCA Rate of 15%. The new production equipment will allow Surf Inc. to increase net cash inflows by $15 min per year over the eight-year life of the new production equipment. However, to accommodate the new production equipment, the firm's inventory levels will need to be increased from their current level of $5.50 mln to $7.75 mln. Additionally, the new equipment is significantly larger than the existing equipment. To accommodate it, the firm will need to cancel the lease of a tenant in its production facility. The lease currently brings in $0.75 mln annually. Surf Inc.'s WACC is 12.25%, its average tax rate is 15% and its marginal tax rate is 20%. Round your final answers to two decimal places. The PVFCE associated with this investment is $ mln. The PVCCA associated with replacing the production equipment is $ mln. The NPV of the project is $ mln. The EAA of the project is $ mln. Surf Inc. makes high-end surfboards used around the world. The firm is considering replacing its existing production equipment. Its existing equipment was purchased ten years prior for $75 mln. Surf Inc. estimates that the equipment can be sold today for $15 mln or salvaged for scrap in eight years for $1.75 mln. The new production equipment would cost the firm $85 mln plus an additional $5 mln in installation and calibration expenses. The equipment's resale value in eight years is estimated to be $15 mln. Both the new and the existing production equipment fall into CCA Class 12 and have a CCA Rate of 15%. The new production equipment will allow Surf Inc. to increase net cash inflows by $15 min per year over the eight-year life of the new production equipment. However, to accommodate the new production equipment, the firm's inventory levels will need to be increased from their current level of $5.50 mln to $7.75 mln. Additionally, the new equipment is significantly larger than the existing equipment. To accommodate it, the firm will need to cancel the lease of a tenant in its production facility. The lease currently brings in $0.75 mln annually. Surf Inc.'s WACC is 12.25%, its average tax rate is 15% and its marginal tax rate is 20%. Round your final answers to two decimal places. The PVFCE associated with this investment is $ mln. The PVCCA associated with replacing the production equipment is $ mln. The NPV of the project is $ mln. The EAA of the project is $ mln