Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suria A Resident In Malaysia, Is A Managing Director At Suria & Family (Management) Sdn. Bhd. She reported the following incomes for the year assessment

Suria A Resident In Malaysia, Is A Managing Director At Suria & Family (Management) Sdn. Bhd. She reported the following incomes for the year assessment 2021:

Required :

Compute the aggregate income of Suria for the year assessment 2021.

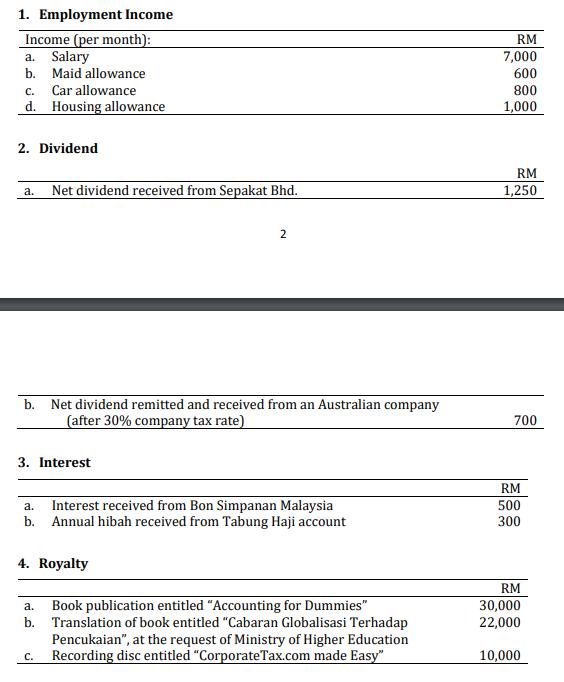

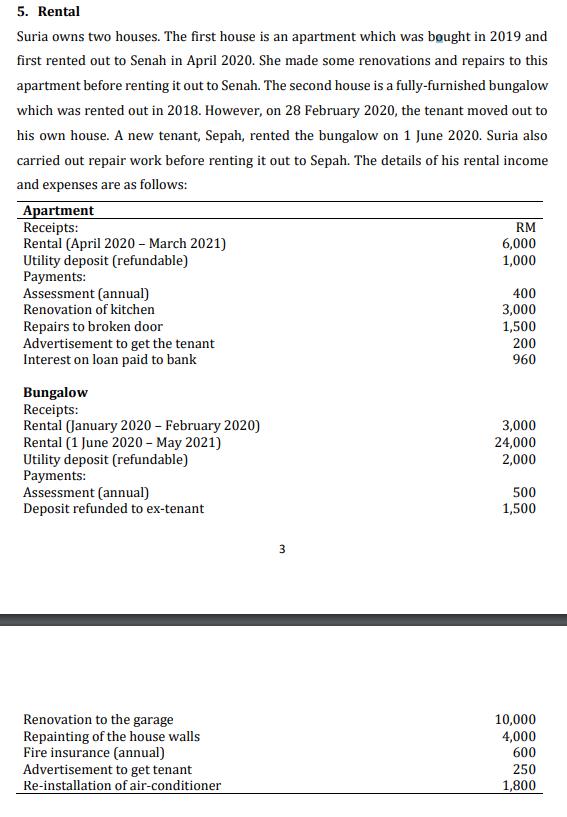

1. Employment Income Income (per month): a. Salary b. Maid allowance Car allowance C. d. Housing allowance 2. Dividend a. Net dividend received from Sepakat Bhd. b. Net dividend remitted and received from an Australian company (after 30% company tax rate) 3. Interest 2 a. Interest received from Bon Simpanan Malaysia Annual hibah received from Tabung Haji account b. 4. Royalty a. Book publication entitled "Accounting for Dummies" b. Translation of book entitled "Cabaran Globalisasi Terhadap Pencukaian", at the request of Ministry of Higher Education Recording disc entitled "CorporateTax.com made Easy" C. RM 7,000 600 800 1,000 RM 1,250 700 RM 500 300 RM 30,000 22,000 10,000

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Surias income for the year assessment 2021 we need to add up the various sources of income and deduct any allowable expenses Lets break i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started