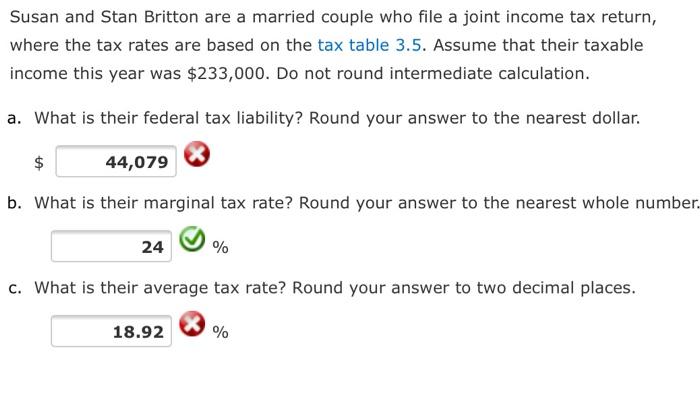

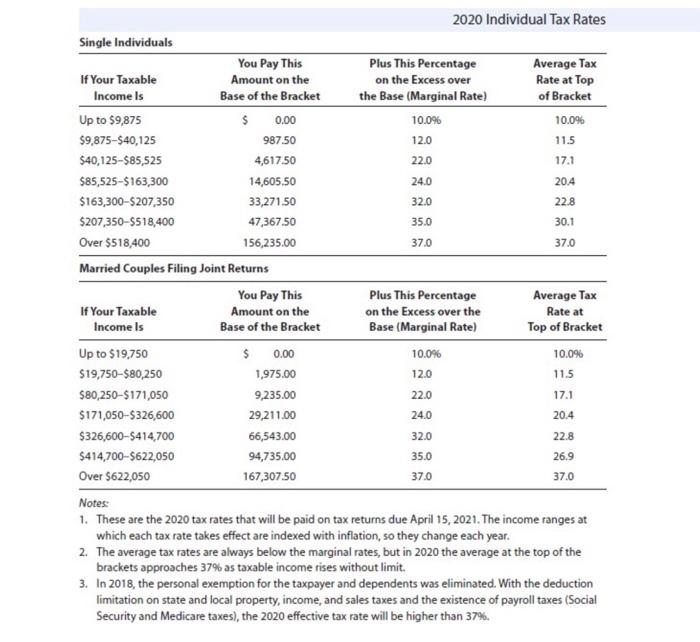

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $233,000. Do not round intermediate calculation. a. What is their federal tax liability? Round your answer to the nearest dollar. $ 44,079 b. What is their marginal tax rate? Round your answer to the nearest whole number. 24 % c. What is their average tax rate? Round your answer to two decimal places. 18.92 % 0.00 24.0 20.4 37.0 37.0 2020 Individual Tax Rates Single Individuals You Pay This Plus This Percentage Average Tax If Your Taxable Amount on the on the Excess over Rate at Top Income Is Base of the Bracket the Base (Marginal Rate) of Bracket Up to $9,875 $ 10.0% 10.0% $9,875-540,125 987.50 12.0 11.5 $40,125-$85,525 4,617.50 22.0 17.1 $85,525-$163,300 14,605.50 $163,300-$207,350 33,27150 320 228 $207,350-$518,400 47,367.50 35.0 30.1 Over $518,400 156,235.00 Married couples Filing Joint Returns You Pay This Plus This Percentage Average Tax If Your Taxable Amount on the on the Excess over the Rate at Income Is Base of the Bracket Base (Marginal Ratel Top of Bracket Up to $19,750 $ 0.00 10.0% 10.0% $19,750-$80,250 1,975.00 12.0 11.5 $80,250-5171,050 9,235.00 22.0 $171,050-5326,600 29,211.00 20.4 $326,600-5414,700 66,543.00 $414,700-$622,050 94,735.00 35.0 26.9 Over $622,050 167,307.50 37.0 Notes: 1. These are the 2020 tax rates that will be paid on tax returns due April 15, 2021. The income ranges at which each tax rate takes effect are indexed with inflation, so they change each year. 2. The average tax rates are always below the marginal rates, but in 2020 the average at the top of the brackets approaches 37% as taxable income rises without limit. 3. In 2018, the personal exemption for the taxpayer and dependents was eliminated. With the deduction limitation on state and local property, income, and sales taxes and the existence of payroll taxes (Social Security and Medicare taxes), the 2020 effective tax rate will be higher than 37%. 171 24.0 32.0 22.8 370