Question

Susan entered into an Employment Agreement with her new Employer. She has agreed to an annual salary of $52,000. She also receives medical coverage

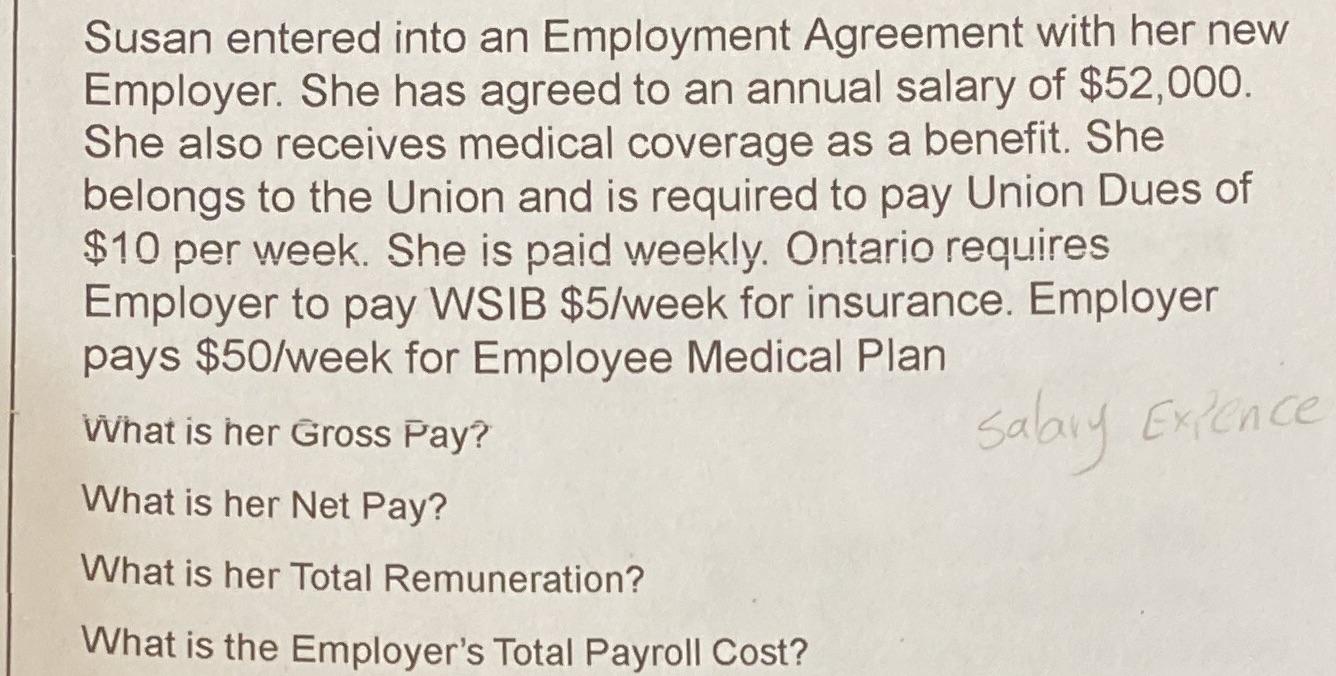

Susan entered into an Employment Agreement with her new Employer. She has agreed to an annual salary of $52,000. She also receives medical coverage as a benefit. She belongs to the Union and is required to pay Union Dues of $10 per week. She is paid weekly. Ontario requires Employer to pay WSIB $5/week for insurance. Employer pays $50/week for Employee Medical Plan What is her Gross Pay? Salary Expence What is her Net Pay? What is her Total Remuneration? What is the Employer's Total Payroll Cost?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate Susans gross pay we need to know her weekly salary Gross Pay Annual Sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Canadian Income Taxation Planning And Decision Making

Authors: Joan Kitunen, William Buckwold

17th Edition 2014-2015 Version

1259094332, 978-1259094330

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App