Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan, Peter, and Mamamia hold 30% of the shares in AV COVID-19 Pty Ltd and the rest of the shares are held by Antonio

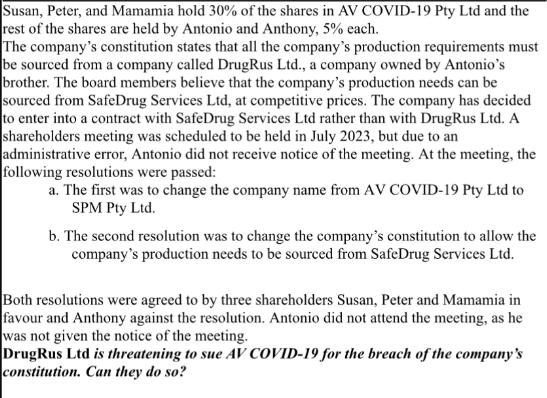

Susan, Peter, and Mamamia hold 30% of the shares in AV COVID-19 Pty Ltd and the rest of the shares are held by Antonio and Anthony, 5% each. The company's constitution states that all the company's production requirements must be sourced from a company called DrugRus Ltd., a company owned by Antonio's brother. The board members believe that the company's production needs can be sourced from SafeDrug Services Ltd, at competitive prices. The company has decided to enter into a contract with SafeDrug Services Ltd rather than with DrugRus Ltd. A shareholders meeting was scheduled to be held in July 2023, but due to an administrative error, Antonio did not receive notice of the meeting. At the meeting, the following resolutions were passed: a. The first was to change the company name from AV COVID-19 Pty Ltd to SPM Pty Ltd. b. The second resolution was to change the company's constitution to allow the company's production needs to be sourced from SafeDrug Services Ltd. Both resolutions were agreed to by three shareholders Susan, Peter and Mamamia in favour and Anthony against the resolution. Antonio did not attend the meeting, as he was not given the notice of the meeting. DrugRus Ltd is threatening to sue AV COVID-19 for the breach of the company's constitution. Can they do so?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Yes DrugRus Ltd may have grounds ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started