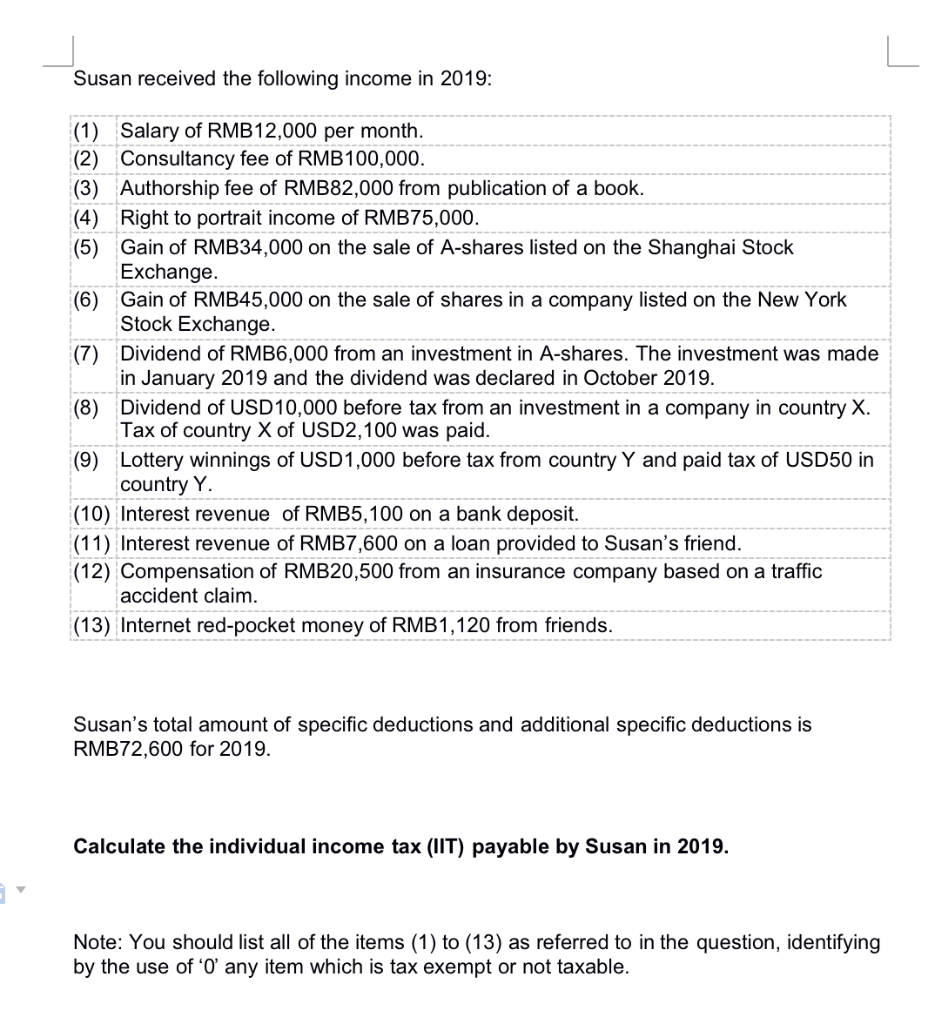

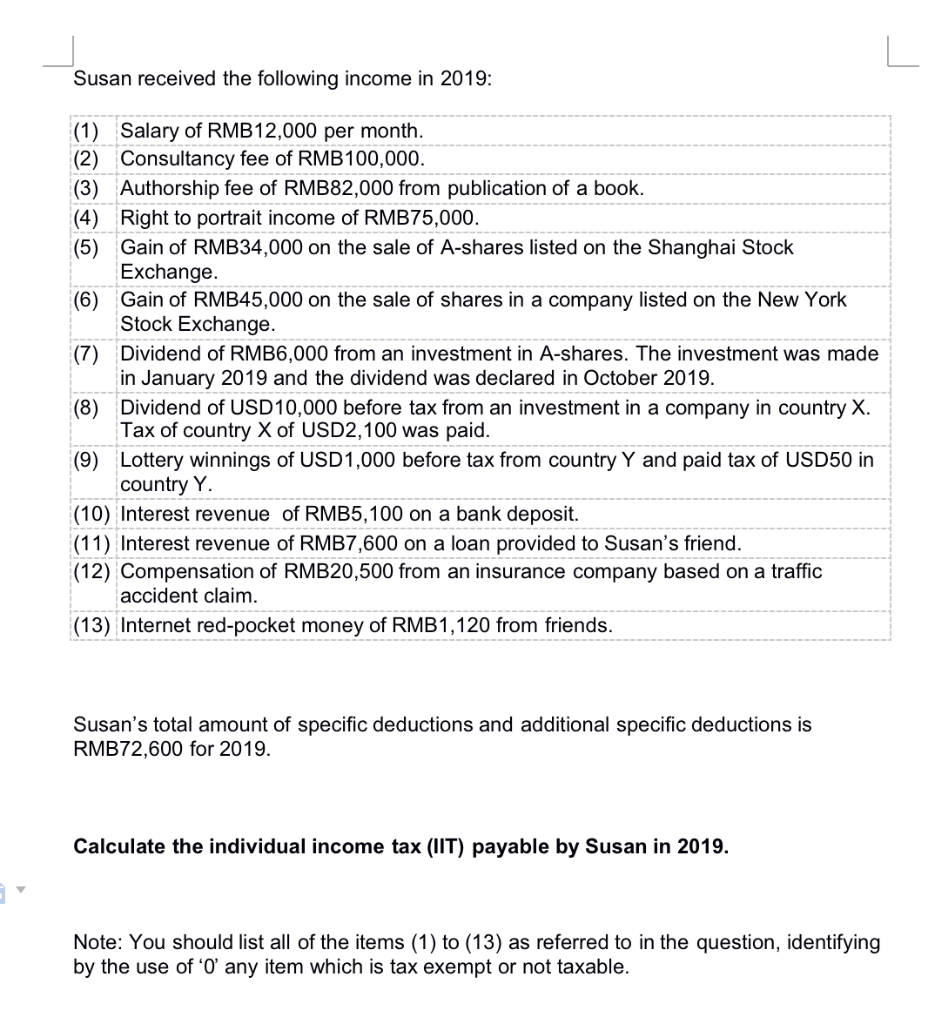

Susan received the following income in 2019: (1) Salary of RMB12,000 per month. (2) Consultancy fee of RMB100,000. (3) Authorship fee of RMB82,000 from publication of a book. (4) Right to portrait income of RMB75,000. (5) Gain of RMB34,000 on the sale of A-shares listed on the Shanghai Stock Exchange. (6) Gain of RMB45,000 on the sale of shares in a company listed on the New York Stock Exchange. (7) Dividend of RMB6,000 from an investment in A-shares. The investment was made in January 2019 and the dividend was declared in October 2019. (8) Dividend of USD10,000 before tax from an investment in a company in country X. Tax of country X of USD2,100 was paid. (9) Lottery winnings of USD1,000 before tax from country Y and paid tax of USD50 in country Y. (10) Interest revenue of RMB5,100 on a bank deposit. (11) Interest revenue of RMB7,600 on a loan provided to Susan's friend. (12) Compensation of RMB20,500 from an insurance company based on a traffic accident claim. (13) Internet red-pocket money of RMB1,120 from friends. Susan's total amount of specific deductions and additional specific deductions is RMB72,600 for 2019. Calculate the individual income tax (IIT) payable by Susan in 2019. Note: You should list all of the items (1) to (13) as referred to in the question, identifying by the use of 'O' any item which is tax exempt or not taxable. Susan received the following income in 2019: (1) Salary of RMB12,000 per month. (2) Consultancy fee of RMB100,000. (3) Authorship fee of RMB82,000 from publication of a book. (4) Right to portrait income of RMB75,000. (5) Gain of RMB34,000 on the sale of A-shares listed on the Shanghai Stock Exchange. (6) Gain of RMB45,000 on the sale of shares in a company listed on the New York Stock Exchange. (7) Dividend of RMB6,000 from an investment in A-shares. The investment was made in January 2019 and the dividend was declared in October 2019. (8) Dividend of USD10,000 before tax from an investment in a company in country X. Tax of country X of USD2,100 was paid. (9) Lottery winnings of USD1,000 before tax from country Y and paid tax of USD50 in country Y. (10) Interest revenue of RMB5,100 on a bank deposit. (11) Interest revenue of RMB7,600 on a loan provided to Susan's friend. (12) Compensation of RMB20,500 from an insurance company based on a traffic accident claim. (13) Internet red-pocket money of RMB1,120 from friends. Susan's total amount of specific deductions and additional specific deductions is RMB72,600 for 2019. Calculate the individual income tax (IIT) payable by Susan in 2019. Note: You should list all of the items (1) to (13) as referred to in the question, identifying by the use of 'O' any item which is tax exempt or not taxable