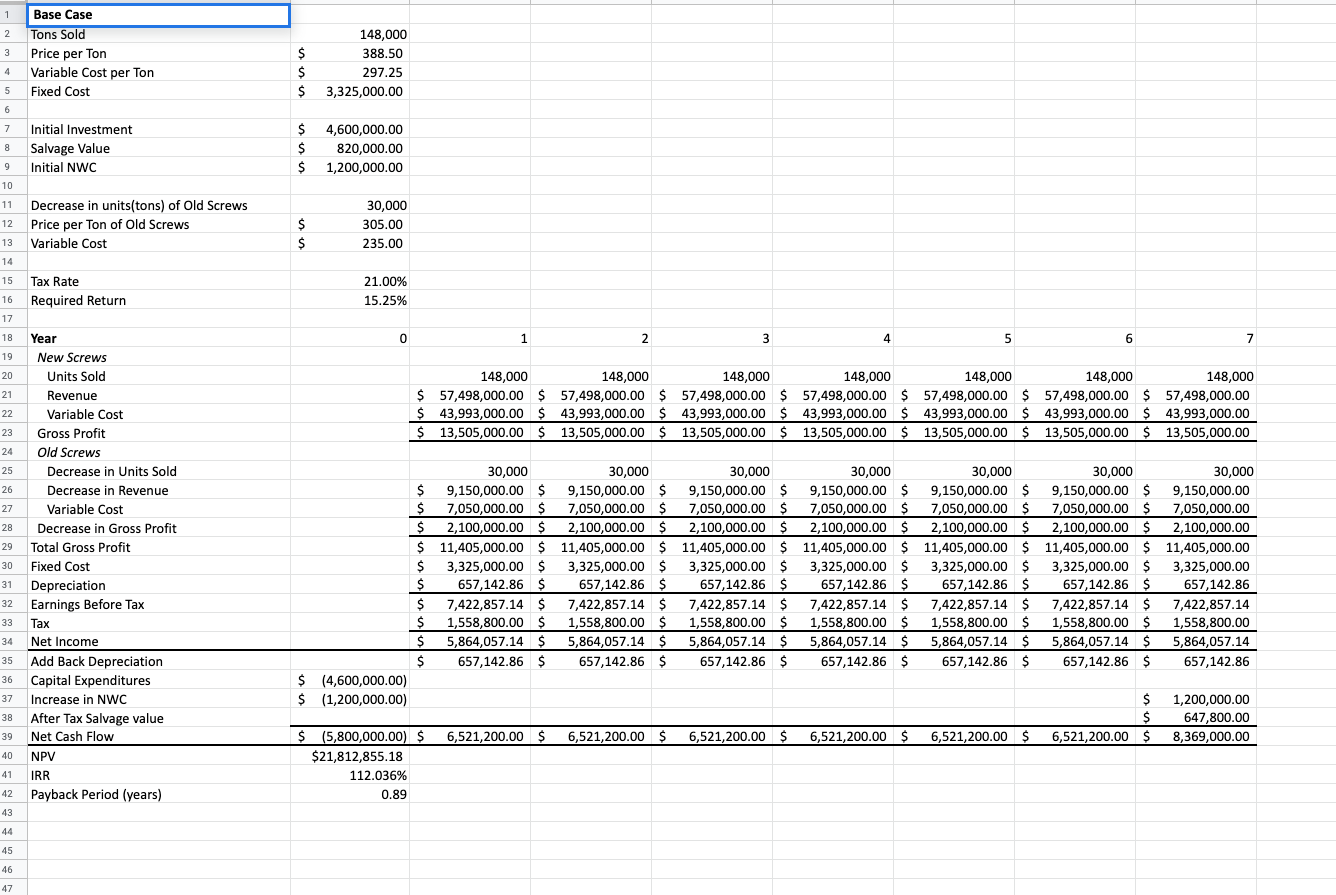

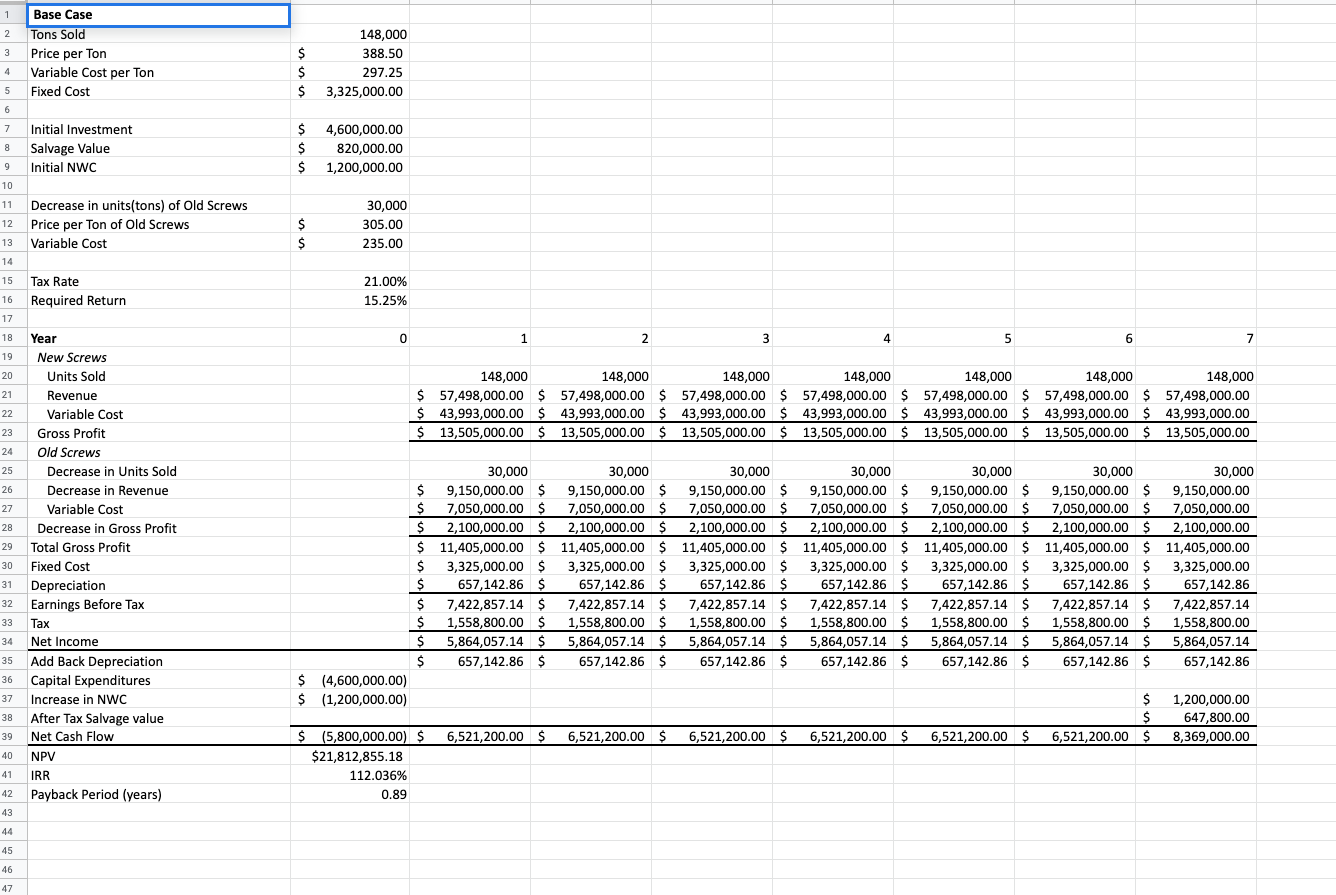

Sustainable Enginnovation is considering a contract for a project to supply South Bay Area Automotive Solutions with 148,000 tons of machine screws annually for automobile production. Sustainable Enginnovation will need an initial $4,600,000 investment in threading equipment to get the project started; the project will last for seven years. The accounting department estimates that annual fixed costs will be $3,325,000 and that variable costs should be $297.25 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the seven-year project life. It also estimates a salvage value of $820,000 after dismantling costs. The initial investment and salvage value are accurate within +/- 7.5% of the initial projections. The marketing department estimates that the automakers will approve the contract at a selling price of $388.50 per ton. The engineering department estimates that Sustainable Enginnovation will need an initial net working capital investment of $1,200,000, then will require 8% of sales for each year, but management expects to recover their net working capital costs in the terminal year of the project. Consider the units produced, sales price, variable costs, and fixed costs to be accurate within +/- 8% of the projections. Unfortunately, a cheaper line of screws that are sold by Sustainable Enginnovation to South Bay Area Automotive Solutions is expected to decrease by 30,000 tons annually for the length of the project. This cheaper line of screws are sold at a price of $305 per ton and have a variable cost of $235 per ton. Also consider, that the Sustainable Enginnovation is offered a similar contract with Valley CAMobility, Inc. that has an expected net present value of $5,900,000, a payback period of 5.2 years, and IRR of 18.25%, but it comes with a non-compete clause that will not allow you to pursue the contract with South Bay Area Automotive Solutions. Sustainable Enginnovation requires a return of 15.25 percent and faces a marginal tax rate of 21 percent on this project. Your group works in the Corporate Finance Division and have been tasked by Sustainable Enginnovations VP-Capital Projects, Jocelyn Pierce, to evaluate this project.

What is the base case scenario NPV of the South Bay Area Automotive Solutions contract? What is the IRR for the base-case scenario? What is the payback period for the base-case scenario of the South Bay Area Automotive contract ? What is the sensitivity of the project NPV to changes in the quantity supplied NPV/Q? What is the sensitivity of the project NPV to changes in the variable costs NPV/VC? What is the sensitivity of the project NPV to changes in the fixed costs NPV/FC? Which of these items have the greatest impact on the projects NPV?

1 2 Base Case Tons Sold 3 Price per Ton 4 Variable Cost per Ton 5 Fixed Cost $ $ $ 148,000 388.50 297.25 3,325,000.00 6 $ $ $ 4,600,000.00 820,000.00 1,200,000.00 $ $ 30,000 305.00 235.00 21.00% 15.25% 0 1 2 3 4 5 6 6 7 7 148,000 148,000 148,000 148,000 148,000 148,000 148,000 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 7 Initial Investment 8 8 Salvage Value 9 9_Initial NWC 10 11 Decrease in units(tons) of Old Screws 12 Price per Ton of Old Screws 13 Variable Cost 14 15 Tax Rate 16 Required Return 17 18 Year 19 New Screws 20 Units Sold 21 Revenue 22 Variable Cost 23 Gross Profit 24 Old Screws 25 Decrease in Units Sold 26 Decrease in Revenue 27 Variable Cost 28 Decrease in Gross Profit 29 Total Gross Profit 30 Fixed Cost 31 Depreciation 32 Earnings Before Tax 33 Tax 34 Net Income 35 Add Back Depreciation 36 Capital Expenditures 37 Increase in NWC 38 After Tax Salvage value 39 Net Cash Flow 40 NPV 41 IRR 42 Payback Period (years) 43 30,000 30,000 30,000 30,000 30,000 30,000 30,000 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ (4,600,000.00) $ (1,200,000.00) $ $ 6,521,200.00 $ 1,200,000.00 647,800.00 8,369,000.00 6,521,200.00 $ 6,521,200.00 $ 6,521,200.00 $ 6,521,200.00 $ 6,521,200.00 $ $ (5,800,000.00) $ $21,812,855.18 112.036% 0.89 44 45 46 47 1 2 Base Case Tons Sold 3 Price per Ton 4 Variable Cost per Ton 5 Fixed Cost $ $ $ 148,000 388.50 297.25 3,325,000.00 6 $ $ $ 4,600,000.00 820,000.00 1,200,000.00 $ $ 30,000 305.00 235.00 21.00% 15.25% 0 1 2 3 4 5 6 6 7 7 148,000 148,000 148,000 148,000 148,000 148,000 148,000 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 57,498,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 43,993,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 $ 13,505,000.00 7 Initial Investment 8 8 Salvage Value 9 9_Initial NWC 10 11 Decrease in units(tons) of Old Screws 12 Price per Ton of Old Screws 13 Variable Cost 14 15 Tax Rate 16 Required Return 17 18 Year 19 New Screws 20 Units Sold 21 Revenue 22 Variable Cost 23 Gross Profit 24 Old Screws 25 Decrease in Units Sold 26 Decrease in Revenue 27 Variable Cost 28 Decrease in Gross Profit 29 Total Gross Profit 30 Fixed Cost 31 Depreciation 32 Earnings Before Tax 33 Tax 34 Net Income 35 Add Back Depreciation 36 Capital Expenditures 37 Increase in NWC 38 After Tax Salvage value 39 Net Cash Flow 40 NPV 41 IRR 42 Payback Period (years) 43 30,000 30,000 30,000 30,000 30,000 30,000 30,000 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 9,150,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 7,050,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 2,100,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 11,405,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 3,325,000.00 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 7,422,857.14 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 1,558,800.00 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 5,864,057.14 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ 657,142.86 $ (4,600,000.00) $ (1,200,000.00) $ $ 6,521,200.00 $ 1,200,000.00 647,800.00 8,369,000.00 6,521,200.00 $ 6,521,200.00 $ 6,521,200.00 $ 6,521,200.00 $ 6,521,200.00 $ $ (5,800,000.00) $ $21,812,855.18 112.036% 0.89 44 45 46 47