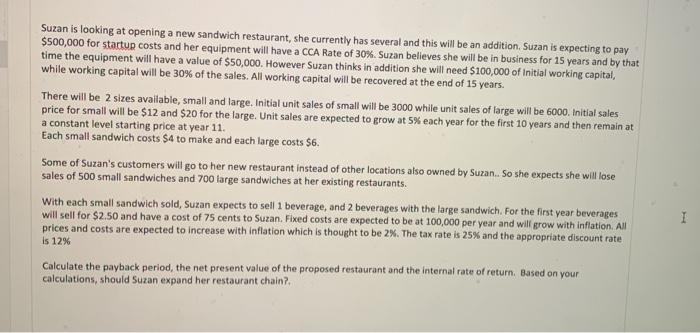

Suzan is looking at opening a new sandwich restaurant, she currently has several and this will be an addition, Suzan is expecting to pay $500,000 for startup costs and her equipment will have a CCA Rate of 30%. Suzan believes she will be in business for 15 years and by that time the equipment will have a value of $50,000. However Suzan thinks in addition she will need $100,000 of Initial working capital, while working capital will be 30% of the sales. All working capital will be recovered at the end of 15 years. There will be 2 sizes available, small and large. Initial unit sales of small will be 3000 while unit sales of large will be 6000. Initial sales price for small will be $12 and $20 for the large. Unit sales are expected to grow at 5% each year for the first 10 years and then remain at a constant level starting price at year 11. Each small sandwich costs $4 to make and each large costs $6. Some of Suzan's customers will go to her new restaurant instead of other locations also owned by Suzan. So she expects she will lose sales of 500 small sandwiches and 700 large sandwiches at her existing restaurants. with each small sandwich sold, Suzan expects to sell 1 beverage, and 2 beverages with the large sandwich. For the first year beverages will sell for $2.50 and have a cost of 75 cents to Suzan. Fixed costs are expected to be at 100,000 per year and will grow with inflation. All prices and costs are expected to increase with inflation which is thought to be 2%. The tax rate is 25% and the appropriate discount rate is 12% Calculate the payback period, the net present value of the proposed restaurant and the internal rate of return. Based on your calculations, should Suzan expand her restaurant chain? Suzan is looking at opening a new sandwich restaurant, she currently has several and this will be an addition, Suzan is expecting to pay $500,000 for startup costs and her equipment will have a CCA Rate of 30%. Suzan believes she will be in business for 15 years and by that time the equipment will have a value of $50,000. However Suzan thinks in addition she will need $100,000 of Initial working capital, while working capital will be 30% of the sales. All working capital will be recovered at the end of 15 years. There will be 2 sizes available, small and large. Initial unit sales of small will be 3000 while unit sales of large will be 6000. Initial sales price for small will be $12 and $20 for the large. Unit sales are expected to grow at 5% each year for the first 10 years and then remain at a constant level starting price at year 11. Each small sandwich costs $4 to make and each large costs $6. Some of Suzan's customers will go to her new restaurant instead of other locations also owned by Suzan. So she expects she will lose sales of 500 small sandwiches and 700 large sandwiches at her existing restaurants. with each small sandwich sold, Suzan expects to sell 1 beverage, and 2 beverages with the large sandwich. For the first year beverages will sell for $2.50 and have a cost of 75 cents to Suzan. Fixed costs are expected to be at 100,000 per year and will grow with inflation. All prices and costs are expected to increase with inflation which is thought to be 2%. The tax rate is 25% and the appropriate discount rate is 12% Calculate the payback period, the net present value of the proposed restaurant and the internal rate of return. Based on your calculations, should Suzan expand her restaurant chain