Question

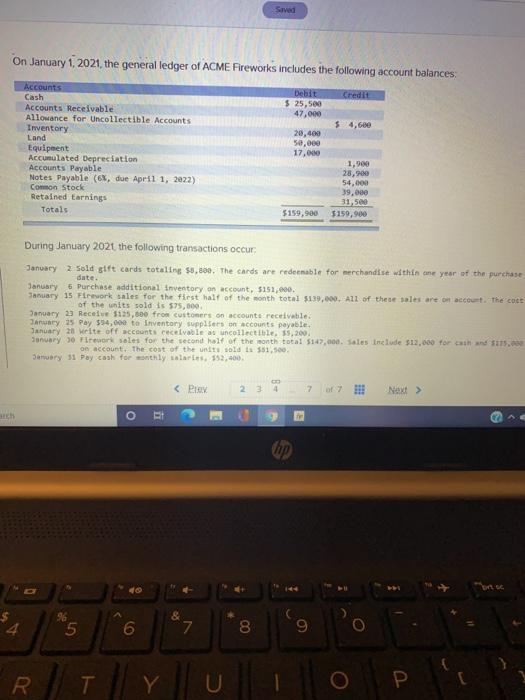

Sved On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances Credit Debit $ 25,500 47.000 $ 4,680 Accounts Cash

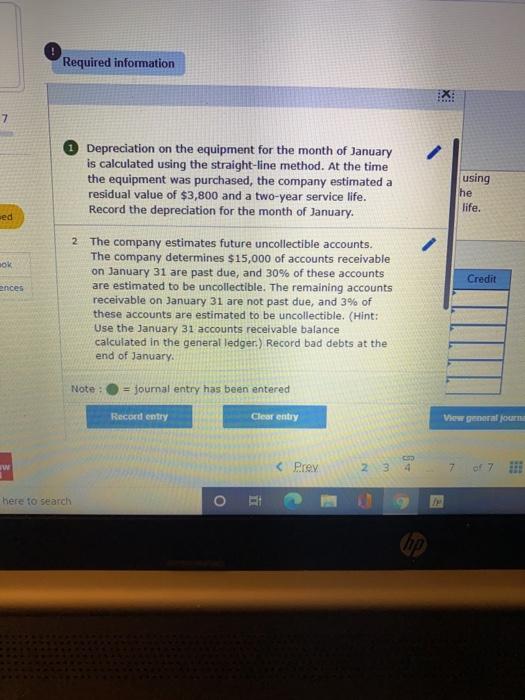

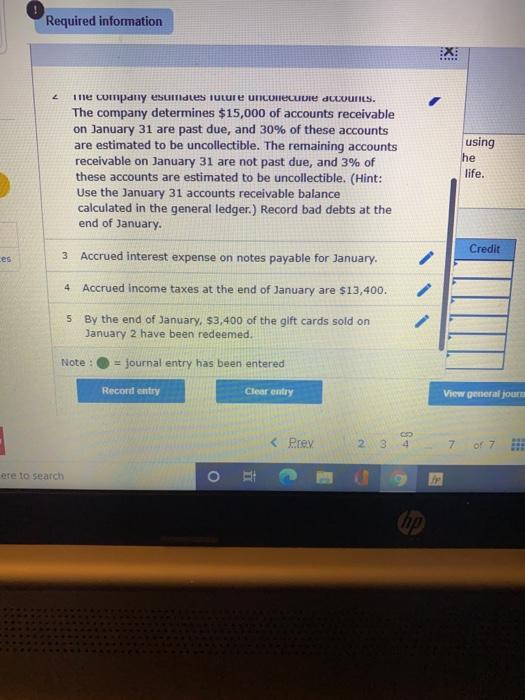

hop 4 5 6 & 7 8 9 O R. R T T o P. Required information X: 7 Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $3,800 and a two-year service life. Record the depreciation for the month of January. using he life. ed OK Credit ences 2 The company estimates future uncollectible accounts. The company determines $15,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 3% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record bad debts at the end of January Note = journal entry has been entered Record entry Clear entry View general CO 2 3 4 w Prey 7 here to search O hp Required information EX: *** ine company esuildles Tuture unicolecule d wounts. The company determines $15,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 3% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record bad debts at the end of January using he life. Credit Les 3 Accrued interest expense on notes payable for January 4 Accrued income taxes at the end of January are $13,400. 5 By the end of January, 53,400 of the gift cards sold on January 2 have been redeemed. Note : journal entry has been entered Record entry Clear entry View general jou hop 4 5 6 & 7 8 9 O R. R T T o P. Required information X: 7 Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $3,800 and a two-year service life. Record the depreciation for the month of January. using he life. ed OK Credit ences 2 The company estimates future uncollectible accounts. The company determines $15,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 3% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record bad debts at the end of January Note = journal entry has been entered Record entry Clear entry View general CO 2 3 4 w Prey 7 here to search O hp Required information EX: *** ine company esuildles Tuture unicolecule d wounts. The company determines $15,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 3% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record bad debts at the end of January using he life. Credit Les 3 Accrued interest expense on notes payable for January 4 Accrued income taxes at the end of January are $13,400. 5 By the end of January, 53,400 of the gift cards sold on January 2 have been redeemed. Note : journal entry has been entered Record entry Clear entry View general jou

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started