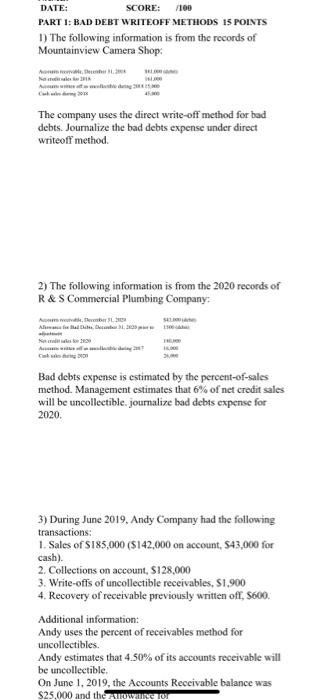

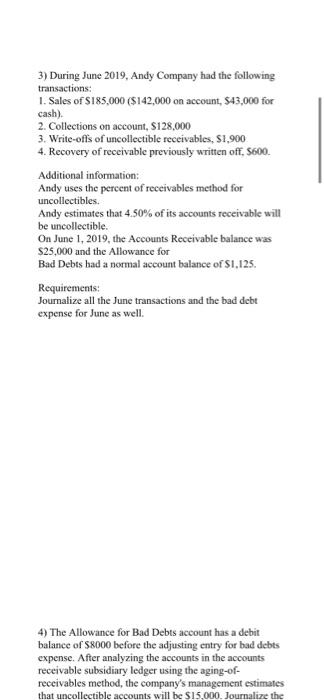

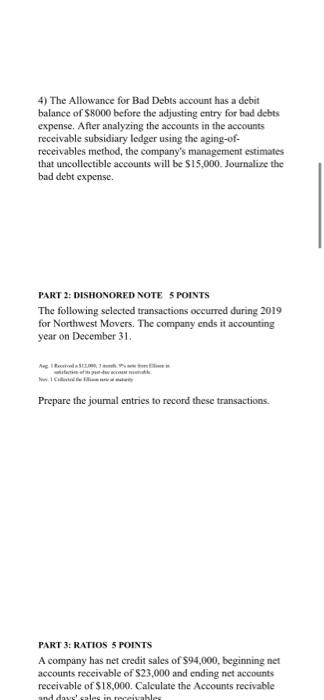

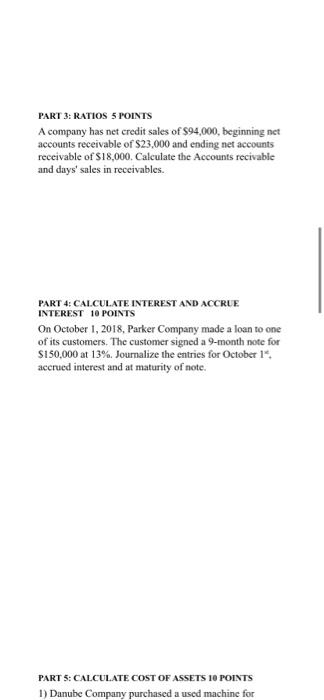

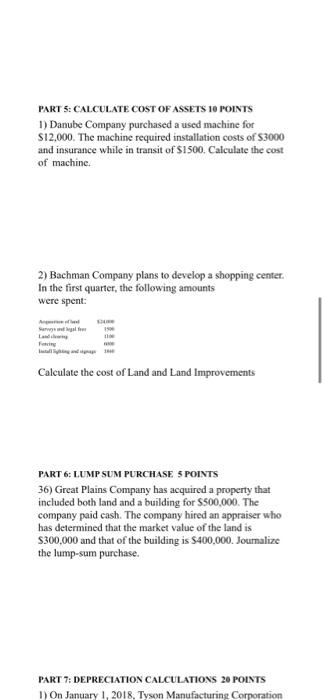

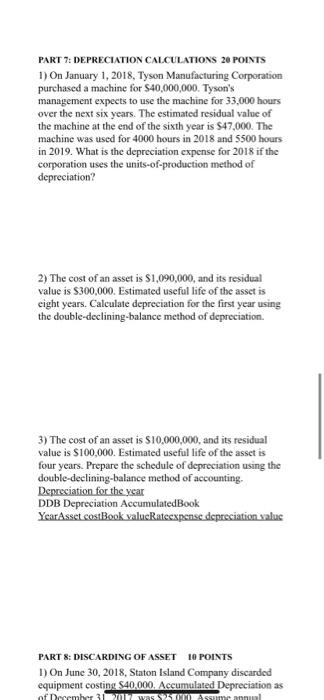

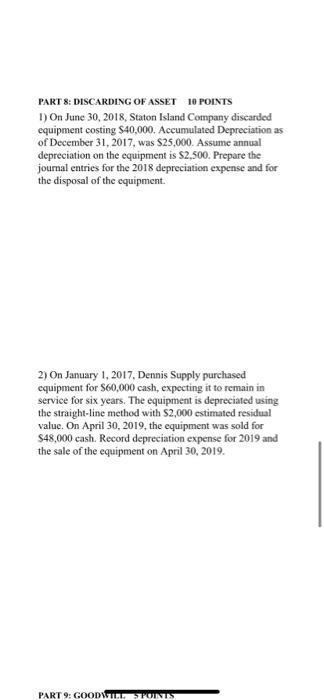

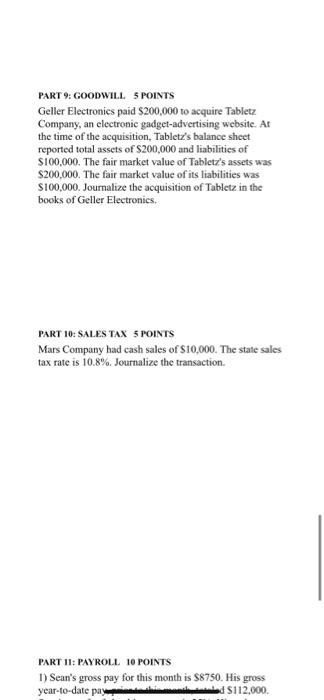

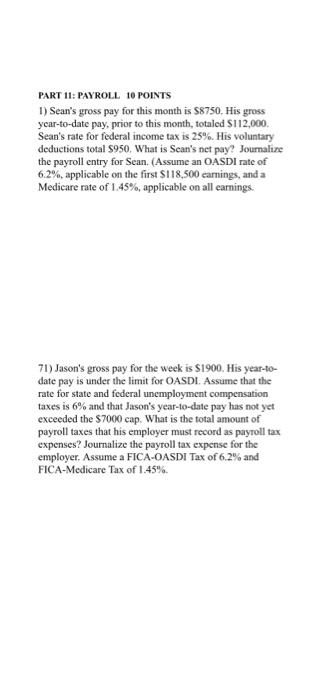

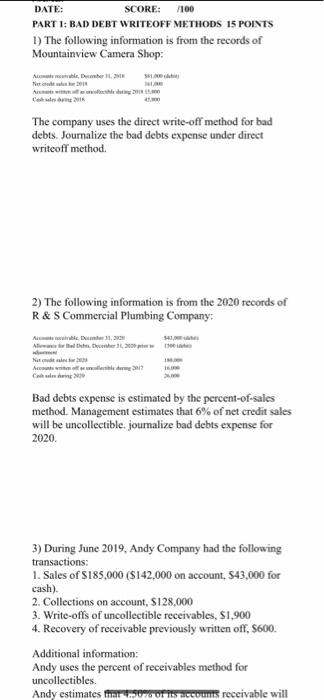

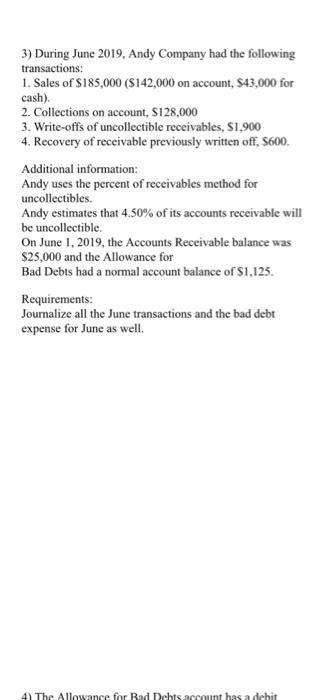

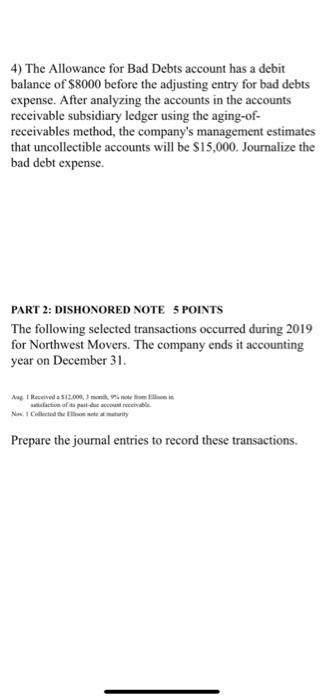

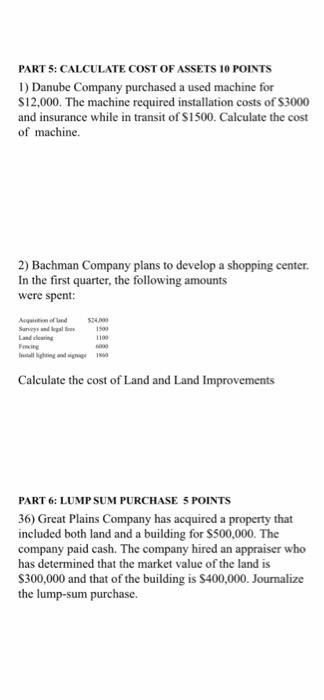

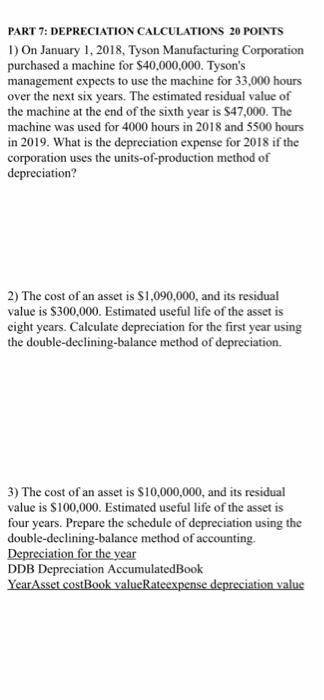

DATE: SCORE: 7100 PART 1: BAD DEBT WRITEOFF METHODS 15 POINTS D) The following information is from the records of Mountainview Camera Shop Ahh A wed The company uses the direct write-off method for bad debts. Journalize the bad debts expense under direct writeoff method 2) The following information is from the 2020 records of R&S Commercial Plumbing Company: A.D.,2018 Bad debts expense is estimated by the percent-of-sales method Management estimates that 6% of net credit sales will be uncollectible journalize bad debts expense for 2020 3) During June 2019. Andy Company had the following transactions: Sales of S185,000 (S142,000 on account, $43,000 for cash). 2. Collections on account, $128,000 3. Write-offs of uncollectible receivables, S1.900 4. Recovery of receivable previously written off, 5600 Additional information: Andy uses the percent of receivables method for uncollectibles Andy estimates that 4.50% of its accounts receivable will be uncollectible On June 1, 2019, the Accounts Receivable balance was $25.000 and the AIRE TO 3) During June 2019, Andy Company had the following transactions: 1. Sales of S185,000 ($142,000 on account, $43,000 for cash) 2. Collections on account, $128.000 3. Write-offs of uncollectible receivables, S1,900 4. Recovery of receivable previously written off, 5600 Additional information: Andy uses the percent of receivables method for uncollectibles. Andy estimates that 4.50% of its accounts receivable will be uncollectible. On June 1, 2019, the Accounts Receivable balance was $25,000 and the Allowance for Bad Debts had a normal account balance of S1,125. Requirements: Journalize all the June transactions and the bad debt expense for June as well 4) The Allowance for Bad Debts account has a debit balance of $8000 before the adjusting entry for bad debts expense. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging-of- receivables method, the company's management estimates that uncollectible accounts will be $15,000. Journalize the 4) The Allowance for Bad Debts account has a debit balance of S8000 before the adjusting entry for bad debts expense. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging-of- receivables method, the company's management estimates that uncollectible accounts will be $15,000. Journalize the bad debt expense. PART 2: DISHONORED NOTE 5 POINTS The following selected transactions occurred during 2019 for Northwest Movers. The company ends it accounting year on December 31 Prepare the joumal entries to record these transactions PART 3: RATIOS S POINTS A company has net credit sales of $94,000, beginning net accounts receivable of $23,000 and ending net accounts receivable of $18,000. Calculate the Accounts recivable and devels in toriyahli PART 3: RATIOS 5 POINTS A company has net credit sales of $94,000, beginning ner accounts receivable of $23,000 and ending net accounts receivable of $18,000. Calculate the Accounts recivable and days' sales in receivables. PART 4 CALCULATE INTEREST AND ACCRUE INTEREST 10 POINTS On October 1, 2018, Parker Company made a loan to one of its customers. The customer signed a 9-month note for S150,000 at 13%. Journalize the entries for October 15, accrued interest and at maturity of note PART 5: CALCULATE COST OF ASSETS 10 POINTS 1) Danube Company purchased a used machine for PARTS: CALCULATE COST OF ASSETS 10 POINTS 1) Danube Company purchased a used machine for S12,000. The machine required installation costs of S3000 and insurance while in transit of $1500. Calculate the cost of machine. 2) Bachman Company plans to develop a shopping center. In the first quarter, the following amounts were spent: Calculate the cost of Land and Land Improvements PART 6: LUMPSUM PURCHASE 5 POINTS 36) Great Plains Company has acquired a property that included both land and a building for $500,000. The company paid cash. The company hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $400.000. Journalize the lump-sum purchase. PART 7: DEPRECIATION CALCULATIONS 20 POINTS 1) On January 1, 2018, Tyson Manufacturing Corporation PART 7: DEPRECIATION CALCULATIONS 20 POINTS 1) On January 1, 2018, Tyson Manufacturing Corporation purchased a machine for $40,000,000. Tyson's management expects to use the machine for 33,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $47,000. The machine was used for 4000 hours in 2018 and 5500 hours in 2019. What is the depreciation expense for 2018 if the corporation uses the units-of-production method of depreciation? 2) The cost of an asset is $1,090,000, and its residual value is $300,000. Estimated useful life of the asset is eight years. Calculate depreciation for the first year using the double-declining-balance method of depreciation. 3) The cost of an asset is $10,000,000, and its residual value is $100,000. Estimated useful life of the asset is four years. Prepare the schedule of depreciation using the double-declining balance method of accounting. Depreciation for the year DDB Depreciation Accumulated Book YearAsset costBook valu.Ratecxpense depreciation valus PART 8: DISCARDING OF ASSET 10 POINTS D) On June 30, 2018, Staton Island Company discarded equipment costing $40.000. Accumulated Depreciation as of December 31 was Asume annual PART 8: DISCARDING OF ASSET 10 POINTS 1) On June 30, 2018, Staton Island Company discarded equipment costing $40,000. Accumulated Depreciation as of December 31, 2017, was $25,000. Assume annual depreciation on the equipment is $2,500. Prepare the journal entries for the 2018 depreciation expense and for the disposal of the equipment. 2) On January 1, 2017, Dennis Supply purchased equipment for $60,000 cash, expecting it to remain in service for six years. The equipment is depreciated using the straight-line method with $2,000 estimated residual value. On April 30, 2019, the equipment was sold for $48,000 cash. Record depreciation expense for 2019 and the sale of the equipment on April 30, 2019. PART 9: GOODWILL POINTS PART 9: GOODWILL S POINTS Geller Electronics paid $200,000 to acquire Tabletz Company, an electronic gadget-advertising website. At the time of the acquisition, Tabletz's balance sheet reported total assets of S200,000 and liabilities of $100,000. The fair market value of Tabletz's assets was $200,000. The fair market value of its liabilities was S100,000. Journalize the acquisition of Tabletz in the books of Geller Electronics PART 10: SALES TAX 5 POINTS Mars Company had cash sales of $10,000. The state sales tax rate is 10.8%. Journalize the transaction. PART 11: PAYROLL 10 POINTS 1) Sean's gross pay for this month is $8750. His gross year-to-date pays ed $112.000 PART 11: PAYROLL 10 POINTS 1) Sean's gross pay for this month is 58750. His gross year-to-date pay, prior to this month, totaled S112,000. Sean's rate for federal income tax is 25%. His voluntary deductions total 950. What is Sean's net pay? Journalize the payroll entry for Sean. (Assume an OASDI rate of 6,2%, applicable on the first S118,500 earnings, and a Medicare rate of 1.45%, applicable on all earnings. 71) Jason's gross pay for the week is $1900. His year-to- date pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6% and that Jason's year-to-date pay has not yet exceeded the $7000 cap. What is the total amount of payroll taxes that his employer must record as payroll tax expenses? Journalize the payroll tax expense for the employer. Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45% 7100 DATE: SCORE: PART 1: BAD DEBT WRITEOFF METHODS 15 POINTS 1) The following information is from the records of Mountainview Camera Shop: Tietoa A The company uses the direct write-off method for bad debts. Journalize the bad debts expense under direct writeoff method. 2) The following information is from the 2020 records of R&S Commercial Plumbing Company: 2000 Accede? Ch Bad debts expense is estimated by the percent-of-sales method. Management estimates that 6% of net credit sales will be uncollectible, journalize bad debts expense for 2020 3) During June 2019, Andy Company had the following transactions: 1. Sales of $185,000 ($142,000 on account, S43,000 for cash) 2. Collections on account, $128,000 3. Write-offs of uncollectible receivables, $1,900 4. Recovery of receivable previously written off, $600. Additional information: Andy uses the percent of receivables method for uncollectibles Andy estimates ffrat 50% of its accounts receivable will 3) During June 2019. Andy Company had the following transactions: 1. Sales of $185,000 ($142,000 on account, S43,000 for cash). 2. Collections on account, S128,000 3. Write-offs of uncollectible receivables, S1,900 4. Recovery of receivable previously written off, 5600 Additional information: Andy uses the percent of receivables method for uncollectibles. Andy estimates that 4.50% of its accounts receivable will be uncollectible. On June 1, 2019, the Accounts Receivable balance was $25,000 and the Allowance for Bad Debts had a normal account balance of $1,125. Requirements: Journalize all the June transactions and the bad debt expense for June as well. 4) The Allowance for Rad Debts account has a debit 4) The Allowance for Bad Debts account has a debit balance of $8000 before the adjusting entry for bad debts expense. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging-of- receivables method, the company's management estimates that uncollectible accounts will be $15,000. Journalize the bad debt expense. PART 2: DISHONORED NOTE 5 POINTS The following selected transactions occurred during 2019 for Northwest Movers. The company ends it accounting year on December 31. Aug Received 512.000 metrin fase of spaccount occable Nderity Prepare the journal entries to record these transactions. PART 3: RATIOS 5 POINTS A company has net credit sales of S94,000, beginning net accounts receivable of $23,000 and ending net accounts receivable of $18,000. Calculate the Accounts recivable and days' sales in receivables. PART 4: CALCULATE INTEREST AND ACCRUE INTEREST 10 POINTS On October 1, 2018, Parker Company made a loan to one of its customers. The customer signed a 9-month note for $150,000 at 13%. Journalize the entries for October 1", accrued interest and at maturity of note. PART 5: CALCULATE COST OF ASSETS 10 POINTS 1) Danube Company purchased a used machine for $12,000. The machine required installation costs of $3000 and insurance while in transit of S1500. Calculate the cost of machine 2) Bachman Company plans to develop a shopping center. In the first quarter, the following amounts were spent: Agend Surveys Land cliening more 1100 Calculate the cost of Land and Land Improvements PART 6: LUMPSUM PURCHASE 5 POINTS 36) Great Plains Company has acquired a property that included both land and a building for $500,000. The company paid cash. The company hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $400,000. Journalize the lump-sum purchase. PART 7: DEPRECIATION CALCULATIONS 20 POINTS 1) On January 1, 2018, Tyson Manufacturing Corporation purchased a machine for $40,000,000. Tyson's management expects to use the machine for 33,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $47,000. The machine was used for 4000 hours in 2018 and 5500 hours in 2019. What is the depreciation expense for 2018 if the corporation uses the units-of-production method of depreciation? 2) The cost of an asset is $1,090,000, and its residual value is $300,000. Estimated useful life of the asset is eight years. Calculate depreciation for the first year using the double-declining-balance method of depreciation. 3) The cost of an asset is $10,000,000, and its residual value is $100,000. Estimated useful life of the asset is four years. Prepare the schedule of depreciation using the double-declining-balance method of accounting. Depreciation for the year DDB Depreciation Accumulated Book Year Asset costBook valueRateexpense depreciation value PART 8: DISCARDING OF ASSET 10 POINTS 1) On June 30, 2018, Staton Island Company discarded equipment costing S40,000. Accumulated Depreciation as of December 31, 2017, was $25,000. Assume annual depreciation on the equipment is $2,500. Prepare the journal entries for the 2018 depreciation expense and for the disposal of the equipment. 2) On January 1, 2017, Dennis Supply purchased equipment for $60,000 cash, expecting it to remain in service for six years. The equipment is depreciated using the straight-line method with $2,000 estimated residual value. On April 30, 2019, the equipment was sold for $48,000 cash. Record depreciation expense for 2019 and the sale of the equipment on April 30, 2019. PART 9: GOODWILL S POINTS Geller Electronics paid $200,000 to acquire Tabletz Company, an electronic gadget-advertising website. At the time of the acquisition, Tabletz's balance sheet reported total assets of $200,000 and liabilities of $100,000. The fair market value of Tabletz's assets was $200,000. The fair market value of its liabilities was $100,000. Journalize the acquisition of Tabletz in the books of Geller Electronics. PART 10: SALES TAX 5 POINTS Mars Company had cash sales of $10,000. The state sales tax rate is 10.8%. Journalize the transaction. PART 11: PAYROLL 10 POINTS 1) Sean's gross pay for this month is $8750. His gross year-to-date pay, prior to this month, totaled S112,000. Sean's rate for federal income tax is 25%. His voluntary deductions total $950. What is Sean's net pay? Journalize the payroll entry for Sean. (Assume an OASDI rate of 6.2%, applicable on the first $118,500 earnings, and a Medicare rate of 1.45%, applicable on all earnings. 71) Jason's gross pay for the week is $1900. His year-to- date pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6% and that Jason's year-to-date pay has not yet exceeded the $7000 cap. What is the total amount of payroll taxes that his employer must record as payroll tax expenses? Journalize the payroll tax expense for the employer. Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%. DATE: SCORE: 7100 PART 1: BAD DEBT WRITEOFF METHODS 15 POINTS D) The following information is from the records of Mountainview Camera Shop Ahh A wed The company uses the direct write-off method for bad debts. Journalize the bad debts expense under direct writeoff method 2) The following information is from the 2020 records of R&S Commercial Plumbing Company: A.D.,2018 Bad debts expense is estimated by the percent-of-sales method Management estimates that 6% of net credit sales will be uncollectible journalize bad debts expense for 2020 3) During June 2019. Andy Company had the following transactions: Sales of S185,000 (S142,000 on account, $43,000 for cash). 2. Collections on account, $128,000 3. Write-offs of uncollectible receivables, S1.900 4. Recovery of receivable previously written off, 5600 Additional information: Andy uses the percent of receivables method for uncollectibles Andy estimates that 4.50% of its accounts receivable will be uncollectible On June 1, 2019, the Accounts Receivable balance was $25.000 and the AIRE TO 3) During June 2019, Andy Company had the following transactions: 1. Sales of S185,000 ($142,000 on account, $43,000 for cash) 2. Collections on account, $128.000 3. Write-offs of uncollectible receivables, S1,900 4. Recovery of receivable previously written off, 5600 Additional information: Andy uses the percent of receivables method for uncollectibles. Andy estimates that 4.50% of its accounts receivable will be uncollectible. On June 1, 2019, the Accounts Receivable balance was $25,000 and the Allowance for Bad Debts had a normal account balance of S1,125. Requirements: Journalize all the June transactions and the bad debt expense for June as well 4) The Allowance for Bad Debts account has a debit balance of $8000 before the adjusting entry for bad debts expense. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging-of- receivables method, the company's management estimates that uncollectible accounts will be $15,000. Journalize the 4) The Allowance for Bad Debts account has a debit balance of S8000 before the adjusting entry for bad debts expense. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging-of- receivables method, the company's management estimates that uncollectible accounts will be $15,000. Journalize the bad debt expense. PART 2: DISHONORED NOTE 5 POINTS The following selected transactions occurred during 2019 for Northwest Movers. The company ends it accounting year on December 31 Prepare the joumal entries to record these transactions PART 3: RATIOS S POINTS A company has net credit sales of $94,000, beginning net accounts receivable of $23,000 and ending net accounts receivable of $18,000. Calculate the Accounts recivable and devels in toriyahli PART 3: RATIOS 5 POINTS A company has net credit sales of $94,000, beginning ner accounts receivable of $23,000 and ending net accounts receivable of $18,000. Calculate the Accounts recivable and days' sales in receivables. PART 4 CALCULATE INTEREST AND ACCRUE INTEREST 10 POINTS On October 1, 2018, Parker Company made a loan to one of its customers. The customer signed a 9-month note for S150,000 at 13%. Journalize the entries for October 15, accrued interest and at maturity of note PART 5: CALCULATE COST OF ASSETS 10 POINTS 1) Danube Company purchased a used machine for PARTS: CALCULATE COST OF ASSETS 10 POINTS 1) Danube Company purchased a used machine for S12,000. The machine required installation costs of S3000 and insurance while in transit of $1500. Calculate the cost of machine. 2) Bachman Company plans to develop a shopping center. In the first quarter, the following amounts were spent: Calculate the cost of Land and Land Improvements PART 6: LUMPSUM PURCHASE 5 POINTS 36) Great Plains Company has acquired a property that included both land and a building for $500,000. The company paid cash. The company hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $400.000. Journalize the lump-sum purchase. PART 7: DEPRECIATION CALCULATIONS 20 POINTS 1) On January 1, 2018, Tyson Manufacturing Corporation PART 7: DEPRECIATION CALCULATIONS 20 POINTS 1) On January 1, 2018, Tyson Manufacturing Corporation purchased a machine for $40,000,000. Tyson's management expects to use the machine for 33,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $47,000. The machine was used for 4000 hours in 2018 and 5500 hours in 2019. What is the depreciation expense for 2018 if the corporation uses the units-of-production method of depreciation? 2) The cost of an asset is $1,090,000, and its residual value is $300,000. Estimated useful life of the asset is eight years. Calculate depreciation for the first year using the double-declining-balance method of depreciation. 3) The cost of an asset is $10,000,000, and its residual value is $100,000. Estimated useful life of the asset is four years. Prepare the schedule of depreciation using the double-declining balance method of accounting. Depreciation for the year DDB Depreciation Accumulated Book YearAsset costBook valu.Ratecxpense depreciation valus PART 8: DISCARDING OF ASSET 10 POINTS D) On June 30, 2018, Staton Island Company discarded equipment costing $40.000. Accumulated Depreciation as of December 31 was Asume annual PART 8: DISCARDING OF ASSET 10 POINTS 1) On June 30, 2018, Staton Island Company discarded equipment costing $40,000. Accumulated Depreciation as of December 31, 2017, was $25,000. Assume annual depreciation on the equipment is $2,500. Prepare the journal entries for the 2018 depreciation expense and for the disposal of the equipment. 2) On January 1, 2017, Dennis Supply purchased equipment for $60,000 cash, expecting it to remain in service for six years. The equipment is depreciated using the straight-line method with $2,000 estimated residual value. On April 30, 2019, the equipment was sold for $48,000 cash. Record depreciation expense for 2019 and the sale of the equipment on April 30, 2019. PART 9: GOODWILL POINTS PART 9: GOODWILL S POINTS Geller Electronics paid $200,000 to acquire Tabletz Company, an electronic gadget-advertising website. At the time of the acquisition, Tabletz's balance sheet reported total assets of S200,000 and liabilities of $100,000. The fair market value of Tabletz's assets was $200,000. The fair market value of its liabilities was S100,000. Journalize the acquisition of Tabletz in the books of Geller Electronics PART 10: SALES TAX 5 POINTS Mars Company had cash sales of $10,000. The state sales tax rate is 10.8%. Journalize the transaction. PART 11: PAYROLL 10 POINTS 1) Sean's gross pay for this month is $8750. His gross year-to-date pays ed $112.000 PART 11: PAYROLL 10 POINTS 1) Sean's gross pay for this month is 58750. His gross year-to-date pay, prior to this month, totaled S112,000. Sean's rate for federal income tax is 25%. His voluntary deductions total 950. What is Sean's net pay? Journalize the payroll entry for Sean. (Assume an OASDI rate of 6,2%, applicable on the first S118,500 earnings, and a Medicare rate of 1.45%, applicable on all earnings. 71) Jason's gross pay for the week is $1900. His year-to- date pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6% and that Jason's year-to-date pay has not yet exceeded the $7000 cap. What is the total amount of payroll taxes that his employer must record as payroll tax expenses? Journalize the payroll tax expense for the employer. Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45% 7100 DATE: SCORE: PART 1: BAD DEBT WRITEOFF METHODS 15 POINTS 1) The following information is from the records of Mountainview Camera Shop: Tietoa A The company uses the direct write-off method for bad debts. Journalize the bad debts expense under direct writeoff method. 2) The following information is from the 2020 records of R&S Commercial Plumbing Company: 2000 Accede? Ch Bad debts expense is estimated by the percent-of-sales method. Management estimates that 6% of net credit sales will be uncollectible, journalize bad debts expense for 2020 3) During June 2019, Andy Company had the following transactions: 1. Sales of $185,000 ($142,000 on account, S43,000 for cash) 2. Collections on account, $128,000 3. Write-offs of uncollectible receivables, $1,900 4. Recovery of receivable previously written off, $600. Additional information: Andy uses the percent of receivables method for uncollectibles Andy estimates ffrat 50% of its accounts receivable will 3) During June 2019. Andy Company had the following transactions: 1. Sales of $185,000 ($142,000 on account, S43,000 for cash). 2. Collections on account, S128,000 3. Write-offs of uncollectible receivables, S1,900 4. Recovery of receivable previously written off, 5600 Additional information: Andy uses the percent of receivables method for uncollectibles. Andy estimates that 4.50% of its accounts receivable will be uncollectible. On June 1, 2019, the Accounts Receivable balance was $25,000 and the Allowance for Bad Debts had a normal account balance of $1,125. Requirements: Journalize all the June transactions and the bad debt expense for June as well. 4) The Allowance for Rad Debts account has a debit 4) The Allowance for Bad Debts account has a debit balance of $8000 before the adjusting entry for bad debts expense. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging-of- receivables method, the company's management estimates that uncollectible accounts will be $15,000. Journalize the bad debt expense. PART 2: DISHONORED NOTE 5 POINTS The following selected transactions occurred during 2019 for Northwest Movers. The company ends it accounting year on December 31. Aug Received 512.000 metrin fase of spaccount occable Nderity Prepare the journal entries to record these transactions. PART 3: RATIOS 5 POINTS A company has net credit sales of S94,000, beginning net accounts receivable of $23,000 and ending net accounts receivable of $18,000. Calculate the Accounts recivable and days' sales in receivables. PART 4: CALCULATE INTEREST AND ACCRUE INTEREST 10 POINTS On October 1, 2018, Parker Company made a loan to one of its customers. The customer signed a 9-month note for $150,000 at 13%. Journalize the entries for October 1", accrued interest and at maturity of note. PART 5: CALCULATE COST OF ASSETS 10 POINTS 1) Danube Company purchased a used machine for $12,000. The machine required installation costs of $3000 and insurance while in transit of S1500. Calculate the cost of machine 2) Bachman Company plans to develop a shopping center. In the first quarter, the following amounts were spent: Agend Surveys Land cliening more 1100 Calculate the cost of Land and Land Improvements PART 6: LUMPSUM PURCHASE 5 POINTS 36) Great Plains Company has acquired a property that included both land and a building for $500,000. The company paid cash. The company hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $400,000. Journalize the lump-sum purchase. PART 7: DEPRECIATION CALCULATIONS 20 POINTS 1) On January 1, 2018, Tyson Manufacturing Corporation purchased a machine for $40,000,000. Tyson's management expects to use the machine for 33,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $47,000. The machine was used for 4000 hours in 2018 and 5500 hours in 2019. What is the depreciation expense for 2018 if the corporation uses the units-of-production method of depreciation? 2) The cost of an asset is $1,090,000, and its residual value is $300,000. Estimated useful life of the asset is eight years. Calculate depreciation for the first year using the double-declining-balance method of depreciation. 3) The cost of an asset is $10,000,000, and its residual value is $100,000. Estimated useful life of the asset is four years. Prepare the schedule of depreciation using the double-declining-balance method of accounting. Depreciation for the year DDB Depreciation Accumulated Book Year Asset costBook valueRateexpense depreciation value PART 8: DISCARDING OF ASSET 10 POINTS 1) On June 30, 2018, Staton Island Company discarded equipment costing S40,000. Accumulated Depreciation as of December 31, 2017, was $25,000. Assume annual depreciation on the equipment is $2,500. Prepare the journal entries for the 2018 depreciation expense and for the disposal of the equipment. 2) On January 1, 2017, Dennis Supply purchased equipment for $60,000 cash, expecting it to remain in service for six years. The equipment is depreciated using the straight-line method with $2,000 estimated residual value. On April 30, 2019, the equipment was sold for $48,000 cash. Record depreciation expense for 2019 and the sale of the equipment on April 30, 2019. PART 9: GOODWILL S POINTS Geller Electronics paid $200,000 to acquire Tabletz Company, an electronic gadget-advertising website. At the time of the acquisition, Tabletz's balance sheet reported total assets of $200,000 and liabilities of $100,000. The fair market value of Tabletz's assets was $200,000. The fair market value of its liabilities was $100,000. Journalize the acquisition of Tabletz in the books of Geller Electronics. PART 10: SALES TAX 5 POINTS Mars Company had cash sales of $10,000. The state sales tax rate is 10.8%. Journalize the transaction. PART 11: PAYROLL 10 POINTS 1) Sean's gross pay for this month is $8750. His gross year-to-date pay, prior to this month, totaled S112,000. Sean's rate for federal income tax is 25%. His voluntary deductions total $950. What is Sean's net pay? Journalize the payroll entry for Sean. (Assume an OASDI rate of 6.2%, applicable on the first $118,500 earnings, and a Medicare rate of 1.45%, applicable on all earnings. 71) Jason's gross pay for the week is $1900. His year-to- date pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6% and that Jason's year-to-date pay has not yet exceeded the $7000 cap. What is the total amount of payroll taxes that his employer must record as payroll tax expenses? Journalize the payroll tax expense for the employer. Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%