Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sven and Abigail began a business of acquiring valuable artworks and antiques and selling them online in December 2019, using their website SGartandantiques.com. The

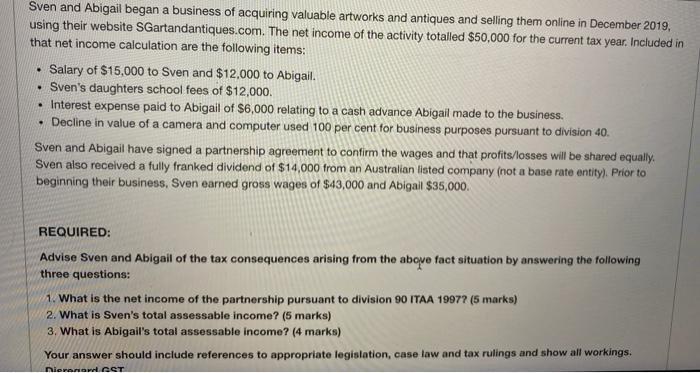

Sven and Abigail began a business of acquiring valuable artworks and antiques and selling them online in December 2019, using their website SGartandantiques.com. The net income of the activity totalled $50,000 for the current tax year. Included in that net income calculation are the following items: Salary of $15,000 to Sven and $12,000 to Abigail. . Sven's daughters school fees of $12,000. Interest expense paid to Abigail of $6,000 relating to a cash advance Abigail made to the business. . Decline in value of a camera and computer used 100 per cent for business purposes pursuant to division 40. Sven and Abigail have signed a partnership agreement to confirm the wages and that profits/losses will be shared equally. Sven also received a fully franked dividend of $14,000 from an Australian listed company (not a base rate entity). Prior to beginning their business, Sven earned gross wages of $43,000 and Abigail $35,000. REQUIRED: Advise Sven and Abigail of the tax consequences arising from the above fact situation by answering the following three questions: 1. What is the net income of the partnership pursuant to division 90 ITAA 1997? (5 marks) 2. What is Sven's total assessable income? (5 marks) 3. What is Abigail's total assessable income? (4 marks) Your answer should include references to appropriate legislation, case law and tax rulings and show all workings. Dierenard GST

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 What is the net income of the partnership pursuant to division 90 IT AA 1997 5 marks ANS WER The n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started