Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SVEU Seventeen Homework i Ek my work mode: This shows what is correct or incorrect for the work you have completed so far. It does

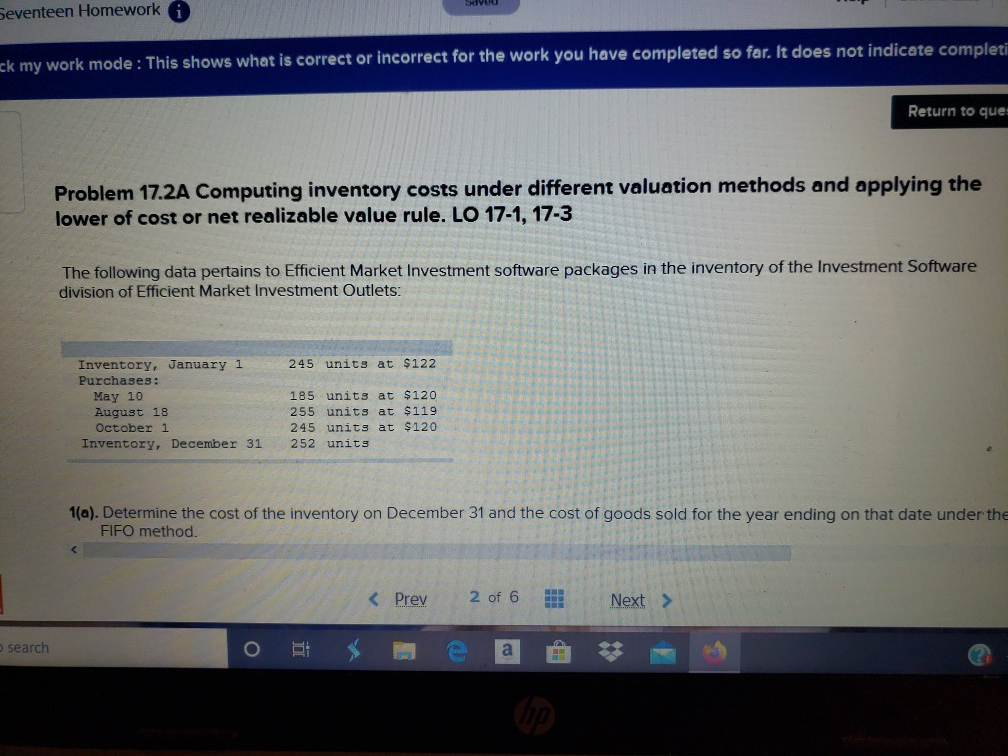

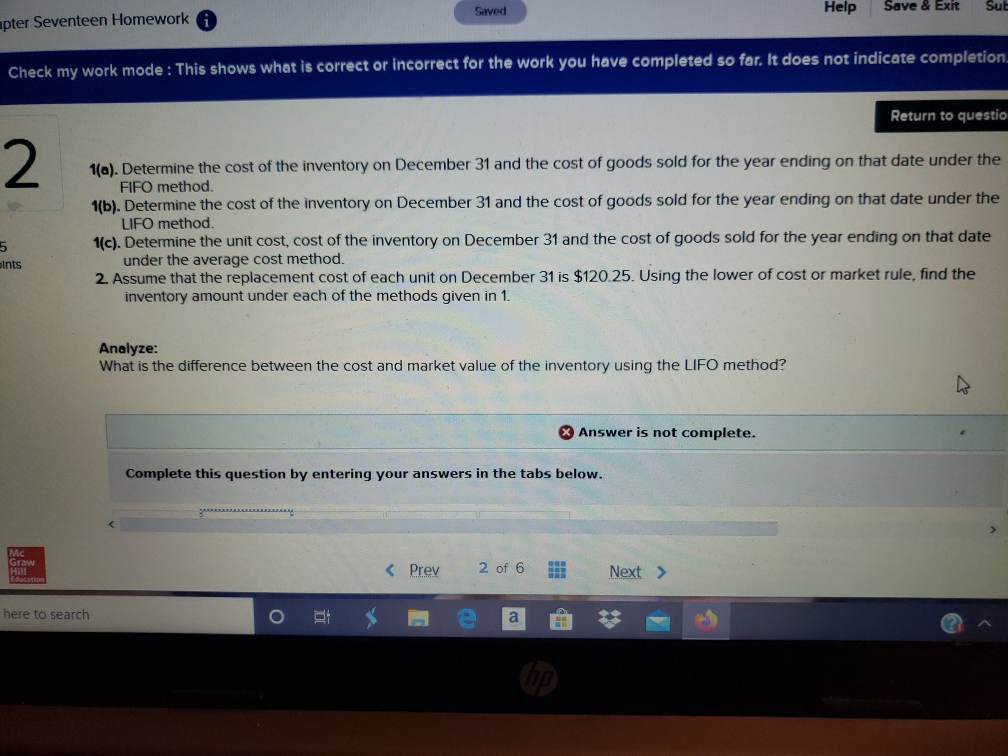

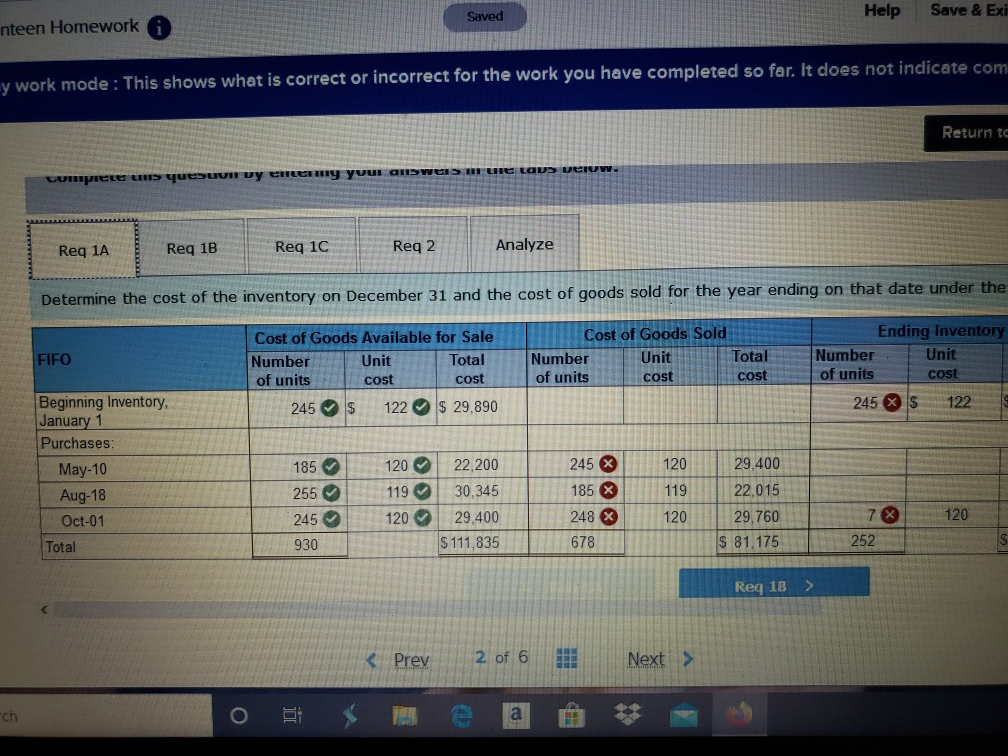

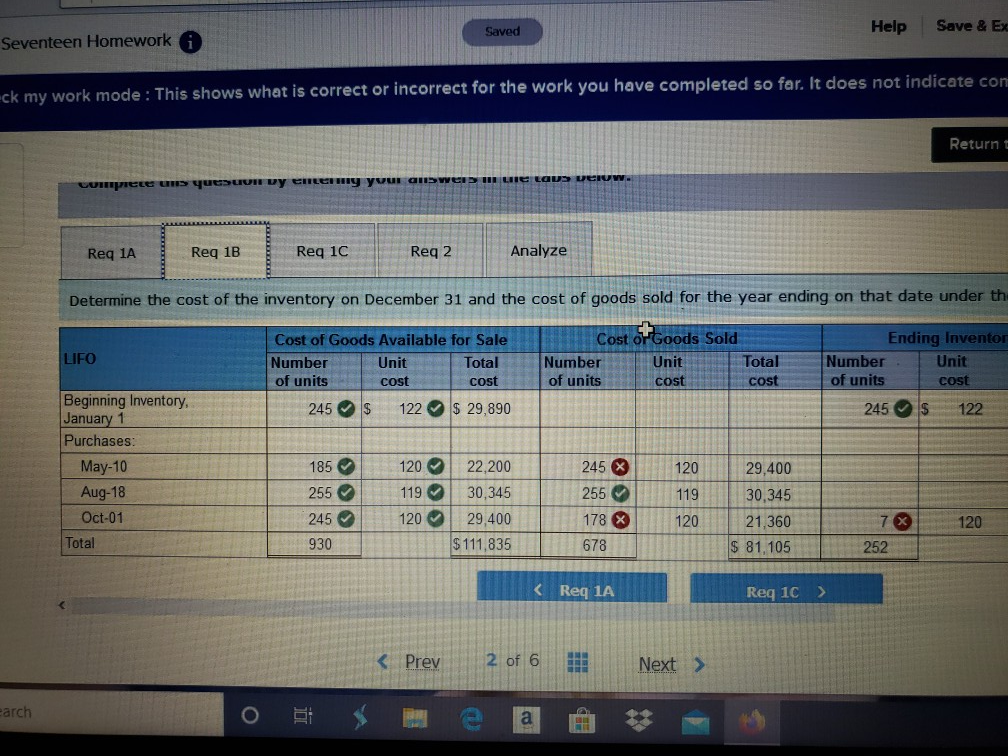

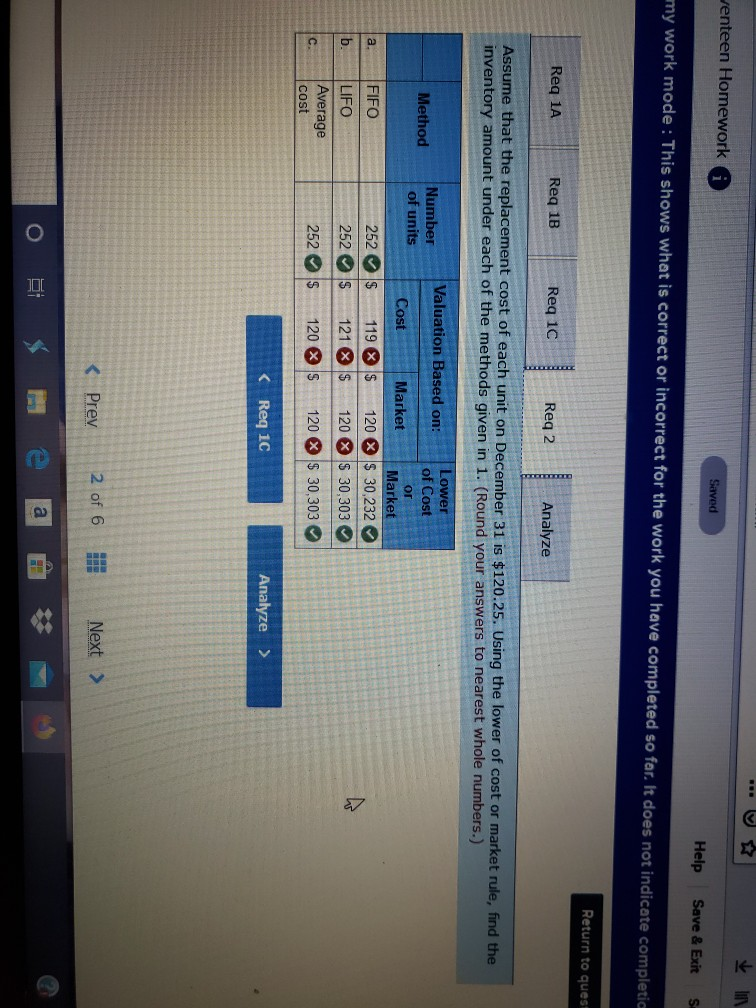

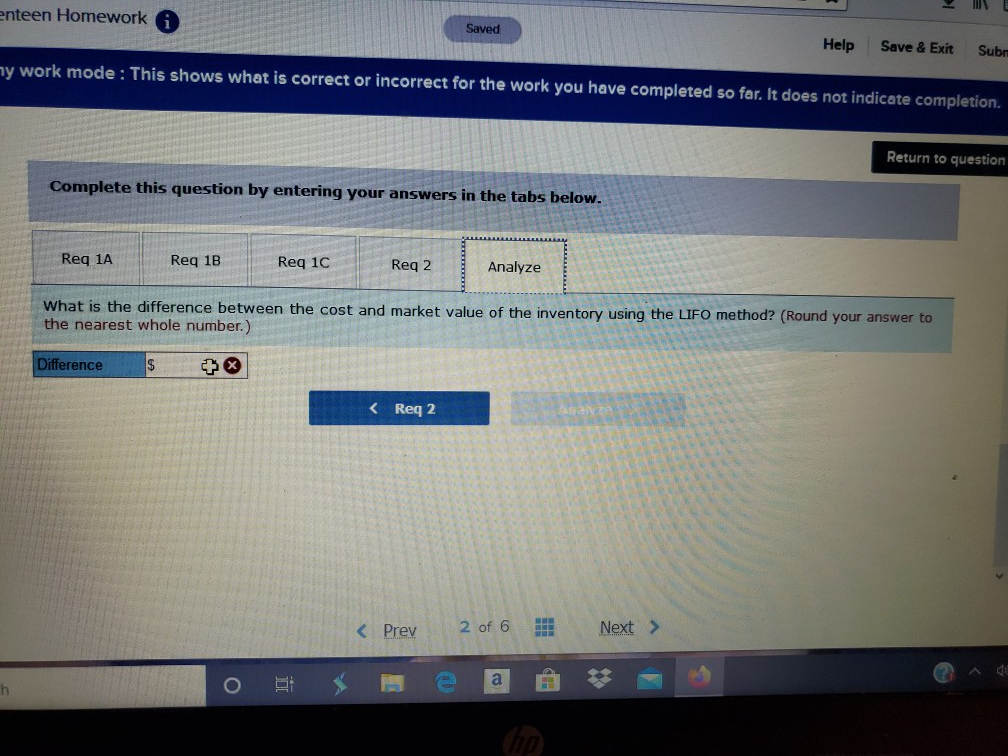

SVEU Seventeen Homework i Ek my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate complet Return to que Problem 17.2A Computing inventory costs under different valuation methods and applying the lower of cost or net realizable value rule. LO 17-1, 17-3 The following data pertains to Efficient Market Investment software packages in the inventory of the Investment Software division of Efficient Market Investment Outlets: 245 units at $122 Inventory, January 1 Purchases: May 10 August 18 October 1 Inventory, December 31 185 units at $12 255 units at $11 245 units at $120 252 units 1(a). Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the FIFO method search Saved pter Seventeen Homework a Help Save & Exit Sur Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to questio 1(a). Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the FIFO method 1(b). Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the LIFO method. 1(c). Determine the unit cost, cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the average cost method. 2. Assume that the replacement cost of each unit on December 31 is $120.25. Using the lower of cost or market rule, find the inventory amount under each of the methods given in 1. Ints Analyze: What is the difference between the cost and market value of the inventory using the LIFO method? Answer is not complete. Complete this question by entering your answers in the tabs below. Graw HU here to search nteen Homework Saved Help Save & EX work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate com Return ti el quesUVI Uy LEERY your answeis Le Laus Dei Req 1A Reg 1B Reg 1C Reg 2 Analyze Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the FIFO Cost of Goods Available for Sale Number Unit Total of units cost cost 245 122 $ 29,890 Cost of Goods Sold Number of units Total cost Ending Inventory Number Unit of units cost 245 X $ cost 122 Beginning Inventory January 1 Purchases: May-10 Aug-18 Oct-01 Total 185 255 245 930 120 119 120 22,200 30,345 29,400 S 111,835 245 185% 248 120 119 120 29.400 22,015 29,760 S 81.175 120 678 252 Reg 1B > ch Saved Help Save & B Seventeen Homework a ck my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate con Return LURDY CLEI BUVU answeMLIG Laus Req 1A Reg 1B Req 1C Req 2 Analyze Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under th LIFO Cost of Goods Available for Sale Number Unit Total of units cost cost 245 $ 122 $ 29,890 Cost of Goods Sold Number Unit Total of units cost cost Ending Invento Number Unit of units cost 245s 122 Beginning Inventory January 1 Purchases: May-10 Aug-18 Oct-01 Total 245$ 185 255 245 930 120 119 120 22,200 30,345 29.400 $ 111,835 255 178 678 120 119 120 29,400 30,345 21,360 $ 81,105 7 120 252 arch In jenteen Homework Saved Help Save & Exit S. my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completig Return to quest Reg 1A Req 1B Req 1C Req 2 Analyze Assume that the replacement cost of each unit on December 31 is $120.25. Using the lower of cost or market rule, find the inventory amount under each of the methods given in 1. (Round your answers to nearest whole numbers.) Method Number of units FIFO LIFO Average cost 252 252 252 Lower Valuation Based on: of Cost or Cost Market Market $ 119 X $ 120 $ 30,232 $ 121 $ 120 S 30,303 $ 120 S 120 $ 30,303 enteen Homework A Saved Help Save & Exit Sub hy work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Req 1C Reg 2 Analyze What is the difference between the cost and market value of the inventory using the LIFO method? (Round your answer to the nearest whole number.) Difference

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started