Munasib Limited (ML) is a manufacturer of Polyester. On December 31, 2016, it decided to classify an item of property, plant and equipment (PPE)

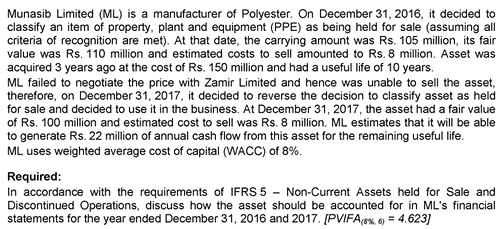

Munasib Limited (ML) is a manufacturer of Polyester. On December 31, 2016, it decided to classify an item of property, plant and equipment (PPE) as being held for sale (assuming all criteria of recognition are met). At that date, the carrying amount was Rs. 105 million, its fair value was Rs. 110 million and estimated costs to sell amounted to Rs. 8 million. Asset was acquired 3 years ago at the cost of Rs. 150 million and had a useful life of 10 years. ML failed to negotiate the price with Zamir Limited and hence was unable to sell the asset, therefore, on December 31, 2017, it decided to reverse the decision to classify asset as held for sale and decided to use it in the business. At December 31, 2017, the asset had a fair value of Rs. 100 million and estimated cost to sell was Rs. 8 million. ML estimates that it will be able to generate Rs. 22 million of annual cash flow from this asset for the remaining useful life. ML uses weighted average cost of capital (WACC) of 8%. Required: In accordance with the requirements of IFRS 5 Non-Current Assets held for Sale and Discontinued Operations, discuss how the asset should be accounted for in ML's financial statements for the year ended December 31, 2016 and 2017. [PVIFA(8%, 6) = 4.623]

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

As per IFRS 5 the asset should be classified as held for sale on December 31 2016 as it met all ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started