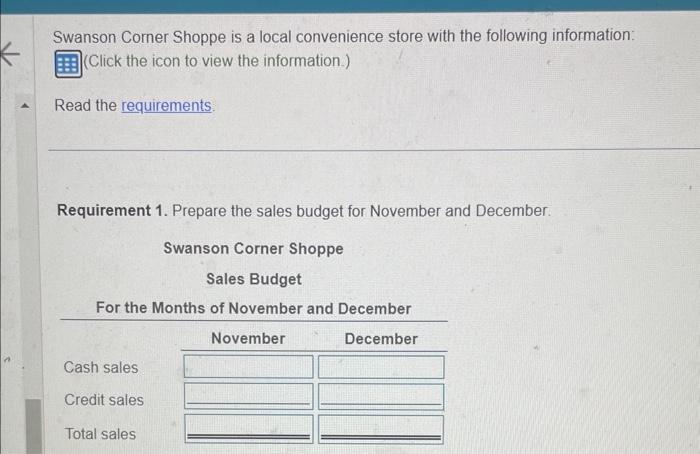

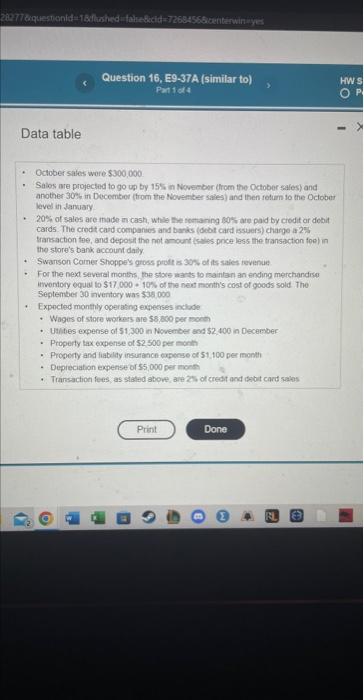

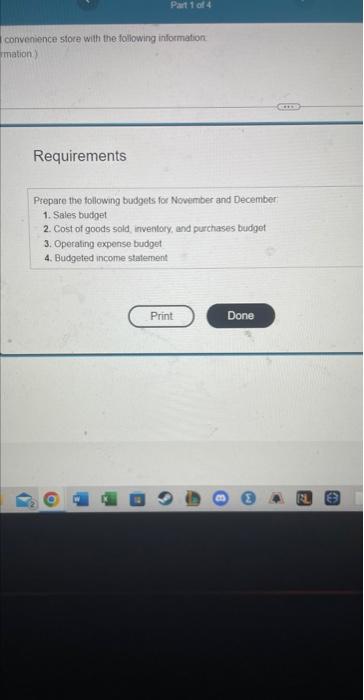

Swanson Corner Shoppe is a local convenience store with the following information: (Click the icon to view the information.) Read the requirements. Requirement 1. Prepare the sales budget for November and December. - October sates wore $300,000 - Salos are projectid to go up by 15S in November (from the October sales) and another 30 in in Decemtior (trom ele Noventer sales) and then retum to the Oclober level in tanuary. - 20% of sales are made in cash, while the semaning m0tr aie paid by credit or dobit cards. The crodt cad companies and banis (debt card issuers) charge a 2\%s transaction toe, and deposit the not amount (seles price less the transaction foe) in the store's bank account daily. - Swanson Camer Shoppes gross proit is 30% of tit sales tevenue - For the next several months, the stors ilants to maintan an ending merchandiso itwontory equal to $17,000 - 10% of the neet nonth's cost of goods sold the September 30 inventory was $38000 - Expected monthly ogeraing experses inclode - Wages of store workes are 58 aco per moeh - Uuibes expense of 51,300 in November snd $2,400 in December - Property tax expense of 52500 per nonh - Property and flabldy insurance expense or 51,100 per montl - Depreciation expense of 15,000 per monh - Transaction fees, as staled above, are 2 ts of credit and isabit card sabs convenence stoce with the following information: miation) Requirements Prepare the following budgets for Nowember and December 1. Sales budpet 2. Cost of goods sold inventory, and purchases budget 3. Operaling expense budget 4. Budgeted uncome staternent Swanson Corner Shoppe is a local convenience store with the following information: (Click the icon to view the information.) Read the requirements. Requirement 1. Prepare the sales budget for November and December. - October sates wore $300,000 - Salos are projectid to go up by 15S in November (from the October sales) and another 30 in in Decemtior (trom ele Noventer sales) and then retum to the Oclober level in tanuary. - 20% of sales are made in cash, while the semaning m0tr aie paid by credit or dobit cards. The crodt cad companies and banis (debt card issuers) charge a 2\%s transaction toe, and deposit the not amount (seles price less the transaction foe) in the store's bank account daily. - Swanson Camer Shoppes gross proit is 30% of tit sales tevenue - For the next several months, the stors ilants to maintan an ending merchandiso itwontory equal to $17,000 - 10% of the neet nonth's cost of goods sold the September 30 inventory was $38000 - Expected monthly ogeraing experses inclode - Wages of store workes are 58 aco per moeh - Uuibes expense of 51,300 in November snd $2,400 in December - Property tax expense of 52500 per nonh - Property and flabldy insurance expense or 51,100 per montl - Depreciation expense of 15,000 per monh - Transaction fees, as staled above, are 2 ts of credit and isabit card sabs convenence stoce with the following information: miation) Requirements Prepare the following budgets for Nowember and December 1. Sales budpet 2. Cost of goods sold inventory, and purchases budget 3. Operaling expense budget 4. Budgeted uncome staternent