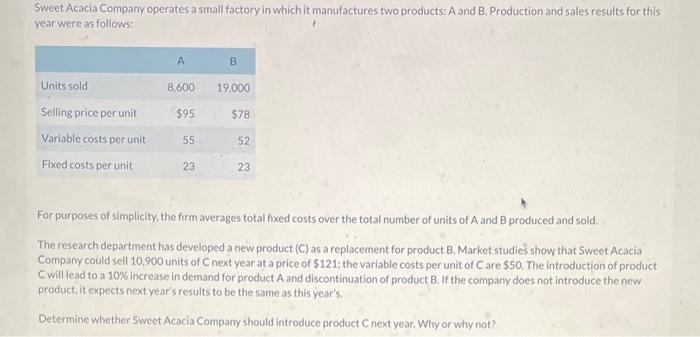

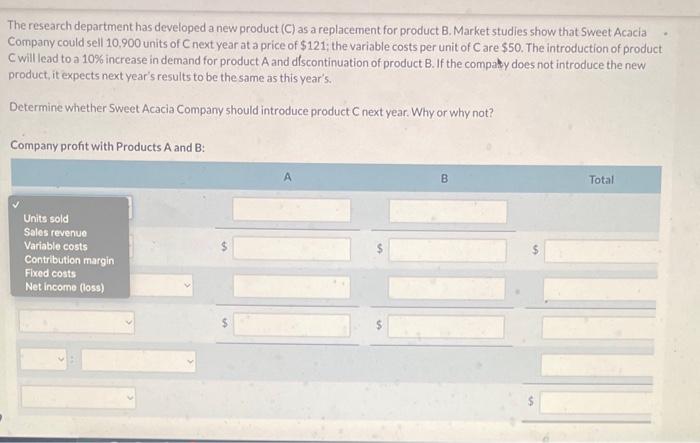

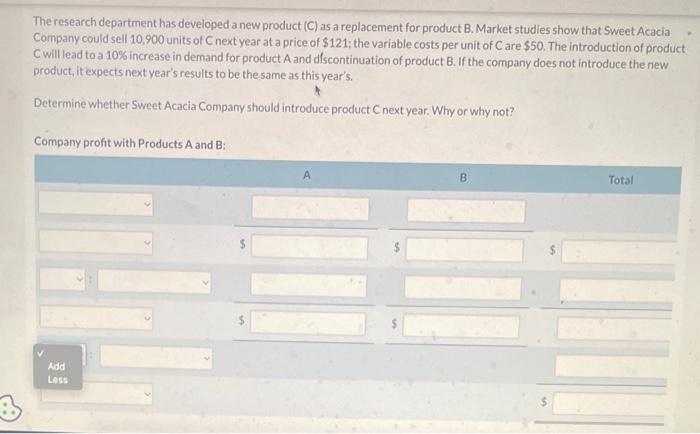

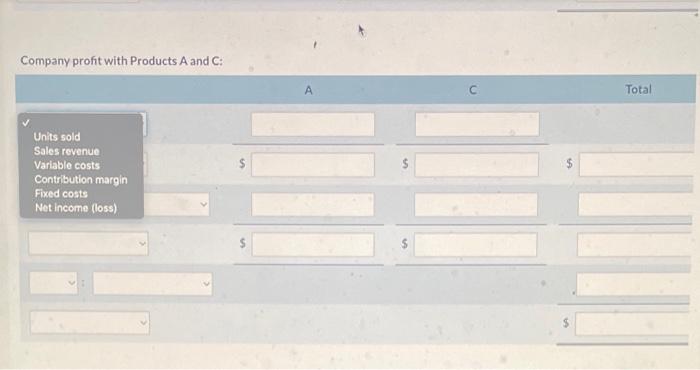

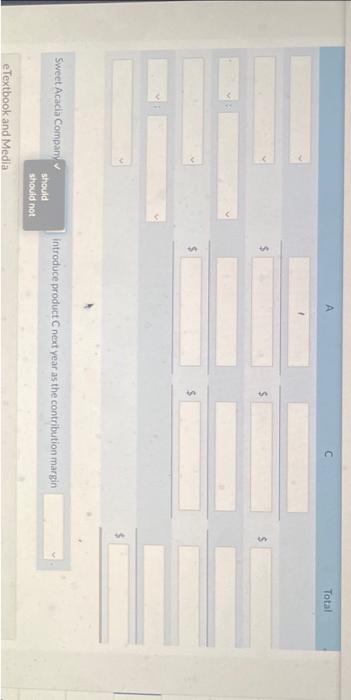

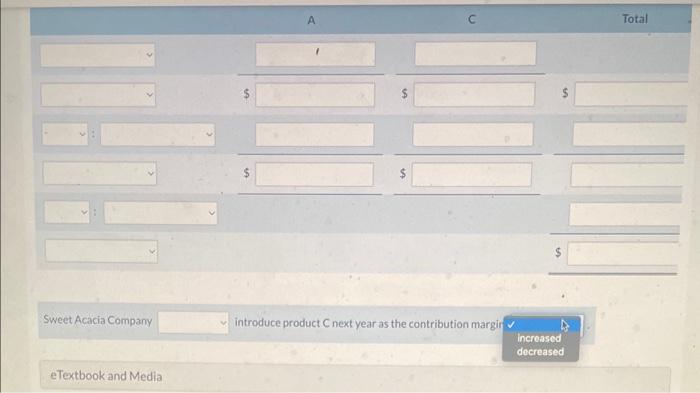

Sweet Acacia Company operates a small factory in which it manufactures two products: A and B. Production and sales results for this year were as follows: For purposes of simplicity, the firm averages total fixed costs over the total number of units of A and B produced and sold. The research department has developed a new product (C) as a replacement for product B. Market studie5 show that Sweet Acacia Company could sell 10,900 units of C next year at a price of $121; the variable costs per unit of C are $50. The introduction of product Cwill lead to a 10% increase in demand for product A and discontinuation of product B. If the company does not introduce the new product, it expects next year's results to be the same as this year's. Determine whether Sweet Acacia Company should introduce product C next year. Why or why not? The research department has developed a new product (C) as a replacement for product B. Market studies show that Sweet Acacia Company could sell 10,900 units of C next year at a price of $121; the variable costs per unit of C are $50. The introduction of product. C will lead to a 10% increase in demand for product A and discontinuation of product B. If the compahy does not introduce the new product, it expects next year's results to be the same as this year's. Determine whether Sweet Acacia Company should introduce product C next year. Why or why not? Company profit with Products A and B : The research department has developed a new product (C) as a replacement for product B. Market studies show that Sweet Acacia Company could sell 10,900 units of C next year at a price of $121; the variable costs per unit of C are $50. The introduction of product C will lead to a 10% increase in demand for product A and discontinuation of product B. If the company does not introduce the new product, it expects next year's results to be the same as this year's. Determine whether Sweet Acacia Company should introduce product C next year. Why or why not? Company profit with Products A and B : Company profit with Products A and C: Units sold Sales revenue Variable costs Contribution margin Fixed costs Net income (loss) Sweet Acacia Company introduce product C next year as the contribution margi