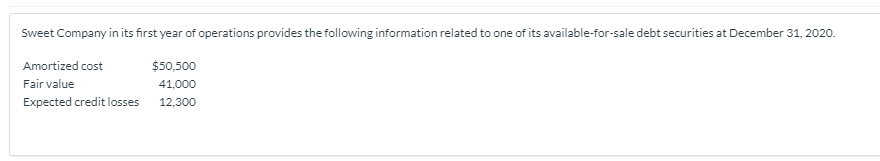

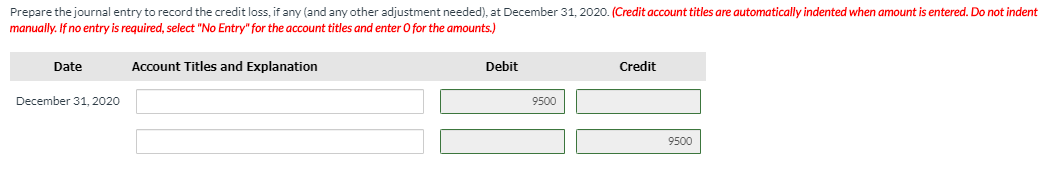

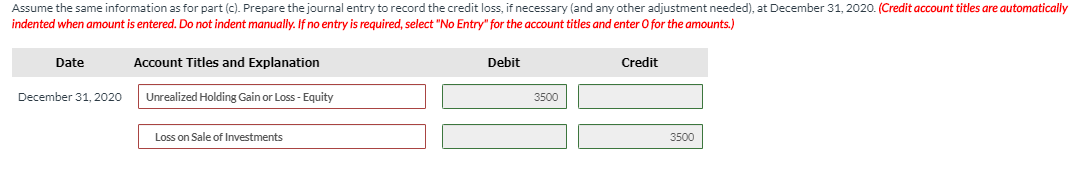

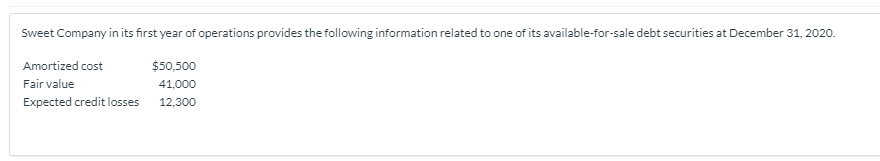

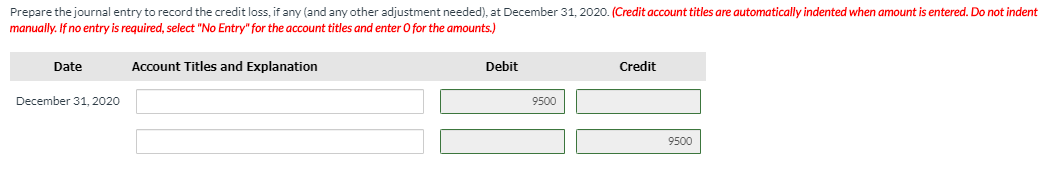

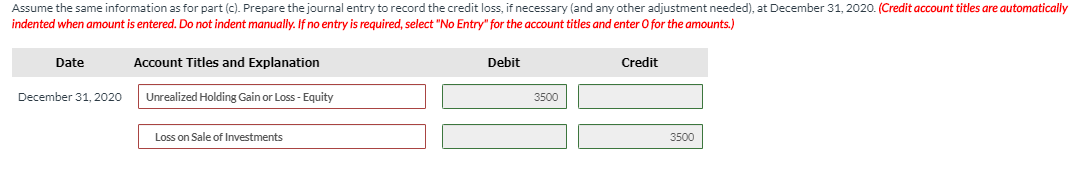

Sweet Company in its first year of operations provides the following information related to one of its available-for-sale debt securities at December 31, 2020. Amortized cost Fair value Expected credit losses $50,500 41,000 12,300 Prepare the journal entry to record the credit loss, if any (and any other adjustment needed), at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and enter Ofor the amounts.) Date Account Titles and Explanation Debit Credit December 31, 2020 9500 9500 Assume the same information as for part (c). Prepare the journal entry to record the credit loss, if necessary (and any other adjustment needed), at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit December 31, 2020 Unrealized Holding Gain or Loss - Equity 3500 Loss on Sale of Investments 3500 Sweet Company in its first year of operations provides the following information related to one of its available-for-sale debt securities at December 31, 2020. Amortized cost Fair value Expected credit losses $50,500 41,000 12,300 Prepare the journal entry to record the credit loss, if any (and any other adjustment needed), at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and enter Ofor the amounts.) Date Account Titles and Explanation Debit Credit December 31, 2020 9500 9500 Assume the same information as for part (c). Prepare the journal entry to record the credit loss, if necessary (and any other adjustment needed), at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit December 31, 2020 Unrealized Holding Gain or Loss - Equity 3500 Loss on Sale of Investments 3500