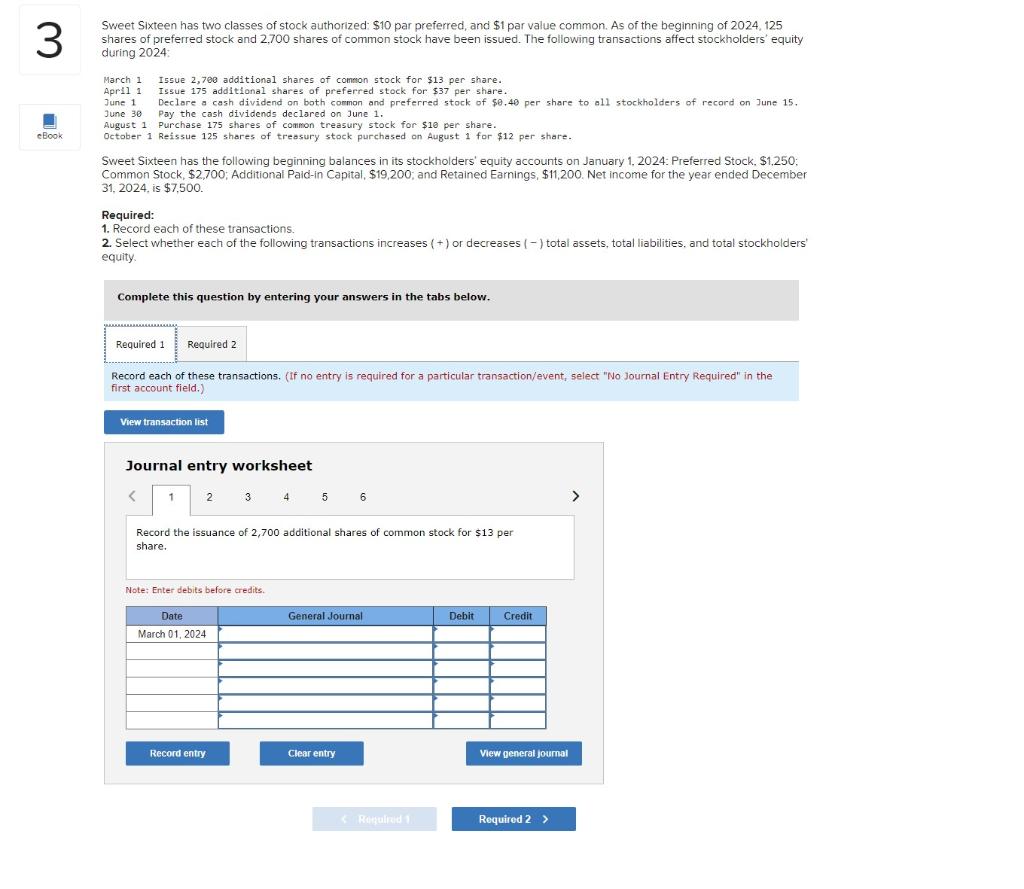

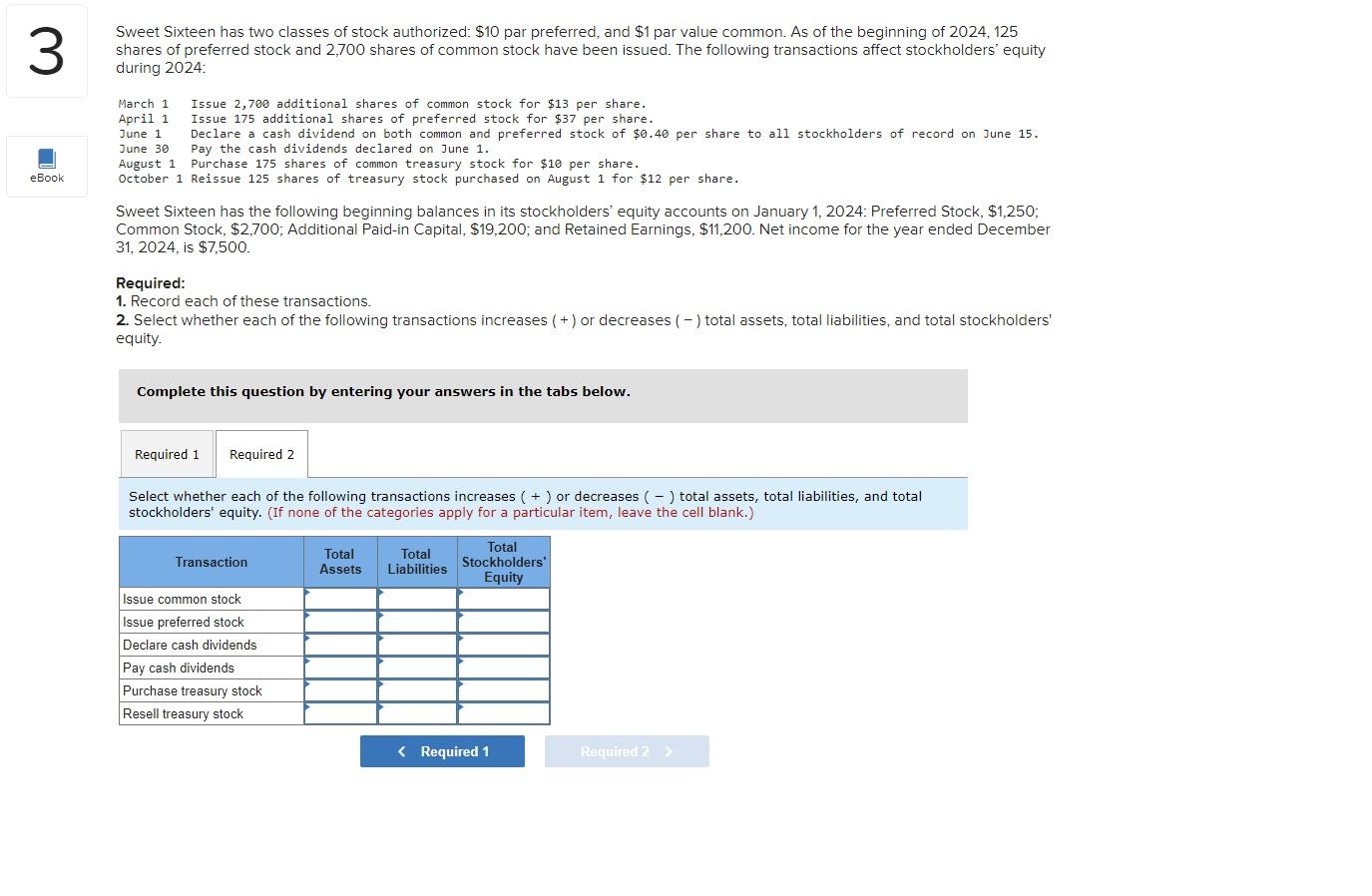

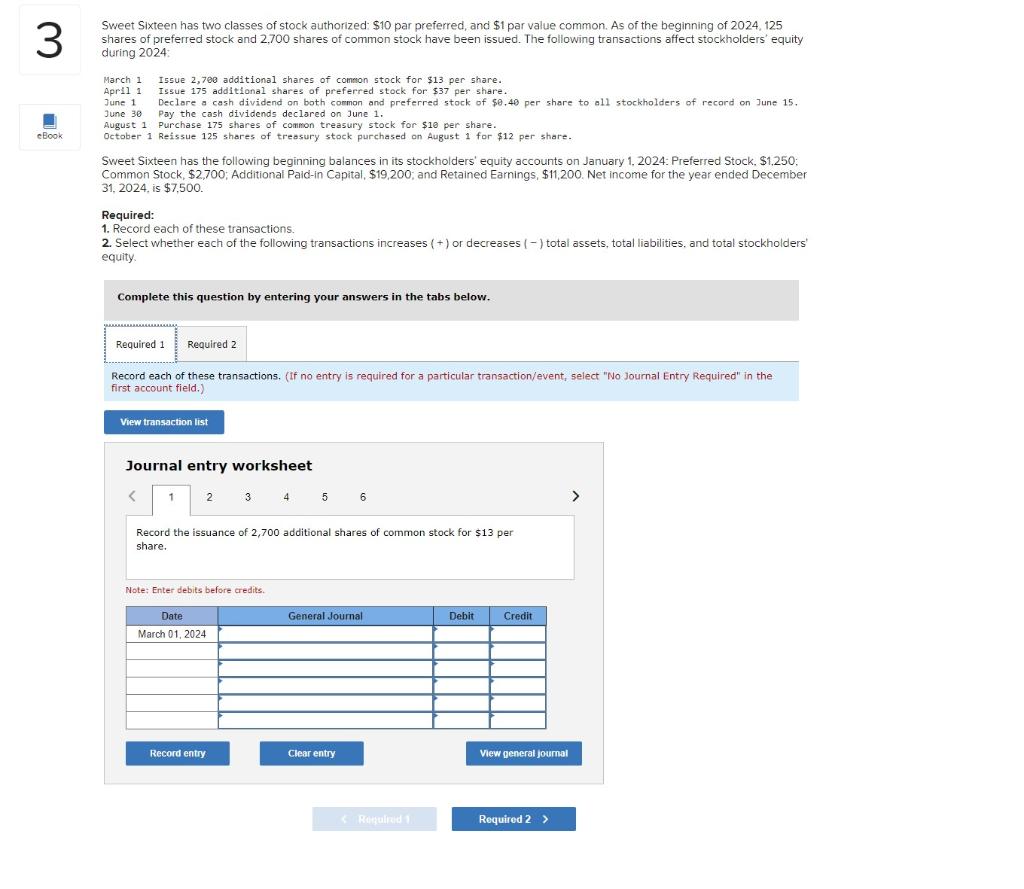

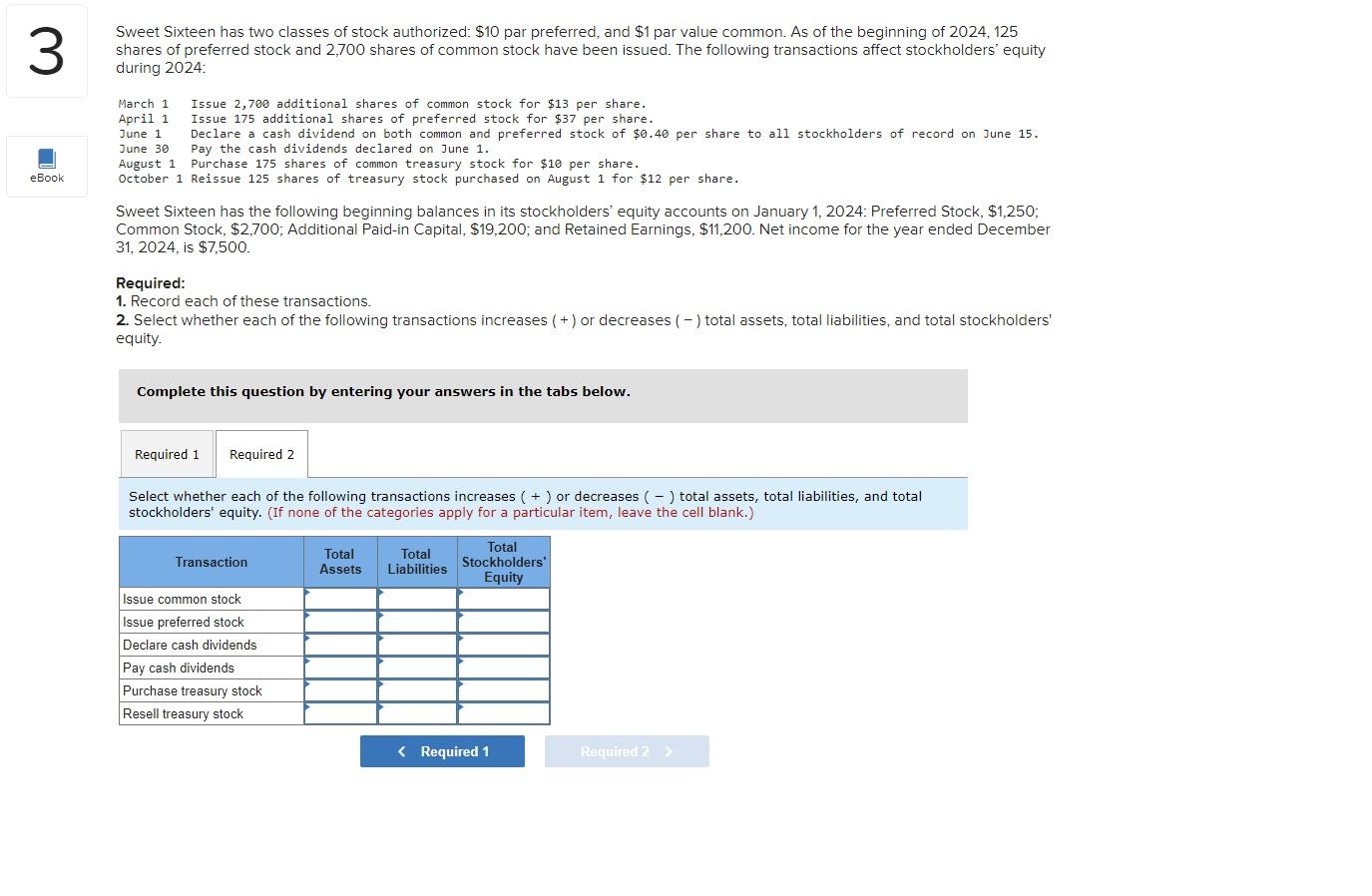

Sweet Sixteen has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the beginning of 2024,125 shares of preferred stock and 2,700 shares of common stock have been issued. The following transactions affect stockholders' equity during 2024: March 1 Issue 2,700 additional shares of conmon stock for $13 per share. April 1 Issue 175 additional shares of preferred stock for $37 per share. June 1 Declare a cash dividend on both common and preferred stock of $9,40 per share to all stockholders of record on June 15 . June 30 Pay the cash dividends declared on June 1. August 1 Purchase 175 shares of common treasury stock for $10 per share. October 1 Reissue 125 shares of treasury stock purchased on August 1 for $12 per share. Sweet Sixteen has the following beginning balances in its stockholders' equity accounts on January 1, 2024: Preferred Stock, $1,250; Common Stock, $2,700; Additional Paid-in Capital, $19,200; and Retained Earnings, $11,200. Net income for the year ended December 31,2024 , is $7,500. Required: 1. Record each of these transactions. 2. Select whether each of the following transactions increases (+) or decreases (-) total assets, total liabilities, and total stockholders' equity. Complete this question by entering your answers in the tabs below. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 23456 Record the issuance of 2,700 additional shares of common stock for $13 per share. Note: Enter debits before credits. Sweet Sixteen has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the beginning of 2024 , 125 shares of preferred stock and 2,700 shares of common stock have been issued. The following transactions affect stockholders' equity during 2024: March 1 Issue 2,700 additional shares of common stock for $13 per share. April 1 Issue 175 additional shares of preferred stock for $37 per share. June 1 Declare a cash dividend on both common and preferred stock of $0.40 per share to all stockholders of record on June 15 . June 30 Pay the cash dividends declared on June 1. August 1 Purchase 175 shares of common treasury stock for $10 per share. October 1 Reissue 125 shares of treasury stock purchased on August 1 for $12 per share. Sweet Sixteen has the following beginning balances in its stockholders' equity accounts on January 1,2024 : Preferred Stock, $1,250; Common Stock, $2,700; Additional Paid-in Capital, $19,200; and Retained Earnings, $11,200. Net income for the year ended December 31,2024 , is $7,500. Required: 1. Record each of these transactions. 2. Select whether each of the following transactions increases (+) or decreases (-) total assets, total liabilities, and total stockholders' equity. Complete this question by entering your answers in the tabs below. Select whether each of the following transactions increases (+) or decreases () total assets, total liabilities, and total stockholders' equity. (If none of the categories apply for a particular item, leave the cell blank.)