Question

Sweet Sixteen has two classes of stock authorized: $100 par value preferred and $1 par value common. Sweet Sixteen has the following beginning balances in

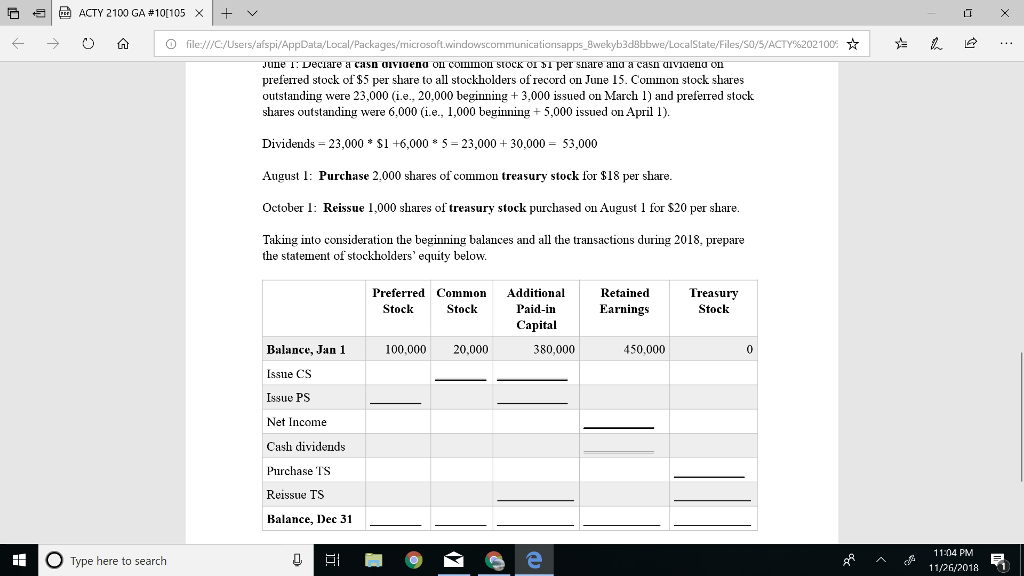

Sweet Sixteen has two classes of stock authorized: $100 par value preferred and $1 par value common. Sweet Sixteen has the following beginning balances in its stockholders' equity accounts on January 1, 2018: preferred stock, $100,000, common stock, $20,000; paid-in capital, $380,000; and retained earnings, $450,000. Net income for the year ended December 31, 2018, is $65,000.

March 1: Issue 3,000 additional shares of common stock for $22 per share (i.e., $66,000). CS par value is $1.

April 1: Issue 5,000 additional shares of preferred stock for $110 per share (i.e., $550,000). PS par value is $100.

LTX file:///C./Users/afspi/App ages/microsoft.windowscommunicationsapps 8wekyb3 te/Files/SO/5/ACT1%202100: June 1 : Declare a casn (nviena on common stock 01 1 per snare ana a casn aividena on prefeired stock of $5 per share to all stockholders of record on June 15. Common stock shares outstanding were 23,000 (i.e., 20.000 beginning + 3,000 issued on March l) and preferred stock shares outstanding were 6,000 (i.e., 1,000 beginning + 5,000 issued on April 1). Dividends-23,000 * S1 +6,000 * 5- 23,000 + 30,000- 53,000 August I: Purchase 2,000 shares of common treasury stock for $18 per share October 1: Reissue 1,000 shares of treasury stock purchased on August 1 for S20 per share. Taking into consideration the beginning balances and all the transactions during 2018, prepare the statement of stockholders' equity below Preferred Common Additional Paid-in Capital Retained Earnings Treasury Stock Stock Stock 380,000 Balance, Jan 1 Issue CS Issue PS Net Income Cash dividends Purchase TS Reissue TS Balance, Dec 31 100.000 20,000 450,000 11:04 PM 11/26/2018 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started