Answered step by step

Verified Expert Solution

Question

1 Approved Answer

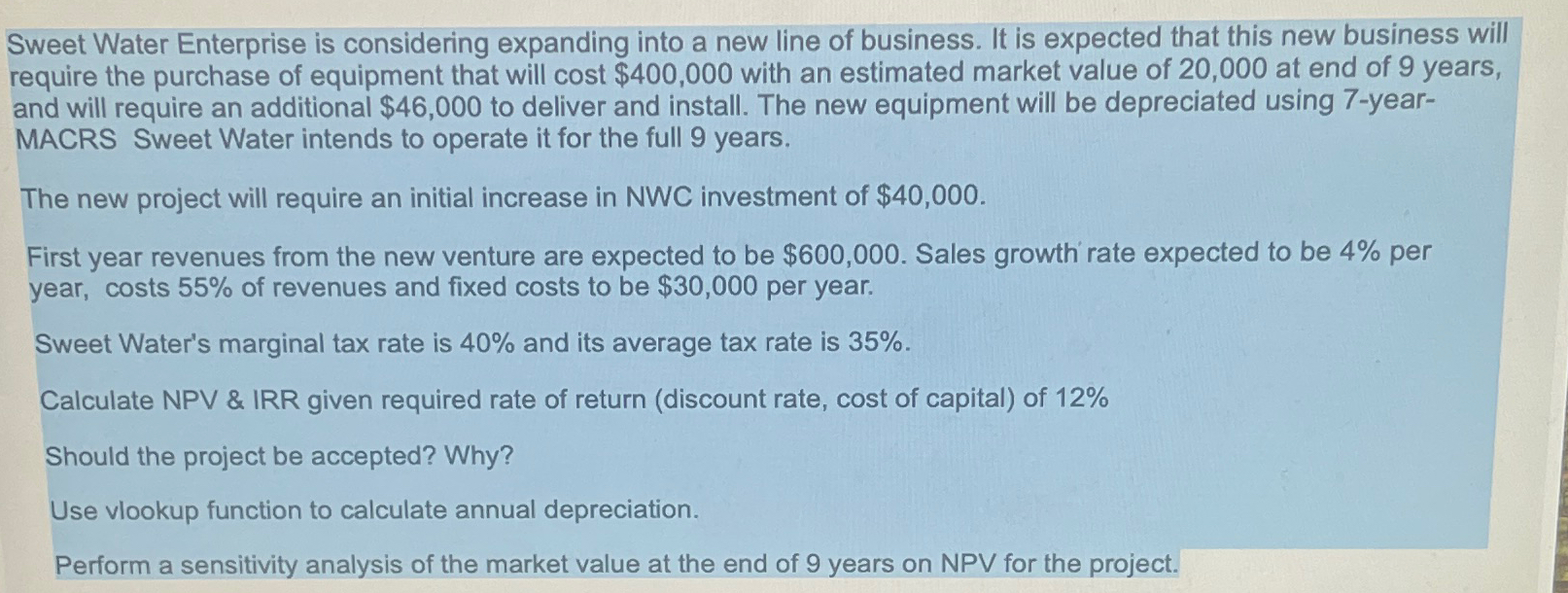

Sweet Water Enterprise is considering expanding into a new line of business. It is expected that this new business will require the purchase of equipment

Sweet Water Enterprise is considering expanding into a new line of business. It is expected that this new business will require the purchase of equipment that will cost $ with an estimated market value of at end of years, and will require an additional $ to deliver and install. The new equipment will be depreciated using yearMACRS Sweet Water intends to operate it for the full years.

The new project will require an initial increase in NWC investment of $

First year revenues from the new venture are expected to be $ Sales growth rate expected to be per year, costs of revenues and fixed costs to be $ per year.

Sweet Water's marginal tax rate is and its average tax rate is

Calculate NPV & IRR given required rate of return discount rate, cost of capital of

Should the project be accepted? Why?

Use vlookup function to calculate annual depreciation.

Perform a sensitivity analysis of the market value at the end of years on NPV for the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started