Question

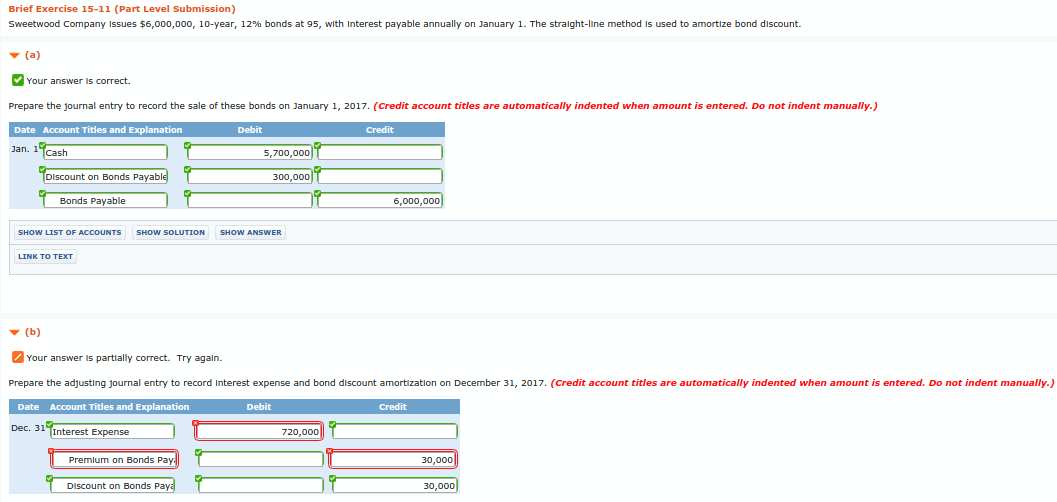

Sweetwood Company issues $6,000,000, 10-year, 12% bonds at 95, with interest payable annually on January 1. The straight-line method is used to amortize bond discount.

Sweetwood Company issues $6,000,000, 10-year, 12% bonds at 95, with interest payable annually on January 1. The straight-line method is used to amortize bond discount.

(A) Prepare the journal entry to record the sale of these bonds on January 1, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

(B) Prepare the adjusting journal entry to record interest expense and bond discount amortization on December 31, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

I need help with part B please

Brief Exercise 15-11 (Part Level Submission) Sweetwood Company Issues $6,000,000, 10-year, 12% bonds at 95, with interest payable annually on January 1. The straight-line method Is used to amortize bond discount. (a) Your answer Is correct Prepare the journal entry to record the sale of these bonds on January 1, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1 Cash 5,700,000 DIscount on Bonds Payabl 300,000 Bonds Payable 6,000,000 SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER (b) Your answer is partially correct. Try agaln. Prepare the adjusting journal entry to record Interest expense and bond discount amortizatlon on December 31, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 TInterest Expense 720,000 Premlum on Bonds Pay 30,000 Discount on Bonds Pay 30,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started