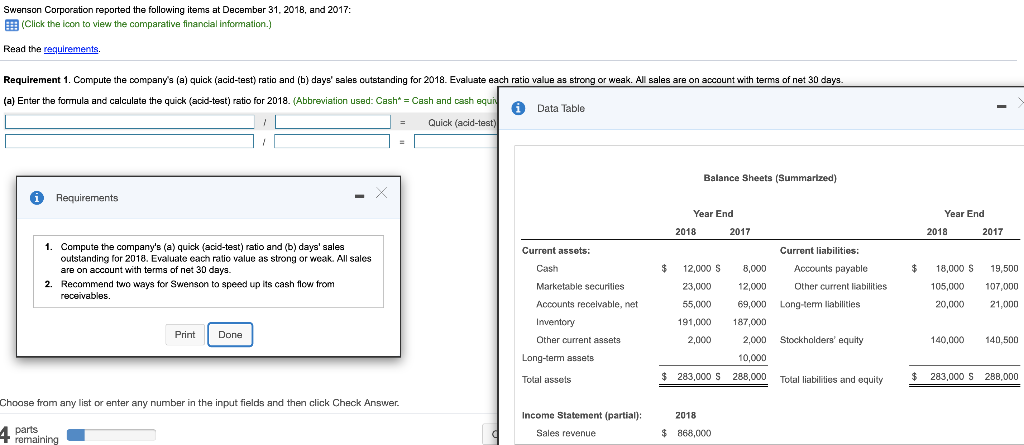

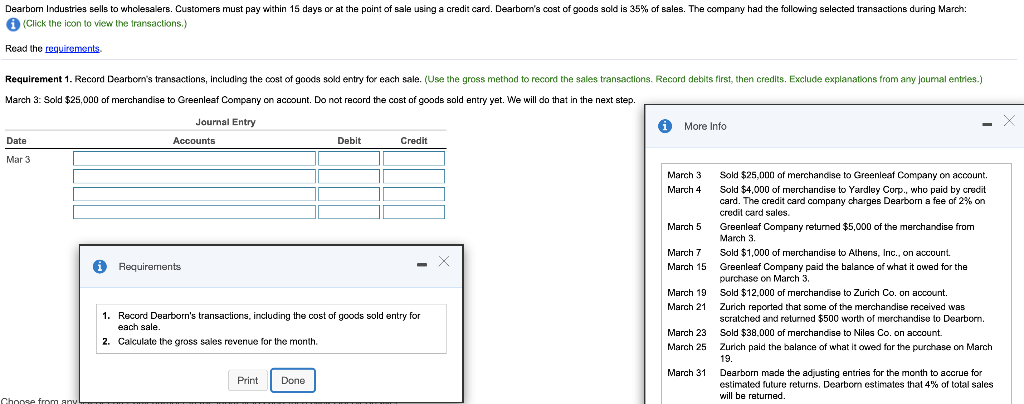

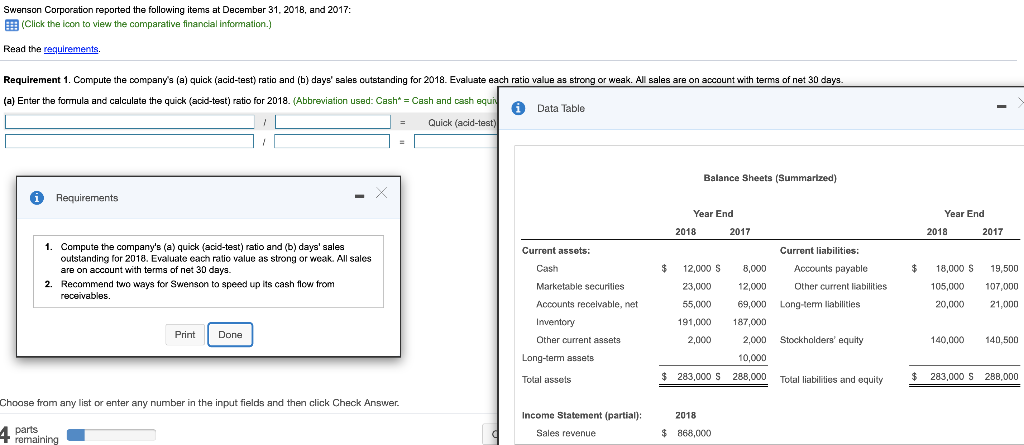

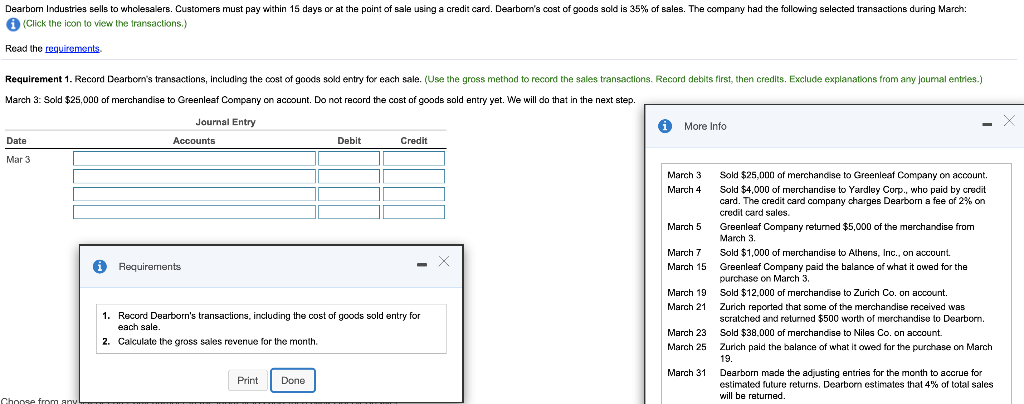

Swenson Corporation reported the following items at December 31, 2018, and 2017: (Click the icon to view the comparative financial information.) Read t requirements. Requirement 1. Compute the company's (a) quick (acid-test) ratio and (b) days' sales outstanding for 2018. Evaluate each ratio value as strong or weak. All sales are on account with terms of net 30 days. 2018. (Abbreviation used: Cash* Cash and cash equi (a) Enter the formula and calculate the quick (acid-test) ratio Data Table Quick (acid-test) Balance Sheets (Summarized) i Requirements Year End Year End. 2018 2017 2018 2017 1. Compute the company's (a) quick (acid-teat) ratio and (b) days' sales Current assets Current liabilities: value as strong or weak. All sales n o areount with tarms of net 30 days 12,000 S Accounts payable Cash 8,000 18,000 S 19,500 2. Recommend two ways for Swenson to speed up its cash flow from receivables. 23.000 Other current liabilities Marketable securities 12,000 105,000 107,000 55,000 20,000 Accounts receivable, net 69.000 Long-term liabilities 21.000 Inventory 191.000 187,000 Print Done Stockholders' equity Other current assets 2,000 2,000 140,000 140.500 Long-term assets 10.000 $ 283.000S 288,000 283,000 S 288,000 Tolal liabilities and equity Total assets Choose from any list enter any number in the input fields and then click Check Answer. Income Statement (partial): 2018 Aparts remaining Sales revenue $ 868.000 Dearbon Industries sells to wholesalers. Customers must pay within 15 days or at the point of sale using a credit card. Dearbom's cost of goods sold is 35 % of sales. The company had the following selected transactions during March: Click the icon to view the transactions.) Read the reguirements Requirement 1. Record Dearbom's transactions, including the cost of goods sold entry for each sale. (Use the gross method to record the sales transactions. Record debits first, then credits. Exclude explanations from any joumal entries.) March 3: Sold $25,000 of merchandise to Greenleaf Company account. Do not record e cost of goods sold entry yet. We will do that in the next step Journal Entry i More Info Date Accounts Debit Credit Mar 3 Sold $25,000 of merchandise to Greenleaf Company on account March 3 March 4 Sold $4,000 merchandise to Yardley Corp., who paid by credit card company charges Dearborn a fee of 2% on a ard sales Greenleaf Company returned $5,000 of the merchandise from March 3 March 5 Sold $1,000 of merchandise to Athens, Inc., on account. March 7 i Requirements March 15 Greenleaf Company paid the balance of what it owed for the purchase on March 3 Sold $12,000 of merchandise to Zurich Co. on account. March 19 March 21 1. Record Dearborn's transactions, including the cost each sale. scratched and returned $500 worth of merchandise to Dearbon. Sold $38.000 of merchandise to Niles Co. goods sold entry for account what it owed for the purchase on March March 23 2. Calculate the gross sales revenue t the month. Zurich paid the balance March 25 19. March 31 Print Done will be returned Chocse from an