Swift Community Hospital, a 310 bed facility, is a sole provider hospital in a rural New England area servicing a large market. Recently, a wealthy philanthropist made a major contribution to the hospital's long-term investment fund. Assess Swift's profitability, liquidity, activity, and capital structure ratios. using the financial ratios from exhibit 4.25 for the current and previous years, evaluate swifts financial condition and also compare its ratios to national industry benchmarks for its bed size using the data from exhibit 4.16a

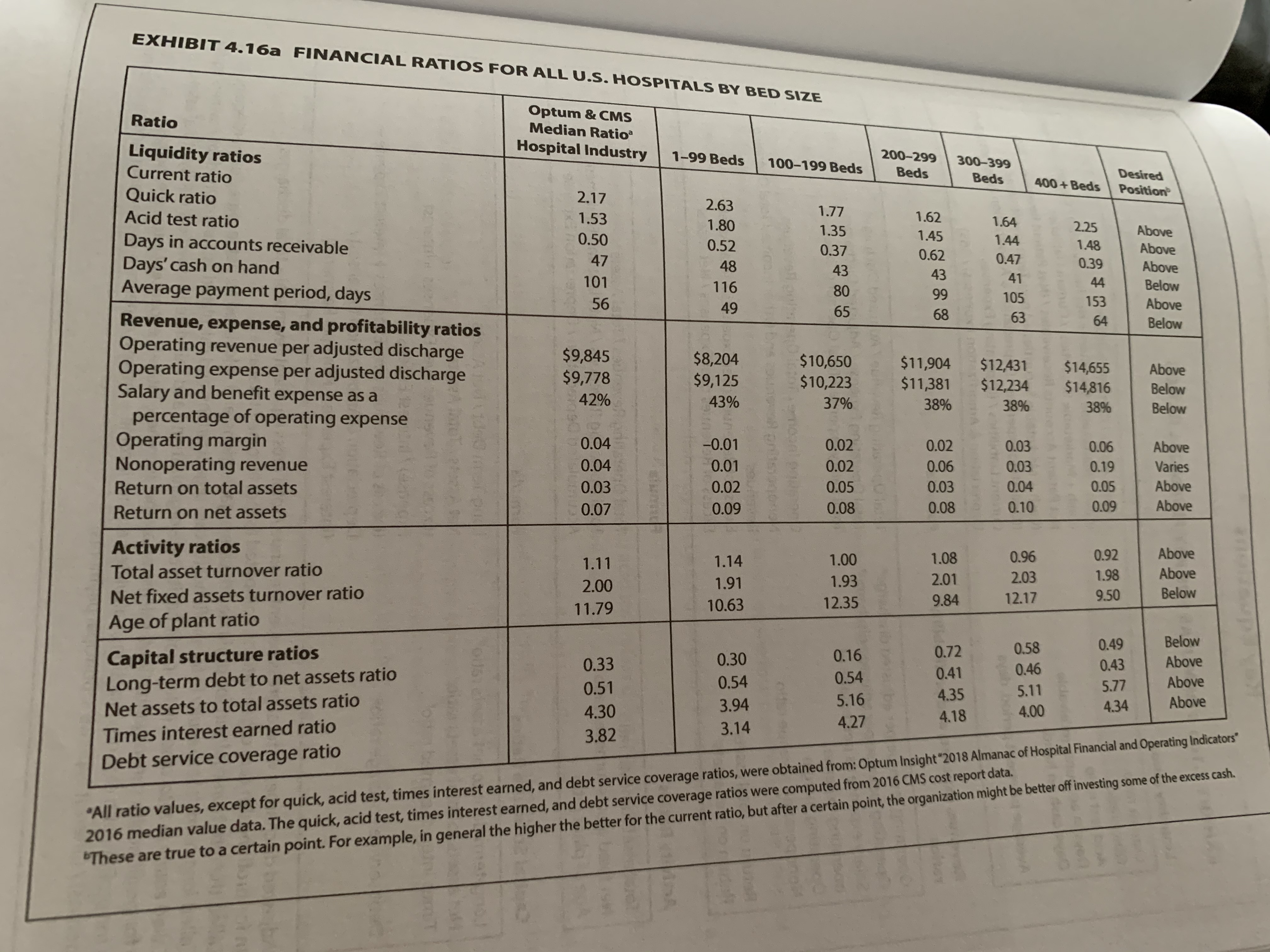

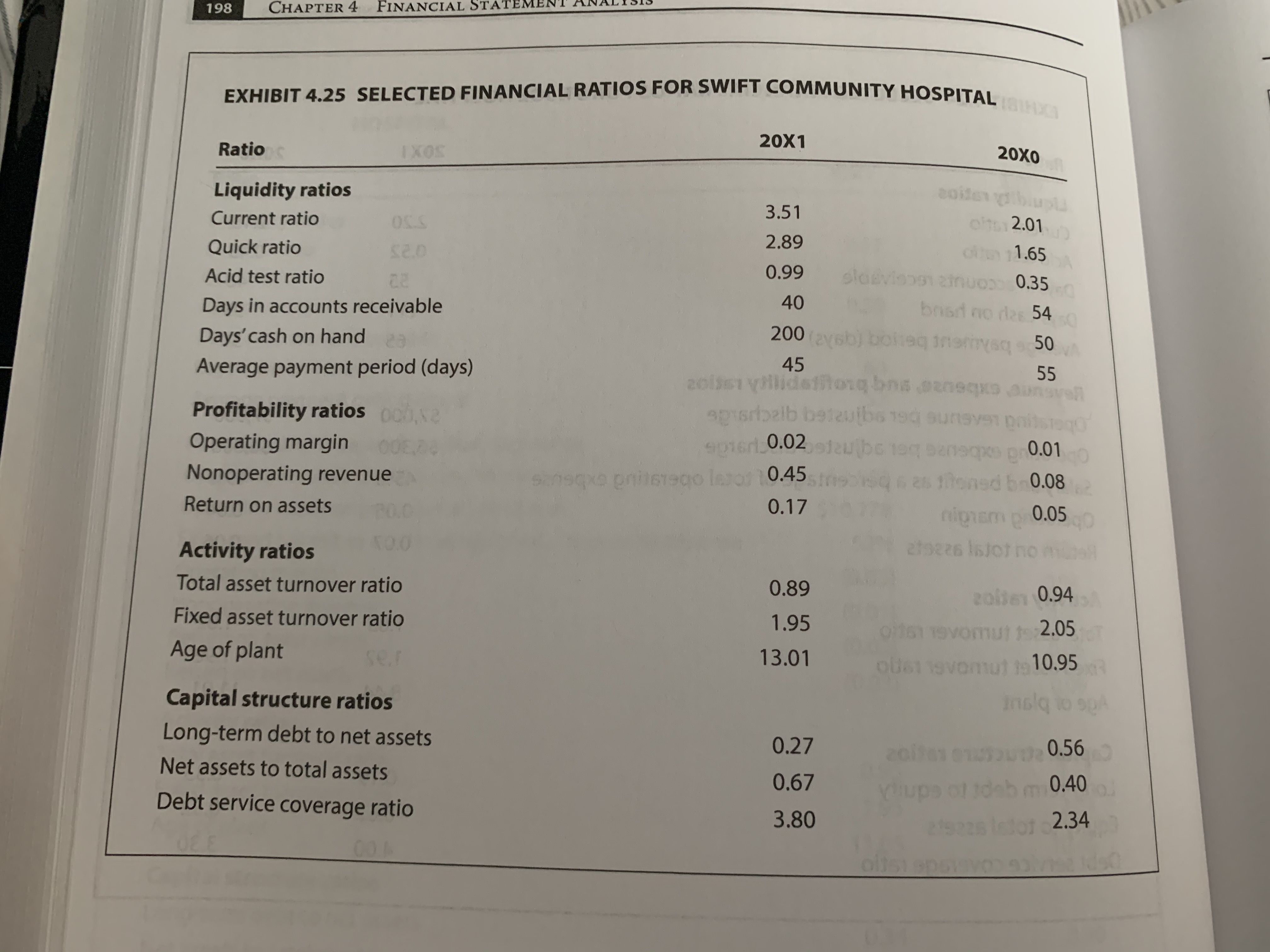

EXHIBIT 4.16a FINANCIAL RATIOS FOR ALL U.S. HOSPITALS BY BED SIZE Ratio Optum & CMS Median Ratio Liquidity ratios Hospital Industry Current ratio 1-99 Beds 100-199 Beds 200-299 Beds 300-399 Desired Quick ratio Beds 2.17 400 + Beds Acid test ratio 1.53 2.63 Position 1.77 1.62 Days in accounts receivable 0.50 1.80 1.35 1.64 2.25 0.52 Above Days' cash on hand 47 0.37 1.45 1.44 43 0.47 1.48 Above 101 48 0.62 43 0.39 Average payment period, days 116 80 99 41 Above 105 44 in Below 65 8 153 Revenue, expense, and profitability ratios 63 Above Below Operating revenue per adjusted discharge Operating expense per adjusted discharge $9,845 $8,204 $9,778 $10,650 $9,125 $11,904 $10,223 $12,431 $11,381 $14,655 Salary and benefit expense as a 12% $12,234 Above 43% 37% $14,816 38% Below percentage of operating expense 38% 38% Below Operating margin 0.04 Nonoperating revenue -0.01 0.02 0.02 0.03 0.04 0.06 Above 0.01 0.02 0.06 Return on total assets 0.03 0.19 Varies 0.03 0.02 0.05 0.03 0.04 0.05 Above Return on net assets 0.07 0.09 0.08 0.08 0.10 0.09 Above Activity ratios Total asset turnover ratio 1.11 1.14 1.00 1.08 0.96 0.92 Above Net fixed assets turnover ratio 2.00 1.91 1.93 2.01 2.03 1.98 Above Age of plant ratio 11.79 10.63 12.35 9.84 12.17 9.50 Below Capital structure ratios 0.30 0.16 0.72 0.58 0.49 Below Long-term debt to net assets ratio 0.33 0.51 0.54 0.41 Above 0.54 0.46 0.43 Net assets to total assets ratio 5.11 5.77 Above Times interest earned ratio 4.30 3.94 5.16 4.35 4.00 4.34 3.14 4.27 4.18 Above Debt service coverage ratio 3.82 "All ratio values, except for quick, acid test, times interest earned, and debt service coverage ratios, were obtained from: Optum Insight "2018 Almanac of Hospital Financial and Operating Indicators" 2016 median value data. The quick, acid test, times interest earned, and debt service coverage ratios were computed from 2016 CMS cost report data. "These are true to a certain point. For example, in general the higher the better for the current ratio, but after a certain point, the organization might be better off investing some of the excess cash.EXHIBIT 4.25 SELECTED FINANCIAL RATIOS FOR SWIFT COMMUNITY HOSPITAL Ratio IXOS 20X1 20XO Liquidity ratios Current ratio OSS 3.51 off 2.01 Quick ratio se.0 2.89 01 1.65 Acid test ratio 0.99 Days in accounts receivable brand no das 54 Days' cash on hand 200 (ayobj bolog insmysq - 50 Average payment period (days) zolis villidefftong bos czasqus aunavel Profitability ratios och,Na aparelb bedeuibe 19q sunsver onitslog Operating margin apier_0.02 few be tog banaque pr 0.01 Nonoperating revenue sensque onitsrego lesof 10.45strebigg s as mened 0.08 Return on assets 0.17 nigam 0.05 Activity ratios atsees IsJot ho mades Total asset turnover ratio 0.89 2016 0.94 Fixed asset turnover ratio 1.95 oils isvomut to 2.05 Age of plant 13.01 oust isvomul 10.95 Capital structure ratios Inslq 10 spa Long-term debt to net assets 0.27 201981 010750)2 0.56 Net assets to total assets 0.67 cups of job m 0.40 Debt service coverage ratio 3.80 etsees ledor 2.34