Answered step by step

Verified Expert Solution

Question

1 Approved Answer

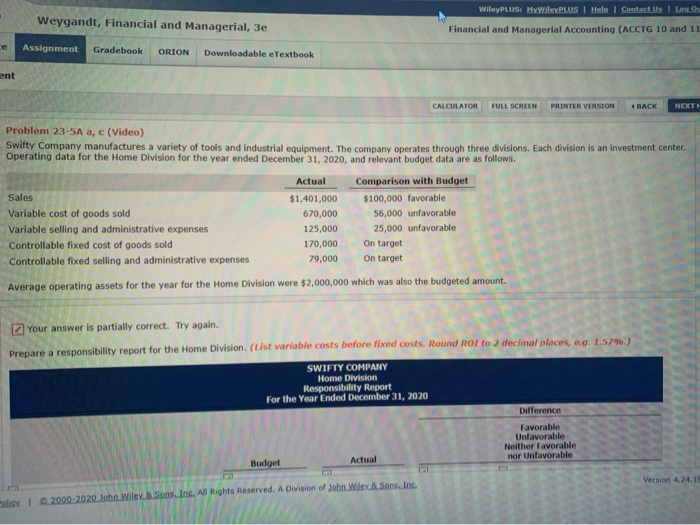

Swifty Company manufactures a variety of tools and industrial equipment. The company operates through three divisions. Each division is an investment center. Operating data for

Swifty Company manufactures a variety of tools and industrial equipment. The company operates through three divisions. Each division is an investment center. Operating data for the Home Division for the year ended December 31, 2020, and relevant budget data are as follows.

| Actual | Comparison with Budget | ||||

| Sales | $1,401,000 | $100,000 | favorable | ||

| Variable cost of goods sold | 670,000 | 56,000 | unfavorable | ||

| Variable selling and administrative expenses | 125,000 | 25,000 | unfavorable | ||

| Controllable fixed cost of goods sold | 170,000 | On target | |||

| Controllable fixed selling and administrative expenses | 79,000 | On target | |||

Average operating assets for the year for the Home Division were $2,000,000 which was also the budgeted amount.

Keeps saying my answers are wrong I don't understand why.

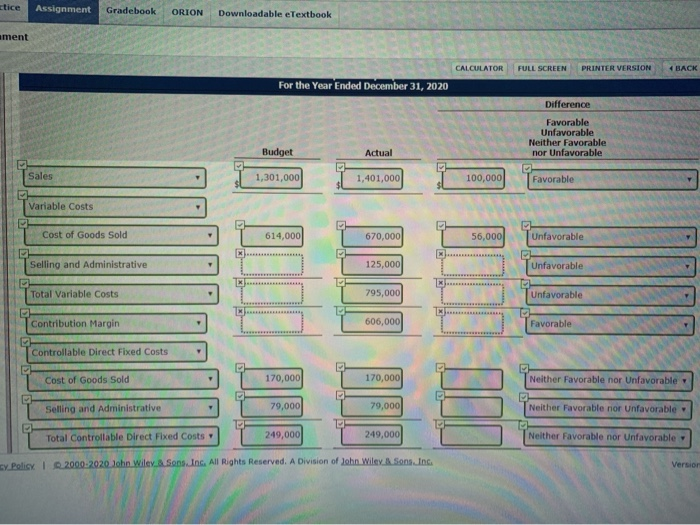

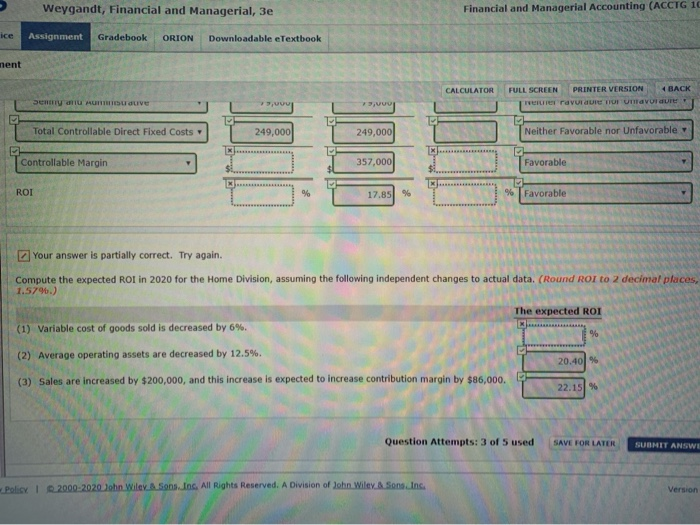

Weygandt, Financial and Managerial, 3e WileyPLUS: HyWileyPLUS I Hele 1 Contact Us I Logos Financial and Managerial Accounting (ACCTG 10 and 11 e Assignment Gradebook ORION Downloadable eTextbook ent calcuIATOR HUU SCHIEN PRITEK VERSION DACK MBET Problem 23-5A a, c (Video) Swifty Company manufactures a variety of tools and industrial equipment. The company operates through three divisions. Each division is an investment center Operating data for the Home Division for the year ended December 31, 2020, and relevant budget data are as follows. Actual Comparison with Budget Comparison Sales $1,401,000 $100,000 favorable Variable cost of goods sold 670,000 56,000 unfavorable Variable selling and administrative expenses 125,000 25,000 unfavorable Controllable fixed cost of goods sold 170,000 On target Controllable fixed selling and administrative expenses 79,000 On target Average operating assets for the year for the Home Division were $2,000,000 which was also the budgeted amount. Your answer is partially correct. Try again. 1.579 Prepare a responsibility report for the Home Division (List variable costs before fixed costs. Round Ror to 2 decimal places SWIFTY COMPANY Home Division Responsibility Report For the Year Ended December 31, 2020 Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Version 4.24.13 blick 2000-2020 John Wiley 2.5 Inc. All Rights Reserved. A Division of John Wiley. A sons. In ctice Assignment Gradebook ORION Downloadable eTextbook ament CALCULATOR FULL SCREEN PRINTER VERSION BACK For the Year Ended December 31, 2020 / Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Actual / Sales 1,301,000 1,401,000 100,000 Favorable 9 // Variable Costs | PILI Cost of Goods Sold 614,000 1 56,000 Selling and Administrative T 670,000 125,000 795,000 606,000 Untuvorable Unfavorable Untavorable favorable Total Variable costs Contribution Margin 1 Controllable Direct Fixed Costs | Cost of Goods Sold 1 170,000 170,000 Neither Favorable nor Unfavorable Selling and Administrative T 79,000 79,000 Neither Favorable nor Unfavorable T 249,000 Total Controllable Direct Fixed Costs T 1 249,000 Neither Favorable nor Unfavorable x 2000-2020. John Wiley . Inc. All Rights Reserved. A Division of John Wiley sons. Inc Version Weygandt, Financial and Managerial, 3e Financial and Managerial Accounting (ACCTG 10 ice Assignment Gradebook ORION Downloadable eTextbook nent CALCULATOR Denty nu numauve FULL SCREEN PRINTER VERSION BACK TERTE Tavare Unavorare Total Controllable Direct Fixed Costs T 249,000 249.0 T T Neither Favorable nor Unfavorable Controllable Margin 357,000 ... Favorable ROL 17.85 % ..... 1 % Favorable Favorable ] Your answer is partially correct. Try again. Compute the expected ROI in 2020 for the Home Division, assuming the following independent changes to actual data. (Round ROI to 2 decimal places 1.579) The expected ROI (1) Variable cost of goods sold is decreased by 6%. (2) Average operating assets are decreased by 12.5%. T (3) Sales are increased by $200,000, and this increase is expected to increase contribution margin by $86.000. 20.40% 22.15% Question Attempts: 3 of 5 used SAVE FOR LATER SUBMIT ANSWE Policy | 2000-2020 John Wiley Sons, Inc. All Rights Reserved. A Division of John Wiley Sons, Inc. VersionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started