Question

Swifty Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience, Swifty estimates that 4% of the units sold

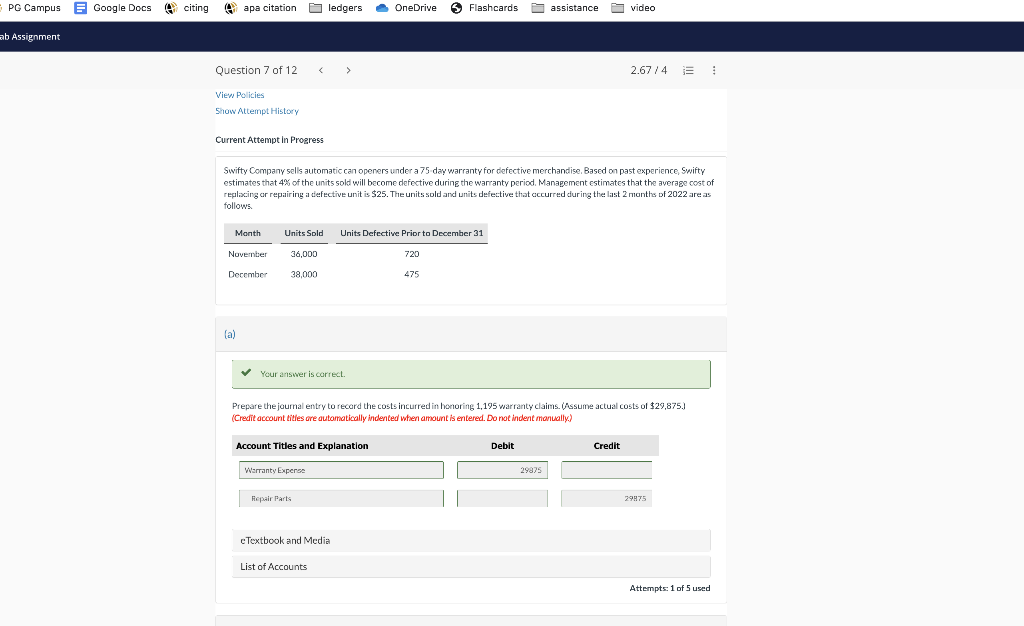

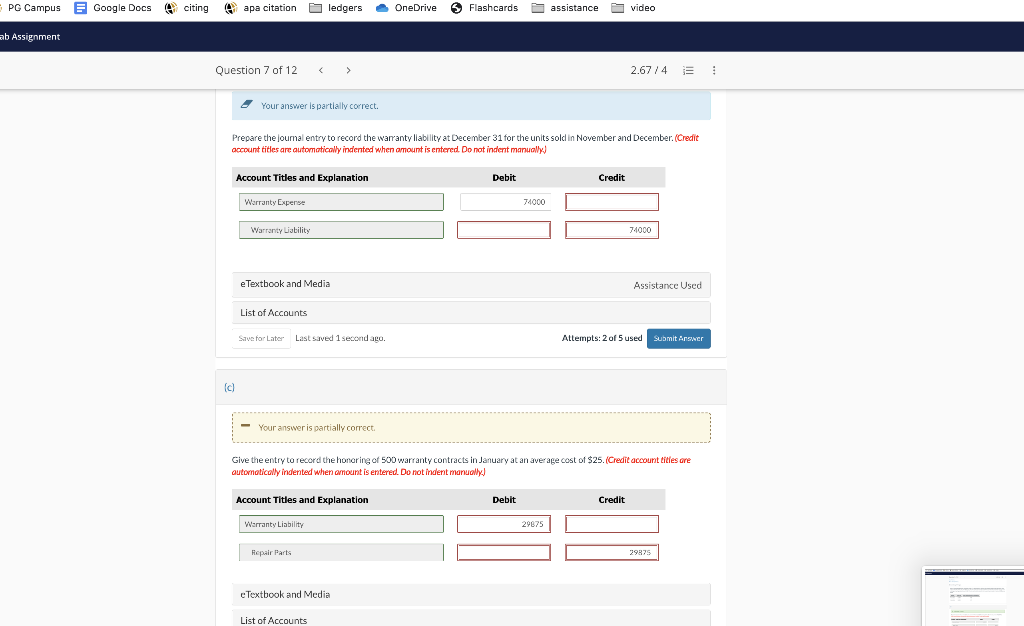

Swifty Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience, Swifty estimates that 4% of the units sold will become defective during the warranty period. Management estimates that the average cost of replacing or repairing a defective unit is $25. The units sold and units defective that occurred during the last 2 months of 2022 are as fOllOws Month November December Units Sold 36.000 38,000 Units Defective Prior to December 31 720 475. Please show work so I can understand the process and learn. Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started