Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Swifty Company uses the LIFO method for financial reporting purposes but FIFO for internal reporting purposes. At January 1, 2020, the LIFO reserve has a

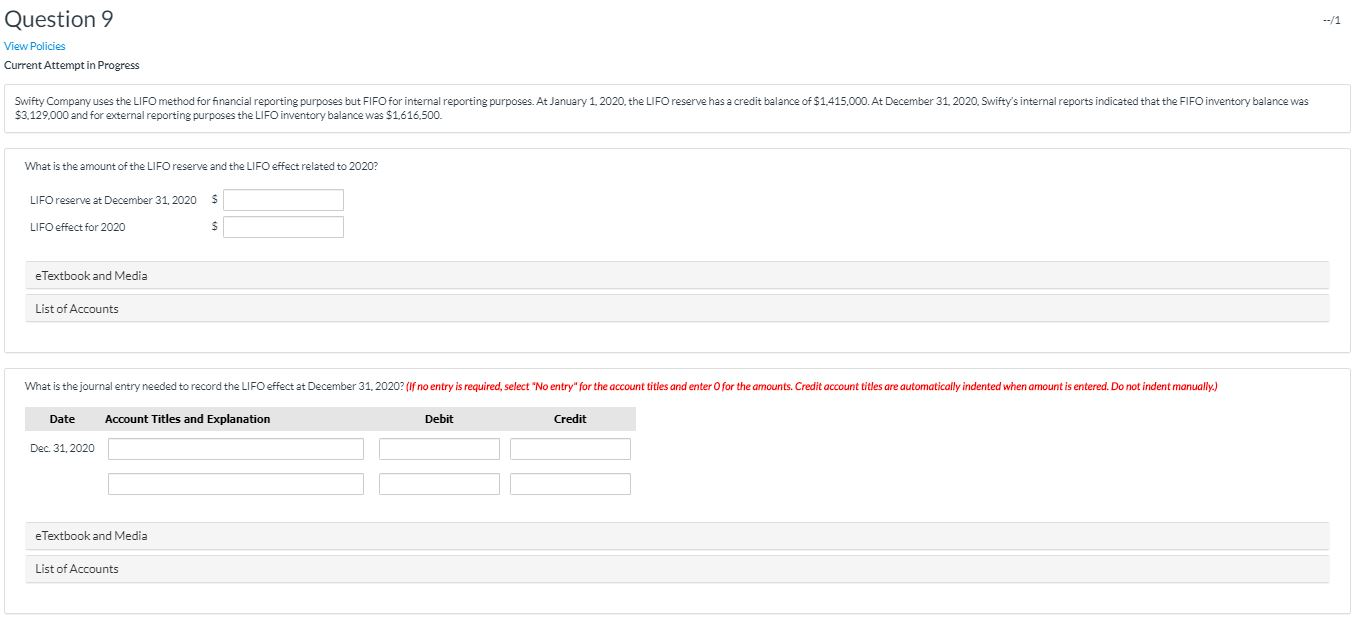

Swifty Company uses the LIFO method for financial reporting purposes but FIFO for internal reporting purposes. At January 1, 2020, the LIFO reserve has a credit balance of $1,415,000. At December 31, 2020, Swiftys internal reports indicated that the FIFO inventory balance was $3,129,000 and for external reporting purposes the LIFO inventory balance was $1,616,500.

Question 9 View Policies Current Attempt in Progress Swifty Company uses the LIFO method for financial reporting purposes but FIFO for internal reporting purposes. At January 1, 2020, the LIFO reserve has a credit balance of $1.415.000. At December 31, 2020. Swifty's internal reports indicated that the FIFO inventory balance was $3.129,000 and for external reporting purposes the LIFO inventory balance was $1.616.500 What is the amount of the LIFO reserve and the LIFO effect related to 2020? LIFO reserve at December 31, 2020 $ LIFO effect for 2020 e Textbook and Media List of Accounts What is the journal entry needed to record the LIFO effect at December 31, 2020? (If no entry is required, select "No entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec 31, 2020 e Textbook and Media List of AccountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started