Answered step by step

Verified Expert Solution

Question

1 Approved Answer

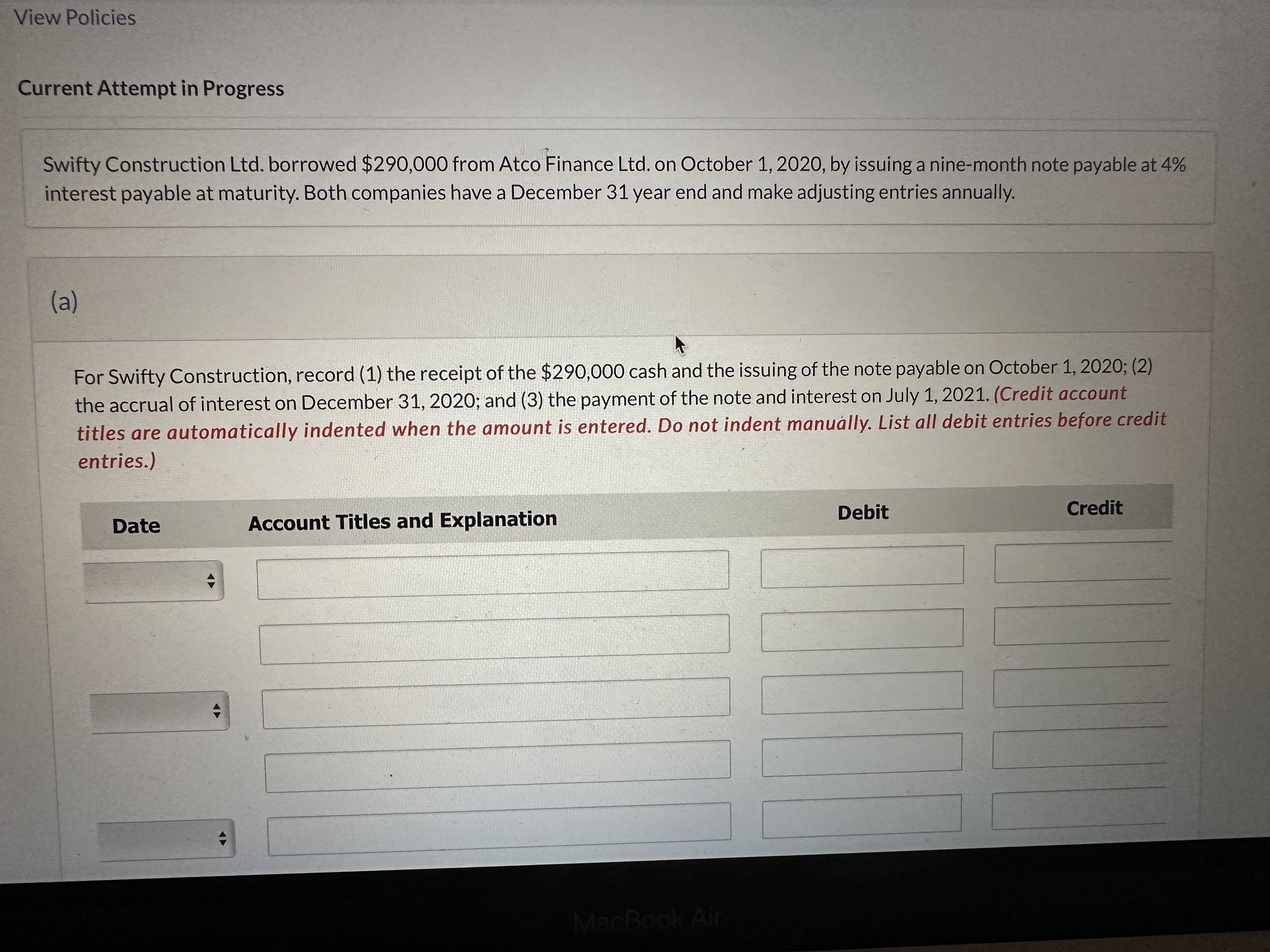

Swifty Construction Ltd. borrowed $290,000 from Atco Finance Ltd. on October 1,2020 , by issuing a nine-month note payable at 4% interest payable at maturity.

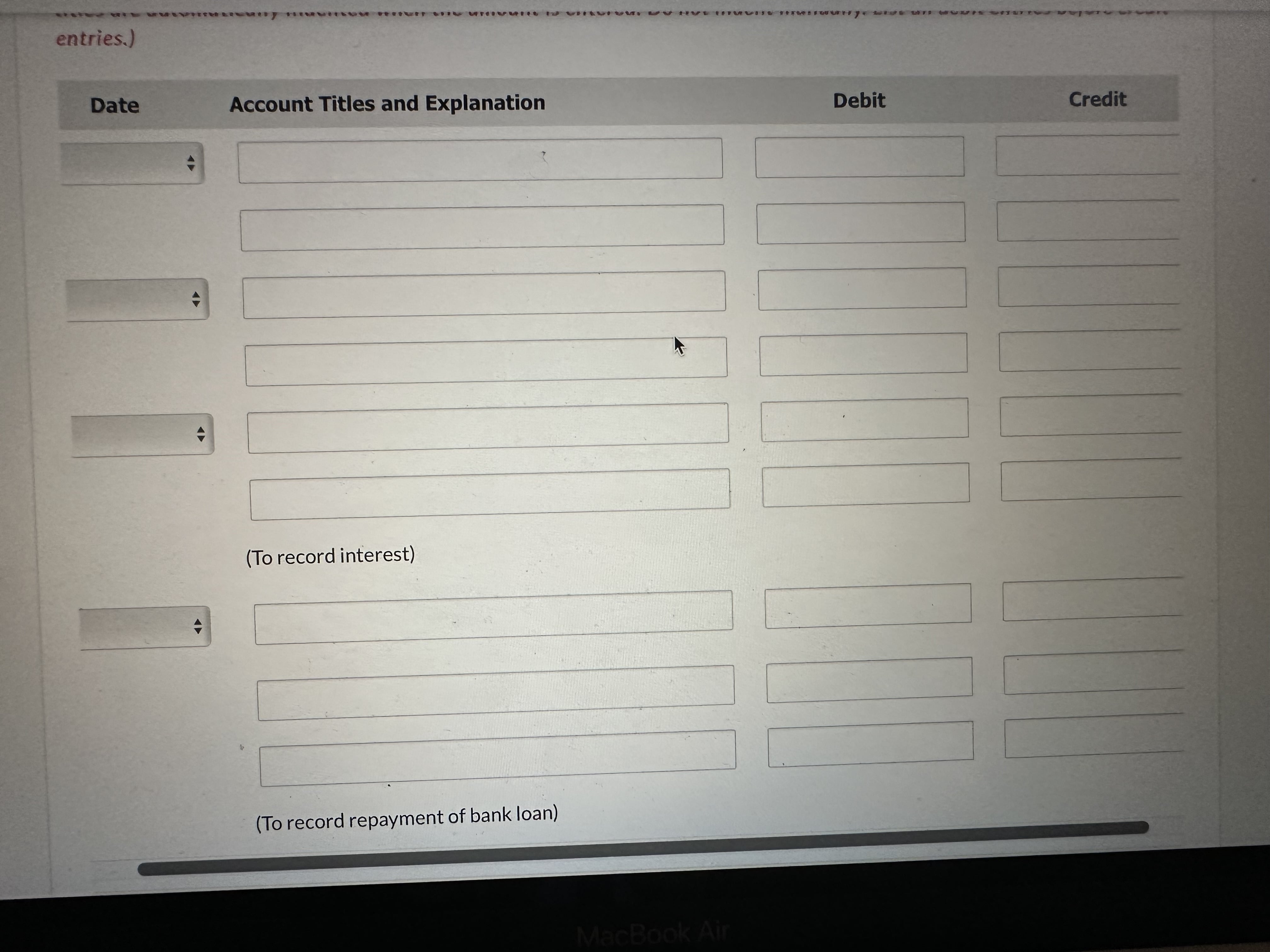

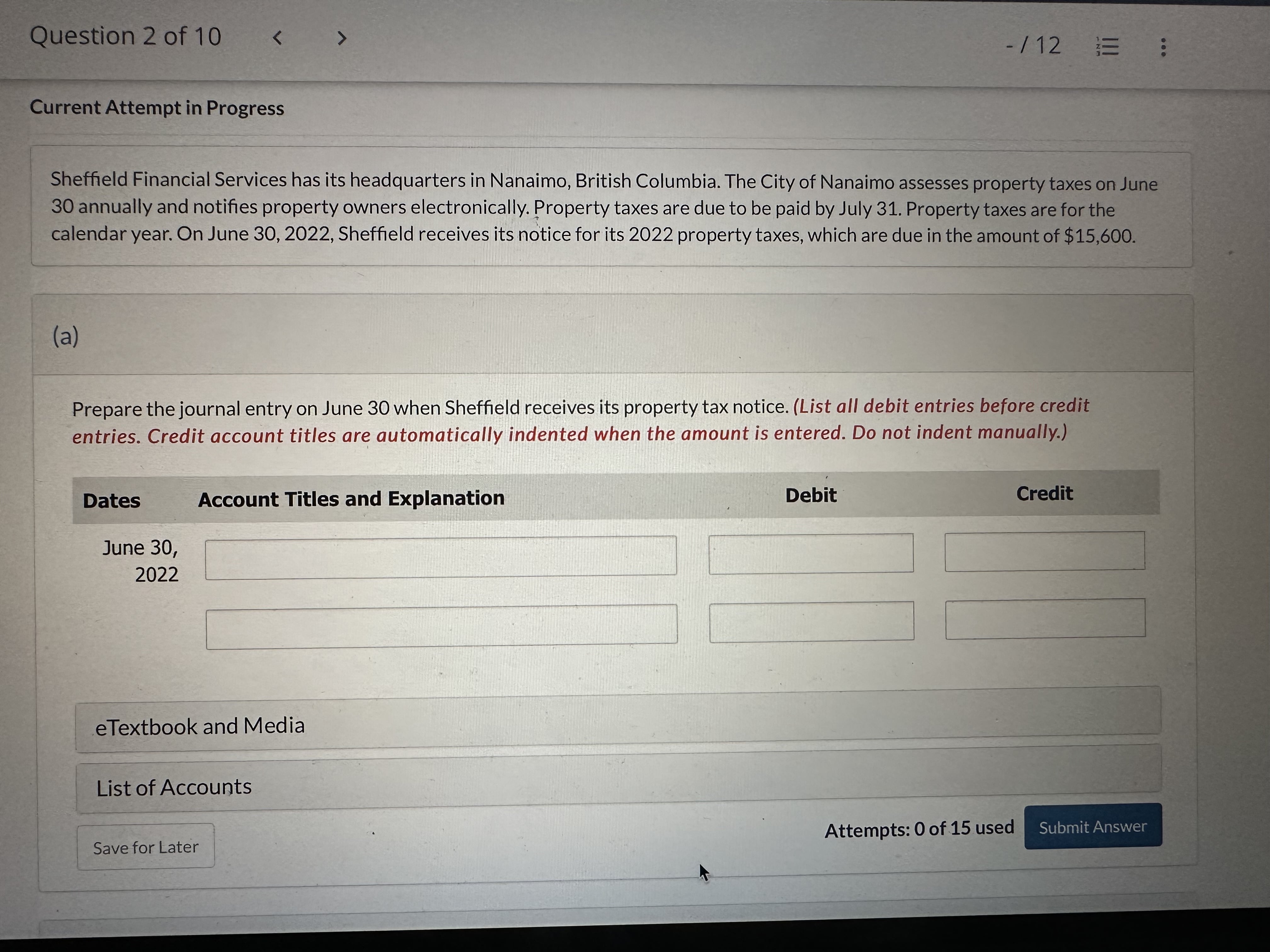

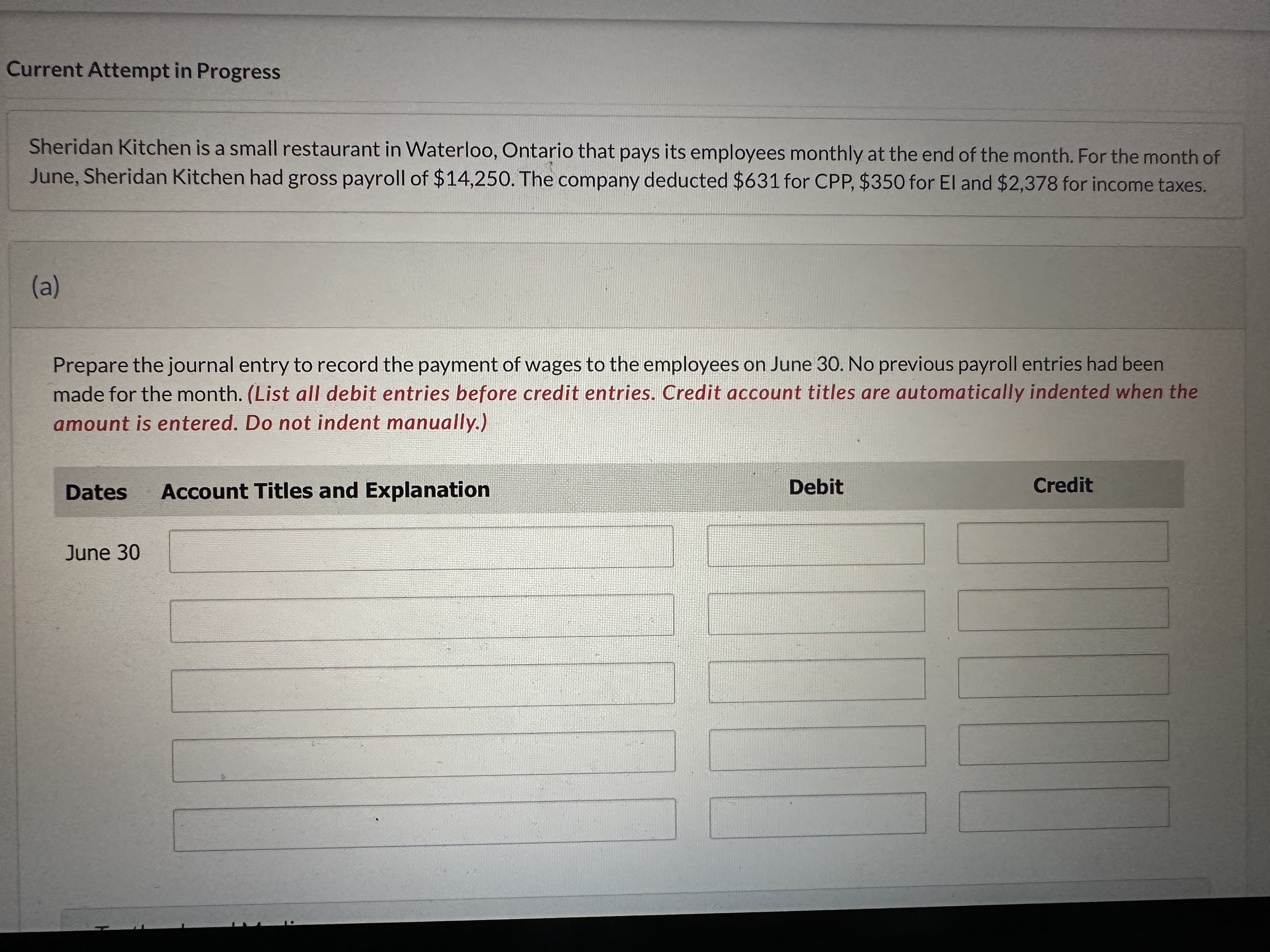

Swifty Construction Ltd. borrowed $290,000 from Atco Finance Ltd. on October 1,2020 , by issuing a nine-month note payable at 4% interest payable at maturity. Both companies have a December 31 year end and make adjusting entries annually. (a) For Swifty Construction, record (1) the receipt of the $290,000 cash and the issuing of the note payable on October 1, 2020; (2) the accrual of interest on December 31,2020; and (3) the payment of the note and interest on July 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) entries.) Date Account Titles and Explanation Debit Credit (To record interest) (To record repayment of bank loan) Sheffield Financial Services has its headquarters in Nanaimo, British Columbia. The City of Nanaimo assesses property taxes on June 30 annually and notifies property owners electronically. Property taxes are due to be paid by July 31 . Property taxes are for the calendar year. On June 30, 2022, Sheffield receives its notice for its 2022 property taxes, which are due in the amount of $15,600. (a) Prepare the journal entry on June 30 when Sheffield receives its property tax notice. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Current Attempt in Progress Sheridan Kitchen is a small restaurant in Waterloo, Ontario that pays its employees monthly at the end of the month. For the month of June, Sheridan Kitchen had gross payroll of $14,250. The company deducted $631 for CPP, $350 for El and $2,378 for income taxes. (a) Prepare the journal entry to record the payment of wages to the employees on June 30 . No previous payroll entries had been made for the month. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Swifty Construction Ltd. borrowed $290,000 from Atco Finance Ltd. on October 1,2020 , by issuing a nine-month note payable at 4% interest payable at maturity. Both companies have a December 31 year end and make adjusting entries annually. (a) For Swifty Construction, record (1) the receipt of the $290,000 cash and the issuing of the note payable on October 1, 2020; (2) the accrual of interest on December 31,2020; and (3) the payment of the note and interest on July 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) entries.) Date Account Titles and Explanation Debit Credit (To record interest) (To record repayment of bank loan) Sheffield Financial Services has its headquarters in Nanaimo, British Columbia. The City of Nanaimo assesses property taxes on June 30 annually and notifies property owners electronically. Property taxes are due to be paid by July 31 . Property taxes are for the calendar year. On June 30, 2022, Sheffield receives its notice for its 2022 property taxes, which are due in the amount of $15,600. (a) Prepare the journal entry on June 30 when Sheffield receives its property tax notice. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Current Attempt in Progress Sheridan Kitchen is a small restaurant in Waterloo, Ontario that pays its employees monthly at the end of the month. For the month of June, Sheridan Kitchen had gross payroll of $14,250. The company deducted $631 for CPP, $350 for El and $2,378 for income taxes. (a) Prepare the journal entry to record the payment of wages to the employees on June 30 . No previous payroll entries had been made for the month. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started