Question

Swifty Consulting Inc.s gross salaries for the biweekly period ended August 24 were $13,500. Deductions included $743 for CPP, $254 for EI, and $6,262 for

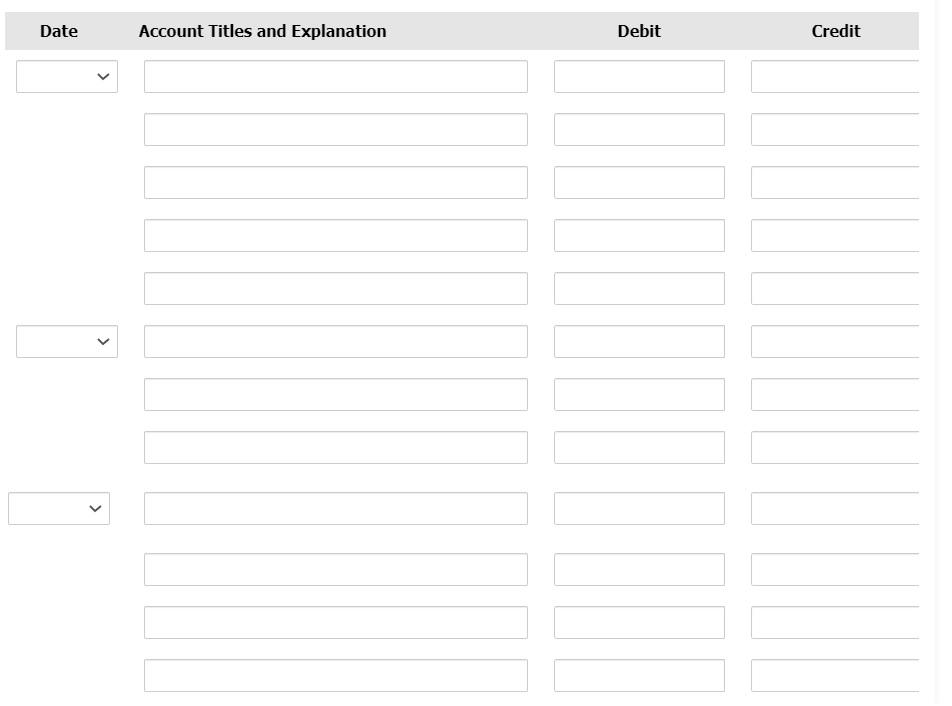

Swifty Consulting Inc.s gross salaries for the biweekly period ended August 24 were $13,500. Deductions included $743 for CPP, $254 for EI, and $6,262 for income tax. The employers payroll costs were $743 for CPP and $356 for EI. Prepare journal entries to record (a) the payment of salaries on August 24; (b) the employer payroll costs on August 24, assuming they will not be remitted to the government until September; and (c) the payment to the government on September 15 of all amounts owed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)

Make sure to fill all the blanks

List of Accounts

- Accounts Payable

- Accounts Receivable

- Accumulated Depreciation - Buildings

- Accumulated Depreciation - Equipment

- Accumulated Depreciation - Vehicles

- Administrative Expenses

- Allowance for Doubtful Accounts

- Bad Debts Expense

- Bank Loan Payable

- Bonds Payable

- Buildings

- Cash

- Common Shares

- Cost of Goods Sold

- CPP Payable

- Current Portion of Bank Loan Payable

- Current Portion of Mortgage Payable

- Current Portion of Notes Payable

- Deferred Revenue

- Depreciation Expense

- Dividends Declared

- Dividends Payable

- EI Payable

- Employee Benefits Expense

- Employee Income Tax Payable

- Estimated Inventory Returns

- Equipment

- Income Tax Expense

- Income Tax Payable

- Income Tax Receivable

- Insurance Expense

- Interest Expense

- Interest Income

- Interest Payable

- Interest Receivable

- Inventory

- Land

- Loan Receivable

- Mortgage Payable

- No Entry

- Notes Payable

- Notes Receivable

- Pension Payable

- Prepaid Insurance

- Prepaid Property Tax

- Property Tax Expense

- Property Tax Payable

- Provisions

- Refund Liability

- Retained Earnings

- Salaries Expense

- Sales

- Sales Tax Payable

- Service Revenue

- Utilities Expense

- Vehicles

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started