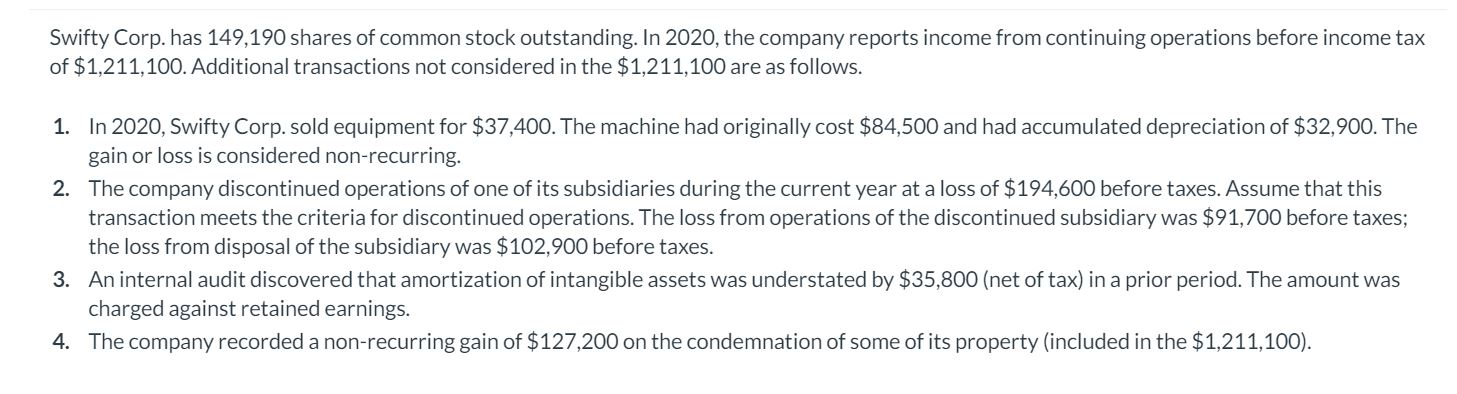

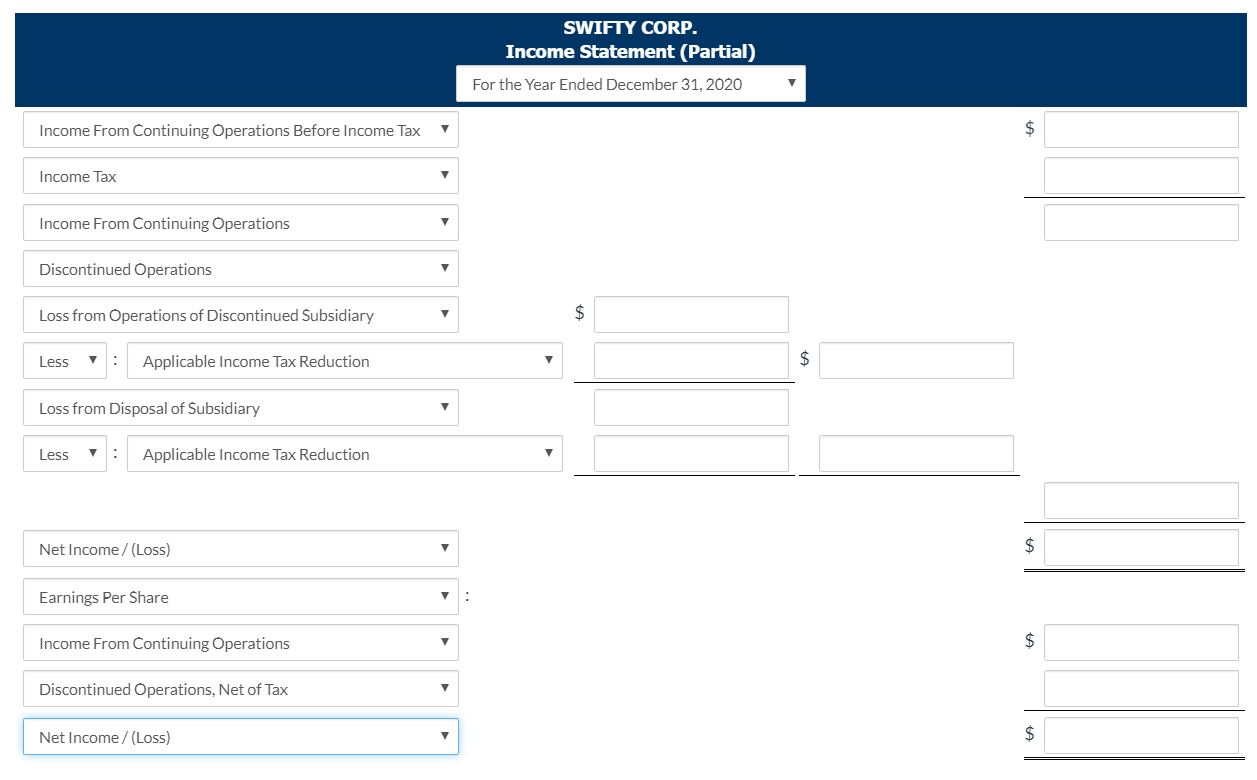

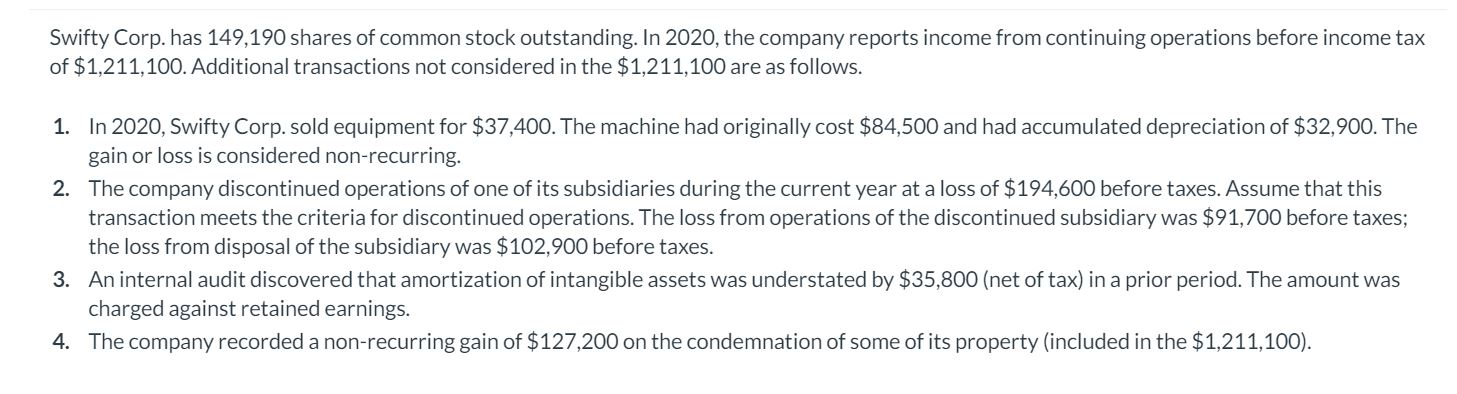

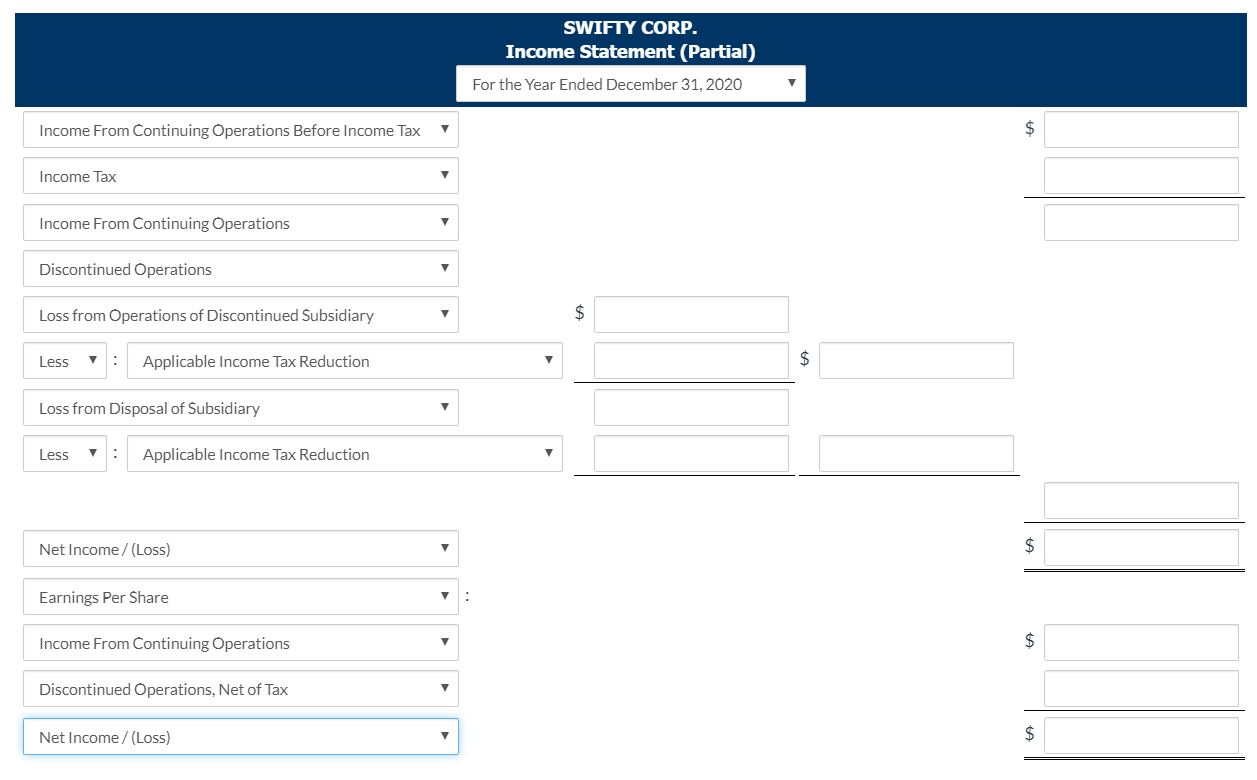

Swifty Corp. has 149,190 shares of common stock outstanding. In 2020, the company reports income from continuing operations before income tax of $1,211,100. Additional transactions not considered in the $1,211,100 are as follows. 1. In 2020, Swifty Corp. sold equipment for $37,400. The machine had originally cost $84,500 and had accumulated depreciation of $32,900. The gain or loss is considered non-recurring. 2. The company discontinued operations of one of its subsidiaries during the current year at a loss of $194,600 before taxes. Assume that this transaction meets the criteria for discontinued operations. The loss from operations of the discontinued subsidiary was $91,700 before taxes; the loss from disposal of the subsidiary was $102,900 before taxes. 3. An internal audit discovered that amortization of intangible assets was understated by $35,800 (net of tax) in a prior period. The amount was charged against retained earnings. 4. The company recorded a non-recurring gain of $127,200 on the condemnation of some of its property (included in the $1,211,100). SWIFTY CORP. Income Statement (Partial) For the Year Ended December 31, 2020 Income From Continuing Operations Before Income Tax Income Tax Income From Continuing Operations Discontinued Operations Loss from Operations of Discontinued Subsidiary Less : Applicable Income Tax Reduction Loss from Disposal of Subsidiary Less : Applicable Income Tax Reduction Net Income /(Loss) Earnings Per Share Income From Continuing Operations Discontinued Operations, Net of Tax Net Income /(Loss) Swifty Corp. has 149,190 shares of common stock outstanding. In 2020, the company reports income from continuing operations before income tax of $1,211,100. Additional transactions not considered in the $1,211,100 are as follows. 1. In 2020, Swifty Corp. sold equipment for $37,400. The machine had originally cost $84,500 and had accumulated depreciation of $32,900. The gain or loss is considered non-recurring. 2. The company discontinued operations of one of its subsidiaries during the current year at a loss of $194,600 before taxes. Assume that this transaction meets the criteria for discontinued operations. The loss from operations of the discontinued subsidiary was $91,700 before taxes; the loss from disposal of the subsidiary was $102,900 before taxes. 3. An internal audit discovered that amortization of intangible assets was understated by $35,800 (net of tax) in a prior period. The amount was charged against retained earnings. 4. The company recorded a non-recurring gain of $127,200 on the condemnation of some of its property (included in the $1,211,100). SWIFTY CORP. Income Statement (Partial) For the Year Ended December 31, 2020 Income From Continuing Operations Before Income Tax Income Tax Income From Continuing Operations Discontinued Operations Loss from Operations of Discontinued Subsidiary Less : Applicable Income Tax Reduction Loss from Disposal of Subsidiary Less : Applicable Income Tax Reduction Net Income /(Loss) Earnings Per Share Income From Continuing Operations Discontinued Operations, Net of Tax Net Income /(Loss)