Answered step by step

Verified Expert Solution

Question

1 Approved Answer

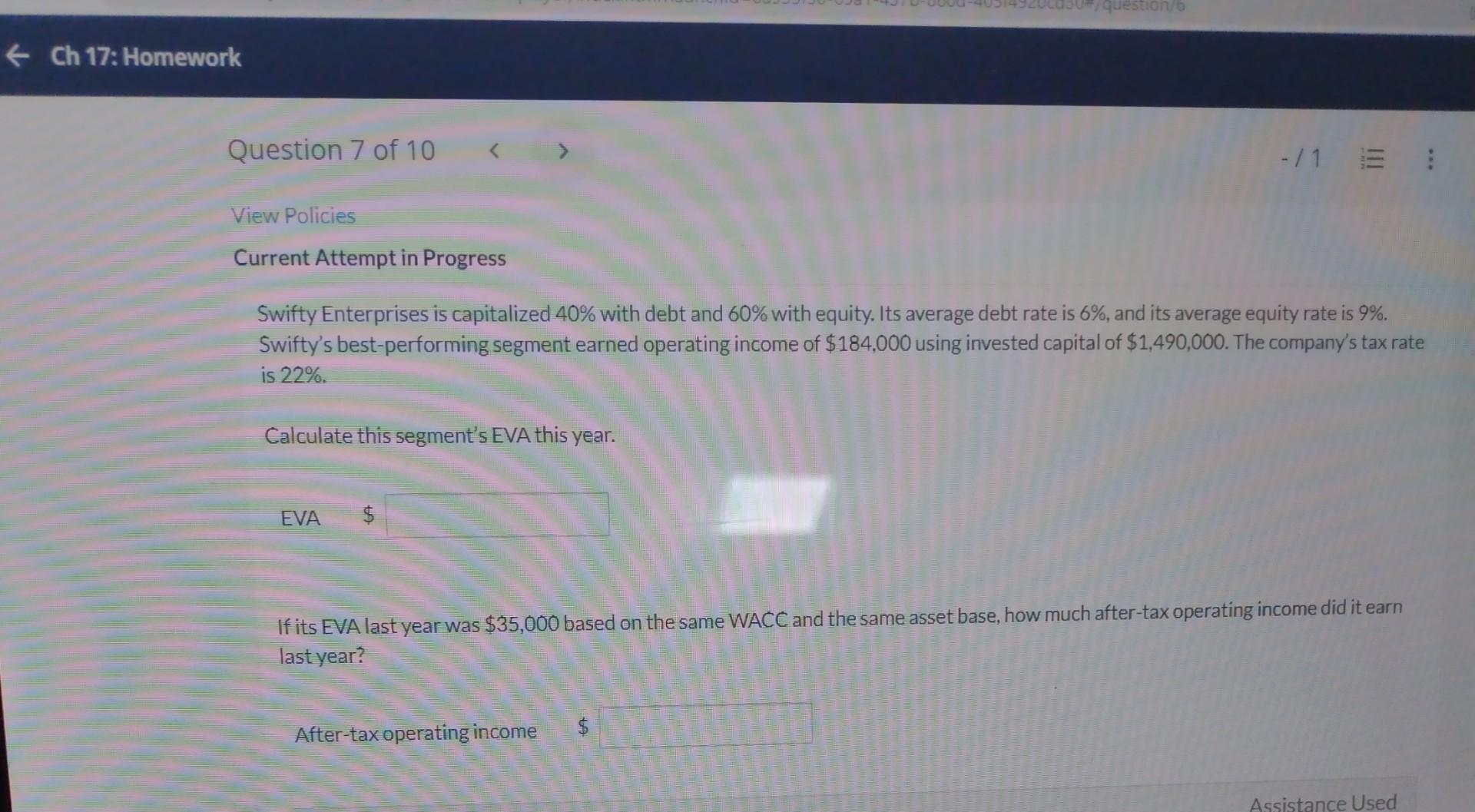

Swifty Enterprises is capitalized 40% with debt and 60% with equity. Its average debt rate is 6%, and its average equity rate is 9%. Swifty's

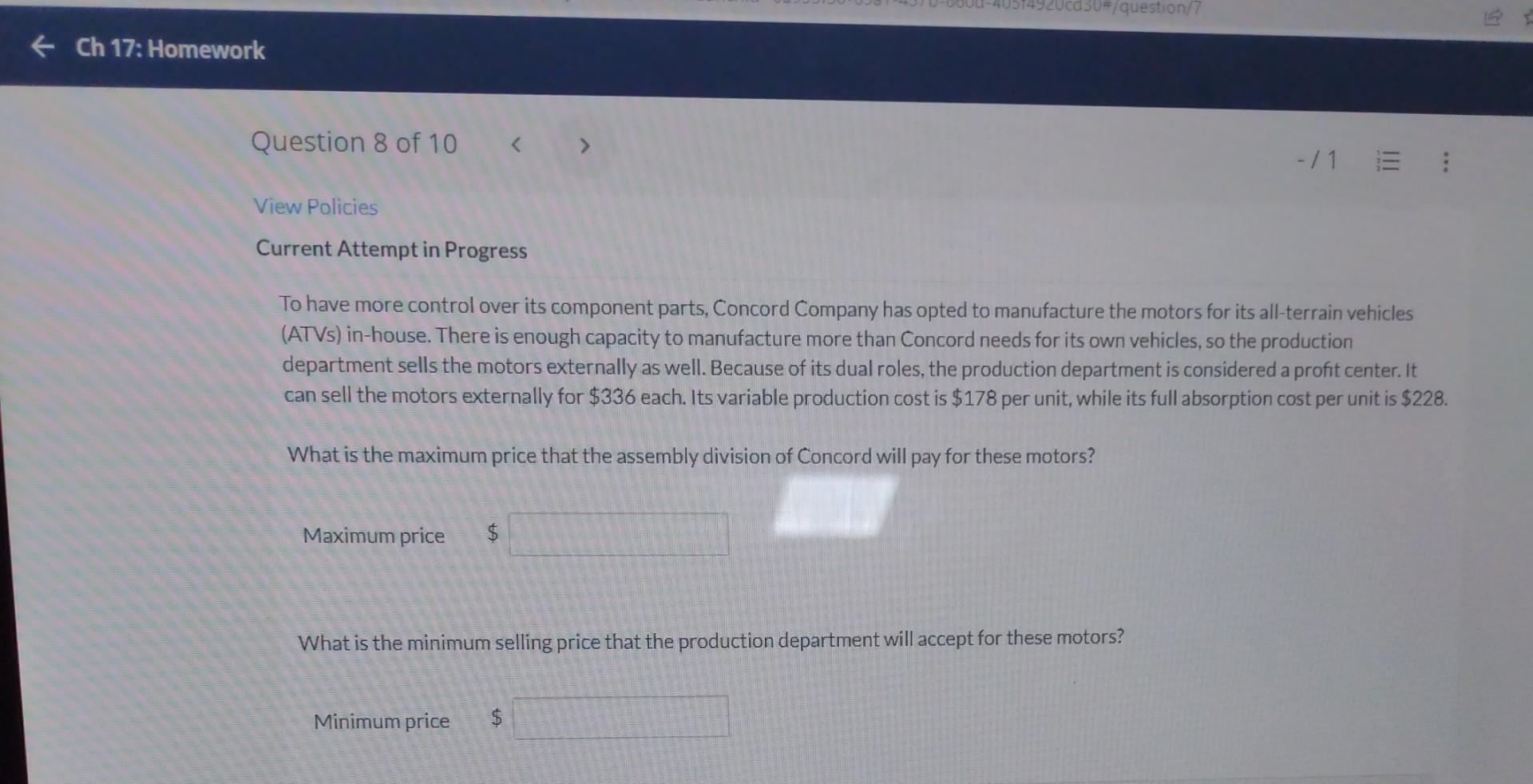

Swifty Enterprises is capitalized 40% with debt and 60% with equity. Its average debt rate is 6%, and its average equity rate is 9%. Swifty's best-performing segment earned operating income of $184,000 using invested capital of $1,490,000. The company's tax rate is 22%. Calculate this segment's EVA this year. EVA $ If its EVA last year was $35,000 based on the same WACC and the same asset base, how much after-tax operating income did it earn last year? Current Attempt in Progress To have more control over its component parts, Concord Company has opted to manufacture the motors for its all-terrain vehicles (ATVs) in-house. There is enough capacity to manufacture more than Concord needs for its own vehicles, so the production department sells the motors externally as well. Because of its dual roles, the production department is considered a profit center. It can sell the motors externally for $336 each. Its variable production cost is $178 per unit, while its full absorption cost per unit is $228. What is the maximum price that the assembly division of Concord will pay for these motors? Maximum price What is the minimum selling price that the production department will accept for these motors? Minimum price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started