Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Swifty Ltd. has an April 30 year end and follows IFRS. On April 30, 2023, Swifty's controller determined that 6% of its $372,000 accounts

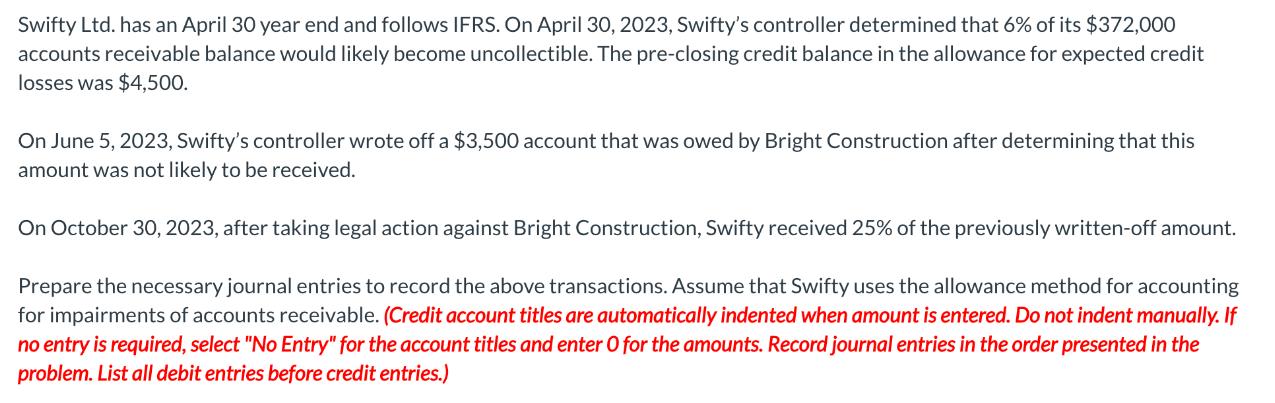

Swifty Ltd. has an April 30 year end and follows IFRS. On April 30, 2023, Swifty's controller determined that 6% of its $372,000 accounts receivable balance would likely become uncollectible. The pre-closing credit balance in the allowance for expected credit losses was $4,500. On June 5, 2023, Swifty's controller wrote off a $3,500 account that was owed by Bright Construction after determining that this amount was not likely to be received. On October 30, 2023, after taking legal action against Bright Construction, Swifty received 25% of the previously written-off amount. Prepare the necessary journal entries to record the above transactions. Assume that Swifty uses the allowance method for accounting for impairments of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Record the expected credit losses on April 30 2023 Bad Debt Expense 223...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started