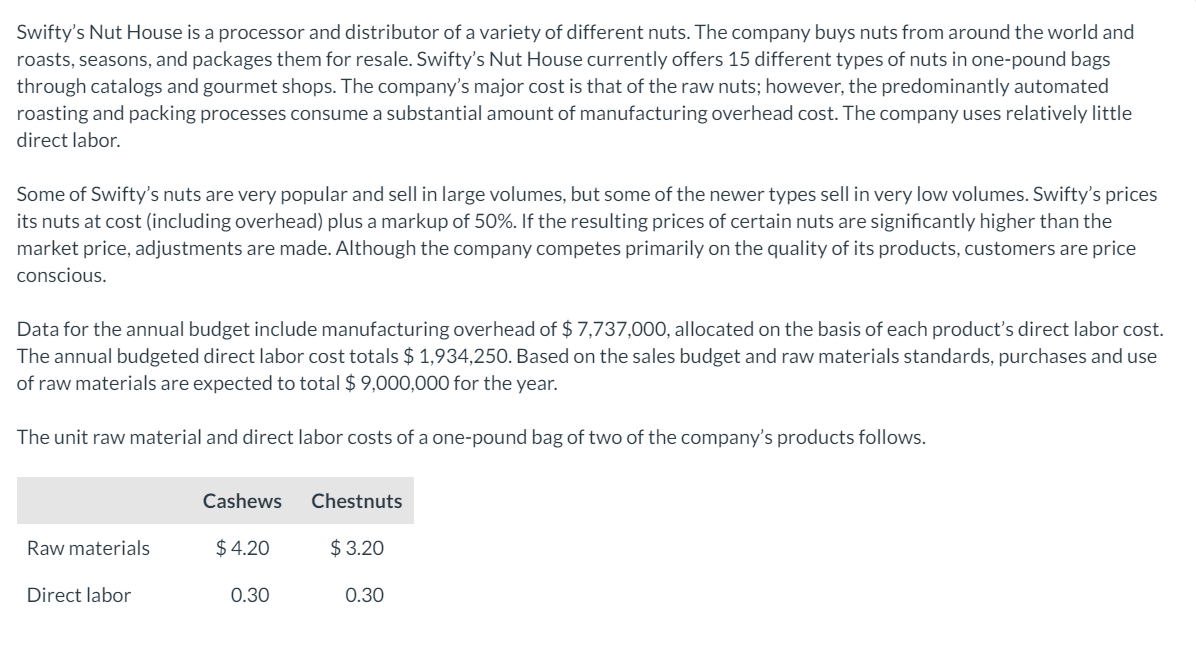

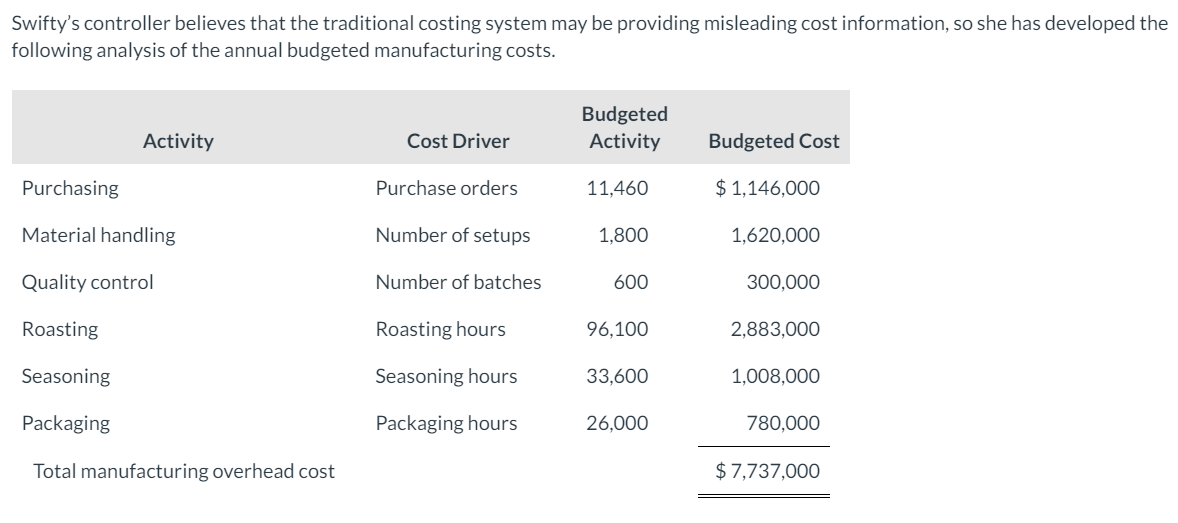

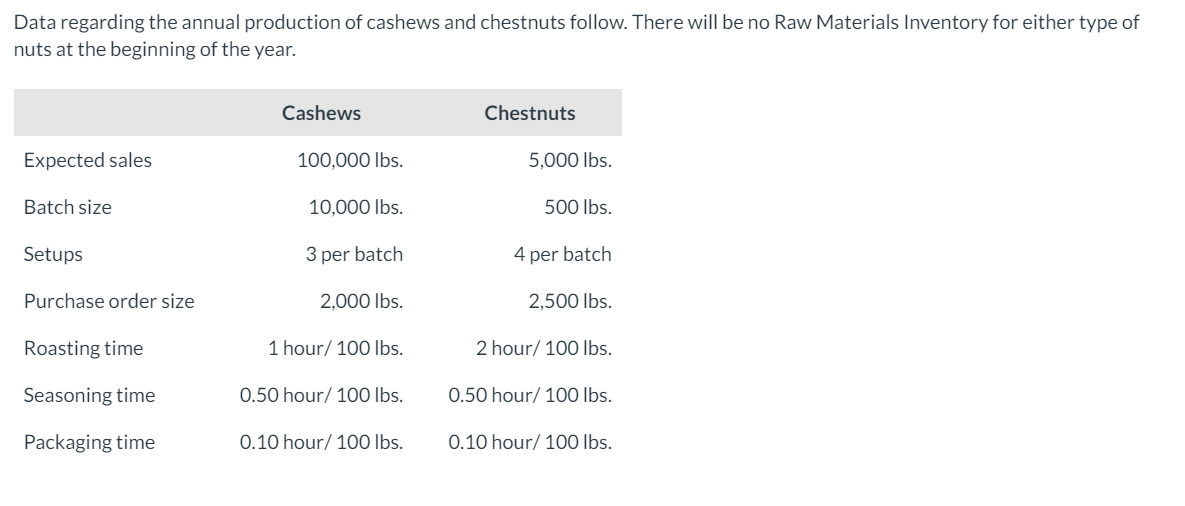

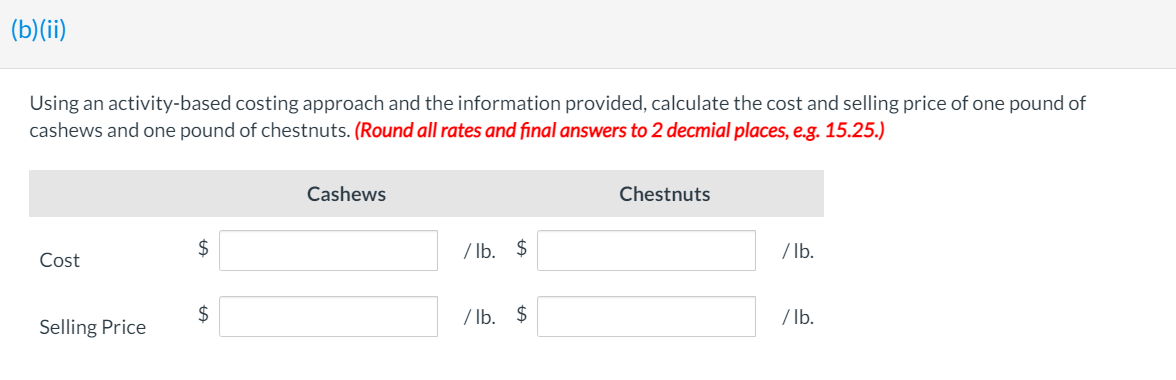

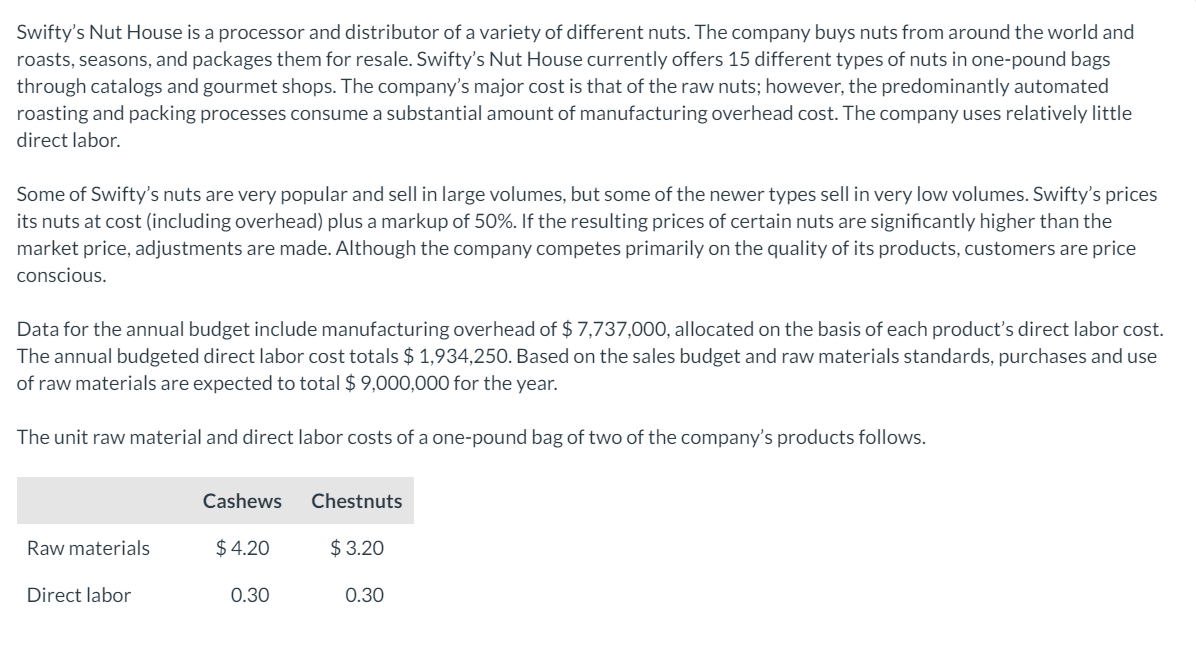

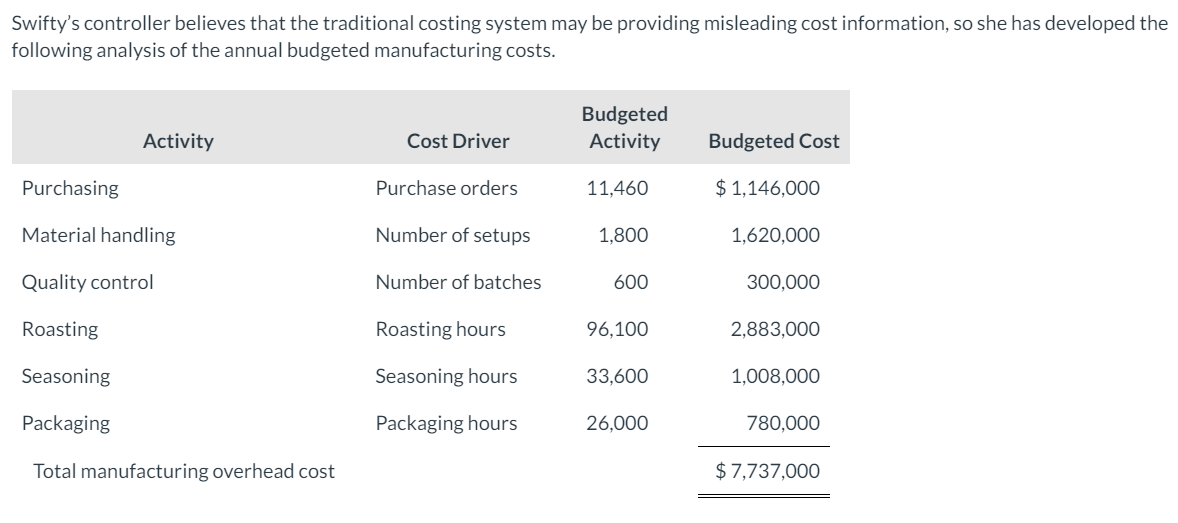

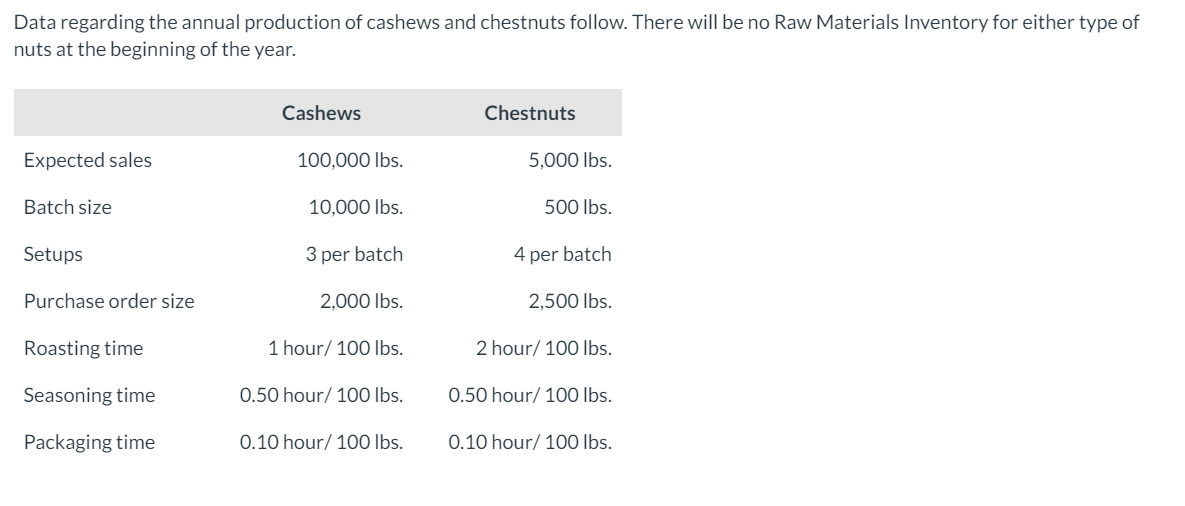

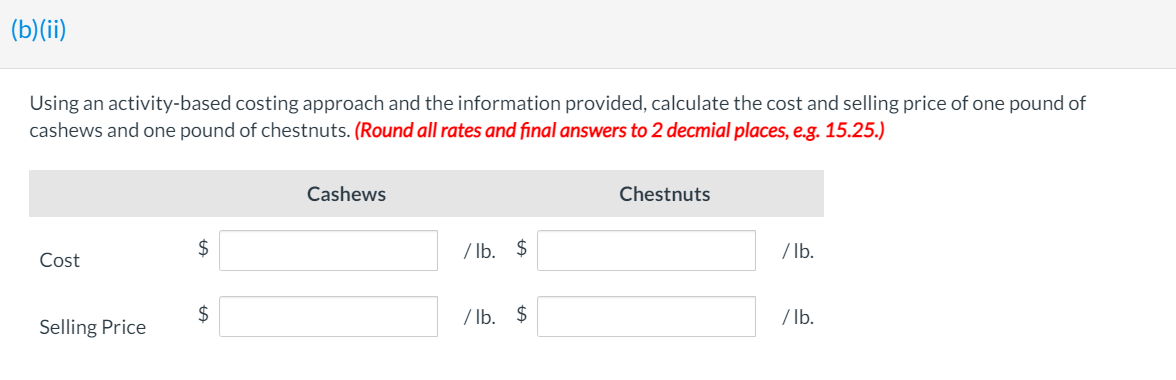

Swifty's Nut House is a processor and distributor of a variety of different nuts. The company buys nuts from around the world and roasts, seasons, and packages them for resale. Swifty's Nut House currently offers 15 different types of nuts in one-pound bags through catalogs and gourmet shops. The company's major cost is that of the raw nuts; however, the predominantly automated roasting and packing processes consume a substantial amount of manufacturing overhead cost. The company uses relatively little direct labor. Some of Swifty's nuts are very popular and sell in large volumes, but some of the newer types sell in very low volumes. Swifty's prices its nuts at cost (including overhead) plus a markup of 50%. If the resulting prices of certain nuts are significantly higher than the market price, adjustments are made. Although the company competes primarily on the quality of its products, customers are price conscious. Data for the annual budget include manufacturing overhead of $ 7,737,000, allocated on the basis of each product's direct labor cost. The annual budgeted direct labor cost totals $ 1,934,250. Based on the sales budget and raw materials standards, purchases and use of raw materials are expected to total $ 9,000,000 for the year. The unit raw material and direct labor costs of a one-pound bag of two of the company's products follows. Cashews Chestnuts Raw materials $ 4.20 $ 3.20 Direct labor 0.30 0.30 Swifty's controller believes that the traditional costing system may be providing misleading cost information, so she has developed the following analysis of the annual budgeted manufacturing costs. Budgeted Activity Activity Cost Driver Budgeted Cost Purchasing Purchase orders 11,460 $ 1,146,000 Material handling Number of setups 1.800 1,620,000 Quality control Number of batches 600 300,000 Roasting Roasting hours 96,100 2,883,000 Seasoning Seasoning hours 33,600 1,008,000 Packaging Packaging hours 26,000 780,000 Total manufacturing overhead cost $ 7,737,000 Data regarding the annual production of cashews and chestnuts follow. There will be no Raw Materials Inventory for either type of nuts at the beginning of the year. Cashews Chestnuts Expected sales 100,000 lbs. 5,000 lbs. Batch size 10,000 lbs. 500 lbs. Setups 3 per batch 4 per batch Purchase order size 2,000 lbs. 2,500 lbs. Roasting time 1 hour/ 100 lbs. 2 hour/100 lbs. Seasoning time 0.50 hour/ 100 lbs. 0.50 hour/ 100 lbs. Packaging time 0.10 hour/ 100 lbs. 0.10 hour/ 100 lbs. (b)(ii) Using an activity-based costing approach and the information provided, calculate the cost and selling price of one pound of cashews and one pound of chestnuts. (Round all rates and final answers to 2 decmial places, e.g. 15.25.) Cashews Chestnuts $ Cost /lb. /lb. $ A /lb. $ /lb. Selling Price