Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Asia Pacific Regional Director of the Olympus hotel group has told the region's hotel General Managers that he would like them to focus

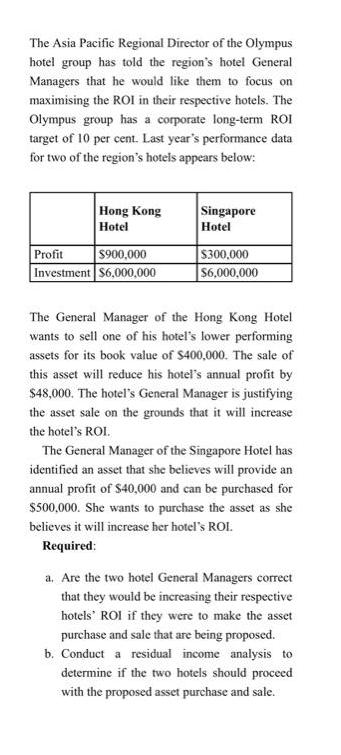

The Asia Pacific Regional Director of the Olympus hotel group has told the region's hotel General Managers that he would like them to focus on maximising the ROI in their respective hotels. The Olympus group has a corporate long-term ROI target of 10 per cent. Last year's performance data for two of the region's hotels appears below: | Hong Kong Hotel Profit $900,000 Investment $6,000,000 Singapore Hotel $300,000 $6,000,000 The General Manager of the Hong Kong Hotel wants to sell one of his hotel's lower performing assets for its book value of $400,000. The sale of this asset will reduce his hotel's annual profit by $48,000. The hotel's General Manager is justifying the asset sale on the grounds that it will increase the hotel's ROI. The General Manager of the Singapore Hotel has identified an asset that she believes will provide an annual profit of $40,000 and can be purchased for $500,000. She wants to purchase the asset as she believes it will increase her hotel's ROL. Required: a. Are the two hotel General Managers correct that they would be increasing their respective hotels ROI if they were to make the asset purchase and sale that are being proposed. b. Conduct a residual income analysis to determine if the two hotels should proceed with the proposed asset purchase and sale.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started