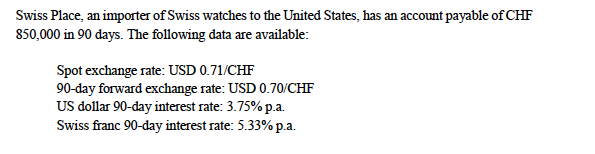

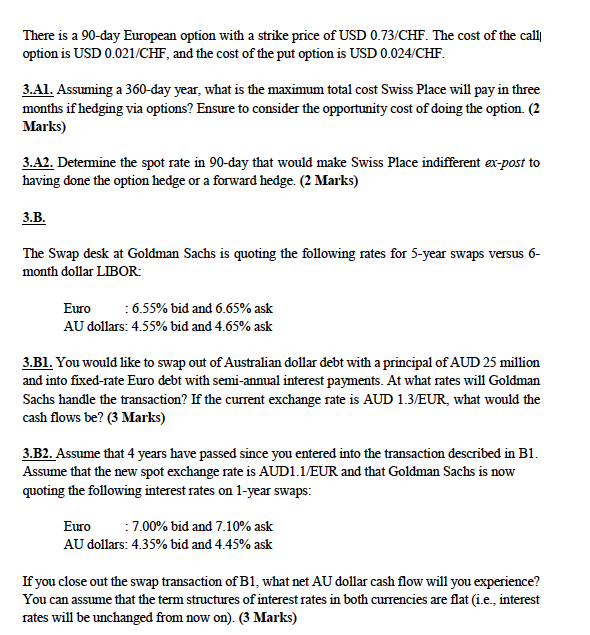

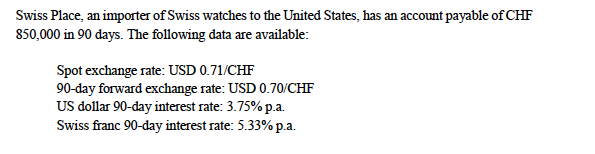

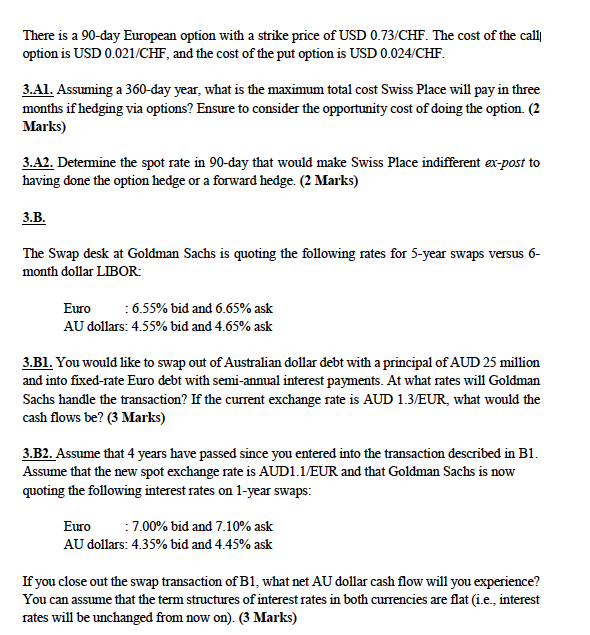

Swiss Place, an importer of Swiss watches to the United States, has an account payable of CHF 850,000 in 90 days. The following data are available: Spot exchange rate: USD 0.71/CHF 90-day forward exchange rate: USD 0.70 CHF US dollar 90-day interest rate: 3.75%p.a. Swiss franc 90-day interest rate: 5.33% p.a. There is a 90-day European option with a strike price of USD 0.73/CHF. The cost of the calls option is USD 0.021/CHF, and the cost of the put option is USD 0.024/CHF. 3.Al. Assuming a 360-day year, what is the maximum total cost Swiss Place will pay in three months if hedging via options? Ensure to consider the opportunity cost of doing the option (2 Marks) 3.A2. Determine the spot rate in 90-day that would make Swiss Place indifferent ex-post to having done the option hedge or a forward hedge. (2 Marks) 3.B. The Swap desk at Goldman Sachs is quoting the following rates for 5-year swaps versus 6- month dollar LIBOR: Euro :6.55% bid and 6.65% ask AU dollars: 4.55% bid and 4.65% ask 3.Bl. You would like to swap out of Australian dollar debt with a principal of AUD 25 million and into fixed-rate Euro debt with semi-annual interest payments. At what rates will Goldman Sachs handle the transaction? If the current exchange rate is AUD 13/EUR, what would the cash flows be? (3 Marks) 3.B2. Assume that 4 years have passed since you entered into the transaction described in B1. Assume that the new spot exchange rate is AUD1.1/EUR and that Goldman Sachs is now quoting the following interest rates on 1-year swaps: Euro :7.00% bid and 7.10% ask AU dollars: 4.35% bid and 4.45% ask If you close out the swap transaction of B1, what net AU dollar cash flow will you experience? You can assume that the term structures of interest rates in both currencies are flat (i.e., interest rates will be unchanged from now on). (3 Marks) Swiss Place, an importer of Swiss watches to the United States, has an account payable of CHF 850,000 in 90 days. The following data are available: Spot exchange rate: USD 0.71/CHF 90-day forward exchange rate: USD 0.70 CHF US dollar 90-day interest rate: 3.75%p.a. Swiss franc 90-day interest rate: 5.33% p.a. There is a 90-day European option with a strike price of USD 0.73/CHF. The cost of the calls option is USD 0.021/CHF, and the cost of the put option is USD 0.024/CHF. 3.Al. Assuming a 360-day year, what is the maximum total cost Swiss Place will pay in three months if hedging via options? Ensure to consider the opportunity cost of doing the option (2 Marks) 3.A2. Determine the spot rate in 90-day that would make Swiss Place indifferent ex-post to having done the option hedge or a forward hedge. (2 Marks) 3.B. The Swap desk at Goldman Sachs is quoting the following rates for 5-year swaps versus 6- month dollar LIBOR: Euro :6.55% bid and 6.65% ask AU dollars: 4.55% bid and 4.65% ask 3.Bl. You would like to swap out of Australian dollar debt with a principal of AUD 25 million and into fixed-rate Euro debt with semi-annual interest payments. At what rates will Goldman Sachs handle the transaction? If the current exchange rate is AUD 13/EUR, what would the cash flows be? (3 Marks) 3.B2. Assume that 4 years have passed since you entered into the transaction described in B1. Assume that the new spot exchange rate is AUD1.1/EUR and that Goldman Sachs is now quoting the following interest rates on 1-year swaps: Euro :7.00% bid and 7.10% ask AU dollars: 4.35% bid and 4.45% ask If you close out the swap transaction of B1, what net AU dollar cash flow will you experience? You can assume that the term structures of interest rates in both currencies are flat (i.e., interest rates will be unchanged from now on)