Question

Swisscom AG, the principal provider of telecommunications in Switzerland, prepares consolidated financial statements in accordance with International Financial Reporting Standards (IFRS). Until 2007, Swisscom also

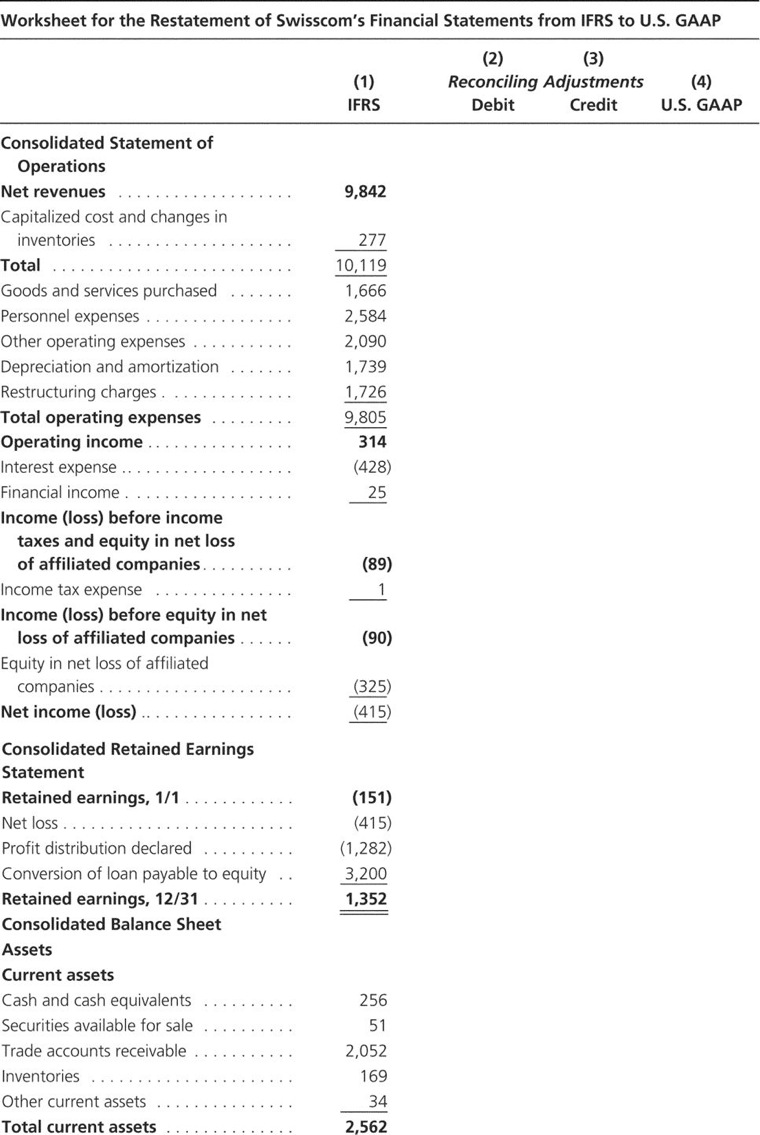

Swisscom AG, the principal provider of telecommunications in Switzerland, prepares consolidated financial statements in accordance with International Financial Reporting Standards (IFRS). Until 2007, Swisscom also reconciled its net income and stockholders equity to U.S. GAAP. Swisscoms consolidated financial statements from a recent annual report are presented in their original format in Column 1 of the following worksheet. Note 27, Differences between International Financial Reporting Standards and U.S. Generally Accepted Accounting Principles, which includes Swisscoms U.S. GAAP reconciliation, also is provided.

Required 1. Use the information in Note 27 to restate Swisscoms consolidated financial statements in accordance with U.S. GAAP. Begin by constructing debit/credit entries for each reconciliation item, and then post these entries to columns 2 and 3 in the worksheets provided.

2. Calculate each of the following ratios under both IFRS and U.S. GAAP and determine the percentage differences between them using IFRS ratios as the base: Net income/Net revenues Operating income/Net revenues Operating income/Total assets Net income/Total shareholders equity Operating income/Total shareholders equity Current assets/Current liabilities Total liabilities/Total shareholders equity

27. Differences between International Financial Reporting Standards and U.S. Generally Accepted Accounting Principles

The consolidated financial statements of Swisscom have been prepared in accordance with International Financial Reporting Standards (IFRS), which differ in certain respects from generally accepted accounting principles in the United States (U.S. GAAP). Application of U.S. GAAP would have affected the balance sheet and net income (loss) to the extent described below. A description of the material differences between IFRS and U.S. GAAP as they relate to Swisscom are discussed in further detail below.

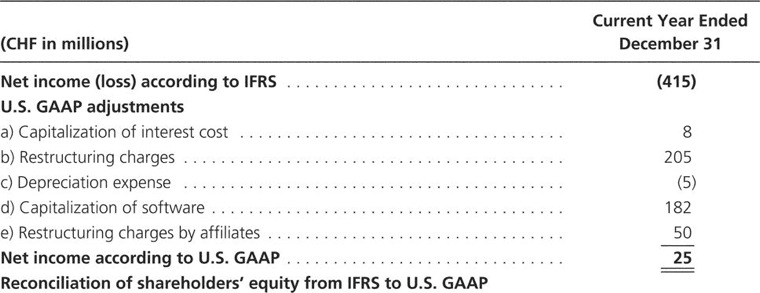

Reconciliation of net income (loss) from IFRS to U.S. GAAP

The following schedule illustrates the significant adjustments to reconcile net income (loss) in accordance with U.S. GAAP to the amounts determined under IFRS, for the current year ended December 31.

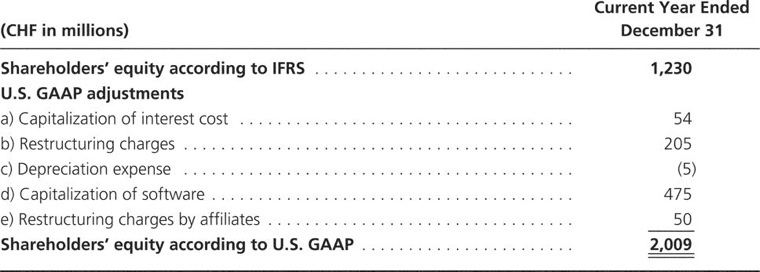

The following is a reconciliation of the significant adjustments necessary to reconcile shareholders equity in accordance with U.S. GAAP to the amounts determined under IFRS as at December 31 of the current year

a) Capitalization of interest cost

Swisscom expenses all interest costs as incurred. U.S. GAAP requires interest costs incurred during the construction of property, plant and equipment to be capitalized. Under U.S. GAAP Swisscom would have capitalized CHF 13 million and amortized CHF 5 million for the current year.

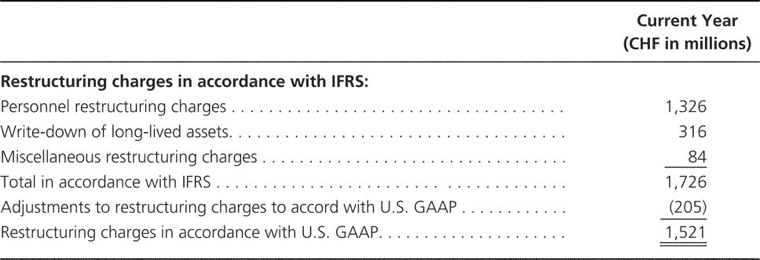

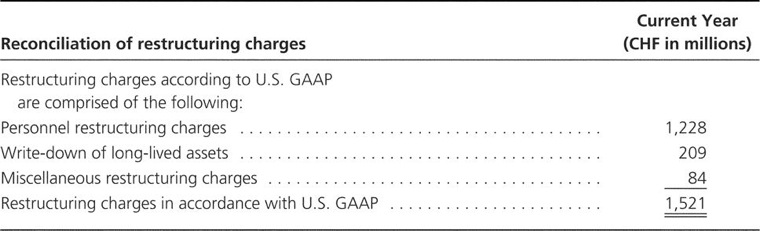

b) Restructuring charges

During the current year, Swisscom recognized under IFRS restructuring charges totaling CHF 1,726 million. The following schedule illustrates adjustments necessary to reconcile these charges to amounts determined under U.S. GAAP

Note: Assume the counterpart to the personnel restructuring charge affects other long-term liabilities.

c) Depreciation Expense

Due to the difference in carrying value of long-lived assets after write-downs described in (b), there is a difference in the amount of depreciation expense taken under IFRS and U.S. GAAP. An adjustment is made for the current year to record an additional CHF 5 million of depreciation under U.S. GAAP.

d) Capitalization of software

Swisscom has expensed software costs as incurred. For U.S. GAAP purposes external consultant costs incurred in the development of software for internal use have been capitalized. These costs are being amortized over a three year period. The capitalization of software costs accords with common practice in the U.S. telecommunications industry.

Swisscom has capitalized, as disclosed in the reconciliation of net income (loss) and shareholders equity to U.S. GAAP, CHF 220 million and amortized CHF 37 million in the previous year and capitalized CHF 370 million and amortized CHF 188 million in the current year.

e) Restructuring charges of affiliates

During the current year, Swisscoms share of personnel and other restructuring charges recorded by affiliates amounted to CHF 50 million. These restructuring charges do not meet all the recognition criteria contained in EITF 943 and therefore cannot be expensed in the current year, under U.S. GAAP.

Worksheet for the Restatement of Swisscom's Financial Statements from IFRS to U.S. GAAP Reconciling Adjustments (4) IFRS Debit Credit U.S. GAAP Consolidated Statement of Operations 9,842 Capitalized cost and changes in 277 10,119 1,666 2,584 2,090 1,739 1,726 9,805 314 (428) 25 Goods and services purchased . . . . . . . Income (loss) before income taxes and equity in net loss (89) Income (loss) before equity in net (90) Equity in net loss of affiliated (325) Consolidated Retained Earnings Statement (151) (1,282) 3,200 1,352 Conversion of loan payable to equity .. Consolidated Balance Sheet Assets Current assets Cash and cash equivalents . 256 51 2,052 169 34 2,562Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started