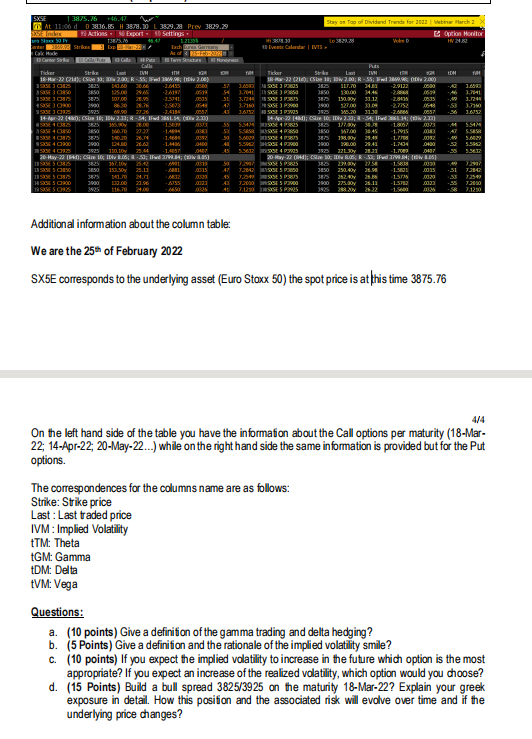

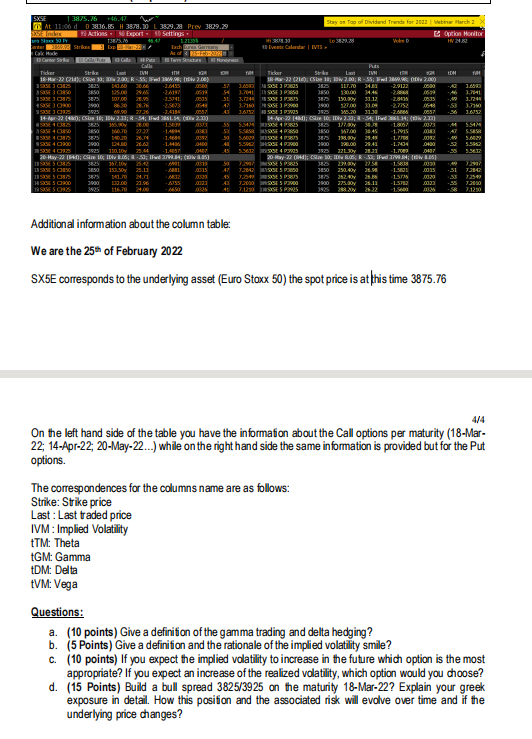

SXSE 3875.76 +46.47 At 11:06 d 03836.85 H 3878.10 55E Index Actions Export | Carter 1869.98 Strik 13875.76 Exp 2 Colley Putr K3 CM PANTS 3900 3925 Calle IVM Lat ITH Ticker 18-Mar-22 (214); CSize 13; 10w 2.00; R -55; IFwd 3969.96; (10kv 2.00) 15336 33825 -2.6455 05:00 3825 3850 3 SKS 33850 35333C3H875 143.60 30.66 125.00 2965 107.00 -2.5741 SKSE 3C900 3850 2900 L 3829.28 Prev 3829.29 50 Settings 3533CH25 69.90 -2.4354 14-Apr-22 (48); CSe 10; IDW 2.33; R -54; 1Fwd 2861.54; (233) 28.00 1.5009 -1.4894 124.00 26.63 355 4 C3850 534C347 -1.4684 53342900 -1.4436 0400 385234 2225 110.10 25.44 -1.4057 0407 20-May-22 (841); CSre 10; IDv 8.05; R-53; IFwd 2799.84; (10825) 11535E 5 CR25 367.10 25.42 6901 1535 3850 153,50 25.13 -881 00:15 1535 C3875 141.70 24.71 320 SCHOD 130.00 23.96 0033 TASSE SCHIS 116.70 24.00 3850 3900 1.21394 Eachres Germany 35-Feb-2000 385.90 160.70 140.20 28.74 IVM: Implied Volatility tTM: Theta tGM: Gamma tDM: Delta tVM: Vega 05-19 0035 ASAN J0887 -6355 37 54 31 47 AS 18 Events CalendaIVIS 55 53 50 All 5.5M2 45 5.5612 Stay on Tap of Dividend Trends for 2022 Veb March 2 Option Monitor HV 24.82 The correspondences for the columns name are as follows: Strike: Strike price Last: Last traded price Lo 3829.28 Strike Lat 121 3,7041SSE 3 P850 00:35 15003385 SSE 3 P900 3.7160 3.675253 335 Ticker 18-Mar-22 (214); CSbe 10; 1DW 2.00; R-55; 1Fwd 3869.98; (DR 2.00) 3.65831450 35 3825 117.70 34.81 -2.9122 J0500 3850 130.00 34.46 -- 150.00 33.12 -2.3435 3900 127.00 33.09 -2.7752 3925 165.20 31.30 -2.6866 J0557 14-Apr-22 (48); CSkre 10; IDv 2.33; R -54; IFwd 2861.34; (12.33) 554 554 3825 177/00 18067 103-73 5.5858 SEPS 3850 $67.00 30.45 -1.7915 0383 5.602954385 3875 195.00 25.45 -1.7798 J0092 SSE 42900 2900 190.00 -1.7434 0400 4123923 3925 221.30 21.21 -1.700 J0407 -35 20-May-22 (944); CSize 10; IDu 8.05; -52; IPvd37994; (5) 50 72507SSE 5 PS 3825 271.00 27.53 -1.5838 03:30 AT 73842 15 3830 250.40 25.98 -1.3821 J0015 -51 45 725453E 5 P385 3875 25240v 25.88 -1.57M 03:30 AI 7.2000 5900 41 7.1290 SE 5 P3925 2900 275.00 26.11 -1.5782 J0023 3925 288.20 26.22 -1.5600 Puts IVN Vol D IDM - Additional information about the column table: We are the 25th of February 2022 SX5E corresponds to the underlying asset (Euro Stoxx 50) the spot price is at this time 3875.76 -53 -56 M -AT -58 TM 1.4033 3.3941 3.7244 3.6732 5.54M4 5.5858 50029 5.5942 5.5632 4/4 On the left hand side of the table you have the information about the Call options per maturity (18-Mar- 22; 14-Apr-22; 20-May-22...) while on the right hand side the same information is provided but for the Put options. 73942 72597 7.3990 7.1210 Questions: a. (10 points) Give a definition of the gamma trading and delta hedging? b. (5 Points) Give a definition and the rationale of the implied volatility smile? c. (10 points) If you expect the implied volatility to increase in the future which option is the most appropriate? If you expect an increase of the realized volatility, which option would you choose? d. (15 Points) Build a bull spread 3825/3925 on the maturity 18-Mar-22? Explain your greek exposure in detail. How this position and the associated risk will evolve over time and if the underlying price changes? SXSE 3875.76 +46.47 At 11:06 d 03836.85 H 3878.10 55E Index Actions Export | Carter 1869.98 Strik 13875.76 Exp 2 Colley Putr K3 CM PANTS 3900 3925 Calle IVM Lat ITH Ticker 18-Mar-22 (214); CSize 13; 10w 2.00; R -55; IFwd 3969.96; (10kv 2.00) 15336 33825 -2.6455 05:00 3825 3850 3 SKS 33850 35333C3H875 143.60 30.66 125.00 2965 107.00 -2.5741 SKSE 3C900 3850 2900 L 3829.28 Prev 3829.29 50 Settings 3533CH25 69.90 -2.4354 14-Apr-22 (48); CSe 10; IDW 2.33; R -54; 1Fwd 2861.54; (233) 28.00 1.5009 -1.4894 124.00 26.63 355 4 C3850 534C347 -1.4684 53342900 -1.4436 0400 385234 2225 110.10 25.44 -1.4057 0407 20-May-22 (841); CSre 10; IDv 8.05; R-53; IFwd 2799.84; (10825) 11535E 5 CR25 367.10 25.42 6901 1535 3850 153,50 25.13 -881 00:15 1535 C3875 141.70 24.71 320 SCHOD 130.00 23.96 0033 TASSE SCHIS 116.70 24.00 3850 3900 1.21394 Eachres Germany 35-Feb-2000 385.90 160.70 140.20 28.74 IVM: Implied Volatility tTM: Theta tGM: Gamma tDM: Delta tVM: Vega 05-19 0035 ASAN J0887 -6355 37 54 31 47 AS 18 Events CalendaIVIS 55 53 50 All 5.5M2 45 5.5612 Stay on Tap of Dividend Trends for 2022 Veb March 2 Option Monitor HV 24.82 The correspondences for the columns name are as follows: Strike: Strike price Last: Last traded price Lo 3829.28 Strike Lat 121 3,7041SSE 3 P850 00:35 15003385 SSE 3 P900 3.7160 3.675253 335 Ticker 18-Mar-22 (214); CSbe 10; 1DW 2.00; R-55; 1Fwd 3869.98; (DR 2.00) 3.65831450 35 3825 117.70 34.81 -2.9122 J0500 3850 130.00 34.46 -- 150.00 33.12 -2.3435 3900 127.00 33.09 -2.7752 3925 165.20 31.30 -2.6866 J0557 14-Apr-22 (48); CSkre 10; IDv 2.33; R -54; IFwd 2861.34; (12.33) 554 554 3825 177/00 18067 103-73 5.5858 SEPS 3850 $67.00 30.45 -1.7915 0383 5.602954385 3875 195.00 25.45 -1.7798 J0092 SSE 42900 2900 190.00 -1.7434 0400 4123923 3925 221.30 21.21 -1.700 J0407 -35 20-May-22 (944); CSize 10; IDu 8.05; -52; IPvd37994; (5) 50 72507SSE 5 PS 3825 271.00 27.53 -1.5838 03:30 AT 73842 15 3830 250.40 25.98 -1.3821 J0015 -51 45 725453E 5 P385 3875 25240v 25.88 -1.57M 03:30 AI 7.2000 5900 41 7.1290 SE 5 P3925 2900 275.00 26.11 -1.5782 J0023 3925 288.20 26.22 -1.5600 Puts IVN Vol D IDM - Additional information about the column table: We are the 25th of February 2022 SX5E corresponds to the underlying asset (Euro Stoxx 50) the spot price is at this time 3875.76 -53 -56 M -AT -58 TM 1.4033 3.3941 3.7244 3.6732 5.54M4 5.5858 50029 5.5942 5.5632 4/4 On the left hand side of the table you have the information about the Call options per maturity (18-Mar- 22; 14-Apr-22; 20-May-22...) while on the right hand side the same information is provided but for the Put options. 73942 72597 7.3990 7.1210 Questions: a. (10 points) Give a definition of the gamma trading and delta hedging? b. (5 Points) Give a definition and the rationale of the implied volatility smile? c. (10 points) If you expect the implied volatility to increase in the future which option is the most appropriate? If you expect an increase of the realized volatility, which option would you choose? d. (15 Points) Build a bull spread 3825/3925 on the maturity 18-Mar-22? Explain your greek exposure in detail. How this position and the associated risk will evolve over time and if the underlying price changes