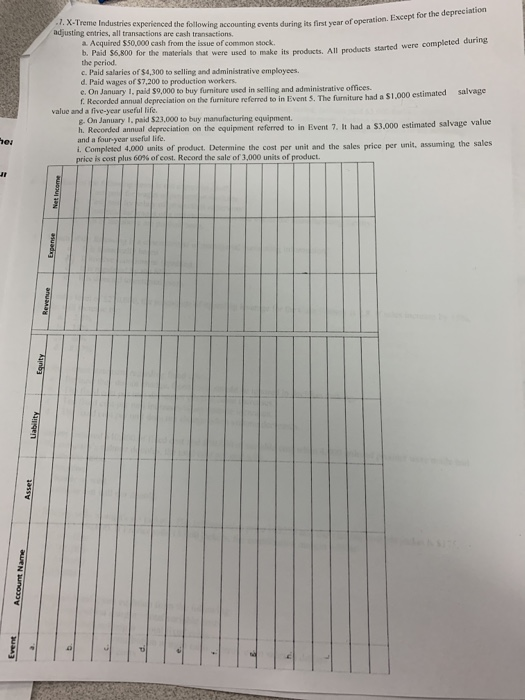

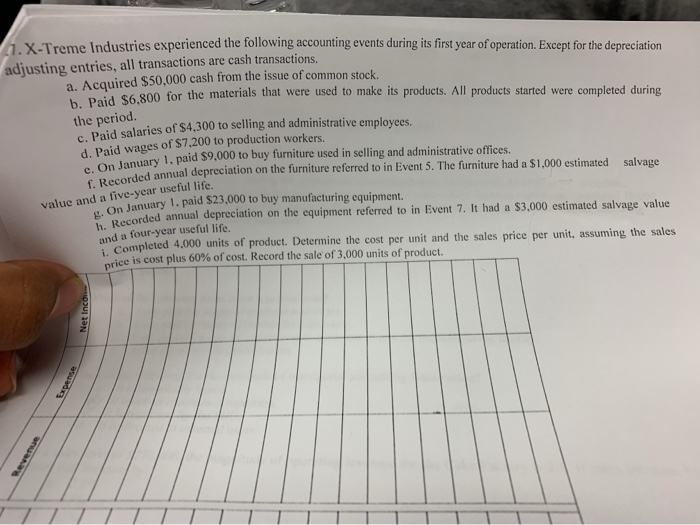

SY vents during its first year of operation. Except for the depreciation .7. X-Treme Industries experienced the following accounting events during its first year of operatio adjusting entries, all transactions are cash transactions a. Acquired 550.000 cash from the issue of common stock. b. Paid $6.800 for the materials that were used to make l o ve l odicts started were completed on the period. c. Pald salaries of $4,300 ta selling and administrative employees. d. Paid wages of $7.200 to production workers. e. On January 1. paid $9,000 to buy furniture used in selling and administrative offices. f. Recorded annual depreciation on the furniture referred to in Event S. The furniture had a $1.000 estimated salvage value and a five-year useful life. . On January 1, paid $23,000 to buy manufacturing equipment h. Recorded annual depreciation on the equipment referred to in Event 7. It had a $3.000 estimated salvage value and a four year useful life. i. Completed 4.000 units of product. Determine the cost per unit and the sales price per unit, assuming the sales price is cast plus 60% of cost. Record the sale of 3.000 units of product. Expense Equity Account Name G X -Treme Industries experienced the following accounting events during its first year of operation. Except for the depreciation adjusting entries, all transactions are cash transactions. a. Acquired $50,000 cash from the issue of common stock. 800 for the materials that were used to make its products. All products started were completed during the period. id salaries of $4,300 to selling and administrative employees. d. Paid wages of $7.200 to production workers. uary 1. paid $9,000 to buy furniture used in selling and administrative offices. ed annual depreciation on the furniture referred to in Event 5. The furniture had a $1.000 estimated salvage c. On January 1, paid $9,000 to f. Recorded annual depreciatio value and a five-year useful life. g. On January 1 and a four-year useful life January 1. paid $23,000 to buy manufacturing equipment. . Recorded corded annual depreciation on the equipment referred to in Event 7. It had a $3.000 estimated salvage value Completed 4,000 units of product. Determine the cost per unit and the sales price per unit, assuming the sales orice is cost plus 60% of cost. Record the sale of 3,000 units of product. Net Inco